- United States

- /

- Industrial REITs

- /

- NYSE:EGP

EastGroup Properties (EGP): Evaluating Valuation Following Analyst Coverage and a 10.7% Dividend Increase

Reviewed by Kshitija Bhandaru

Cantor Fitzgerald has initiated coverage on EastGroup Properties (EGP), highlighting its strong balance sheet and distinctive approach in the industrial real estate market. The company also announced a 10.7% increase in its quarterly dividend, which underscores further confidence in its financial outlook.

See our latest analysis for EastGroup Properties.

EastGroup Properties is attracting attention with its 10.7% dividend boost and solid analyst coverage, moves that are helping fuel positive momentum around the stock. While the 1-year total shareholder return is slightly down, its 3- and 5-year total shareholder returns show steady long-term growth, suggesting investor confidence remains resilient as the company navigates an evolving industrial real estate landscape.

If you’re weighing other opportunities in real estate and beyond, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading at a meaningful discount to analyst price targets and robust growth metrics in place, the question is whether EastGroup Properties is truly undervalued or if the market has already accounted for its future gains.

Most Popular Narrative: 9.1% Undervalued

With EastGroup Properties closing at $171.15, the consensus narrative sets a fair value near $188, suggesting room for appreciation if those ambitious projections are realised. Market-watchers are dissecting the underlying drivers, weighing the prospect of robust growth against real-world execution.

Structural US population growth and migration to Sunbelt markets continues to underpin robust demand for modern industrial/logistics properties, directly benefiting EastGroup's core portfolio and positioning the company for sustained revenue and NOI growth as these regions outpace national averages.

Curious how the narrative arrives at this heady premium? The forecast is anchored by potential step-changes in growth, margin expansion, and future multiples, each built on pivotal quantitative leaps. Which key assumptions hold the key to that elevated fair value? Take a closer look to uncover the surprising drivers that underpin this forecast.

Result: Fair Value of $188 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and rising tenant risk in key regions could slow EastGroup's momentum and challenge even the most optimistic long-term forecasts.

Find out about the key risks to this EastGroup Properties narrative.

Another View: What Do Earnings Multiples Say?

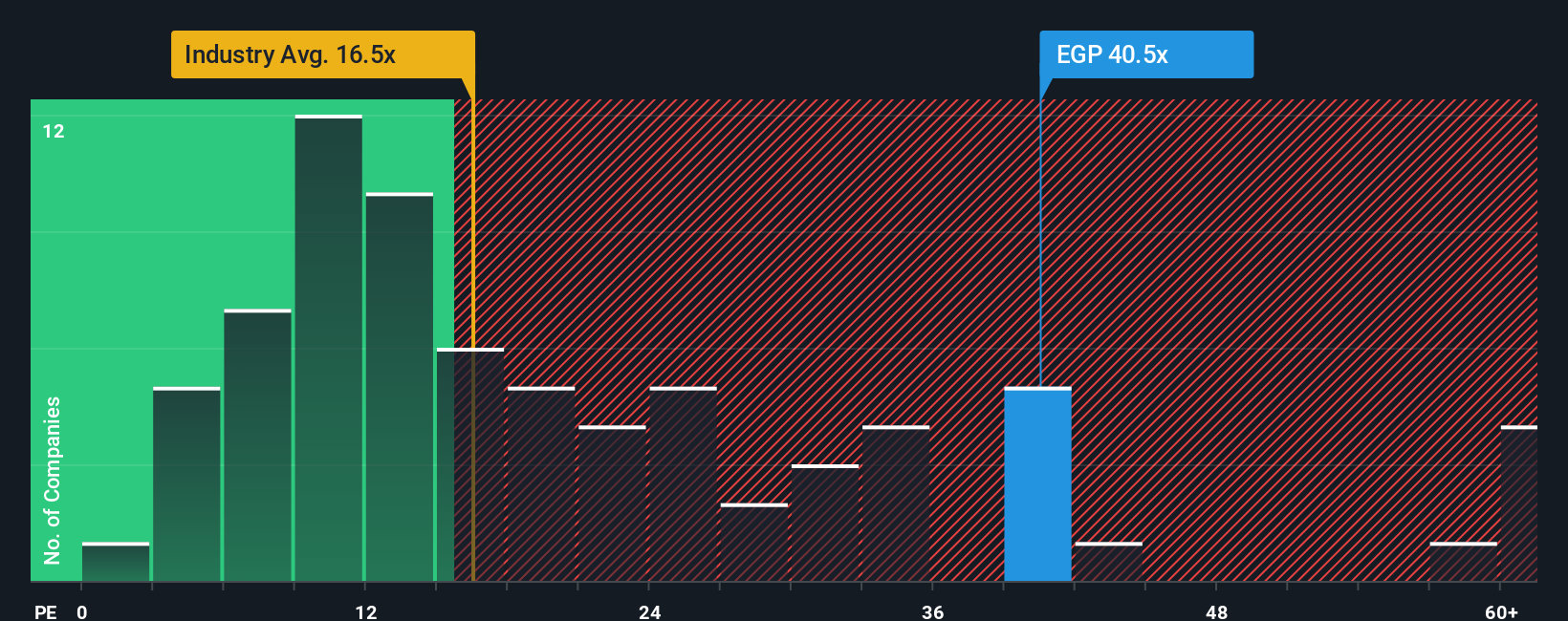

While the consensus is that EastGroup is undervalued based on growth forecasts and analyst targets, its current earnings valuation paints a more expensive picture. The company trades at 38.5 times earnings, which is well above the global industrial REIT average of 16.5x, a peer average of 27.5x, and also above the market’s calculated fair ratio of 36.2x. This premium raises concerns about valuation risk if future growth disappoints. Are expectations too high, or does quality justify paying up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EastGroup Properties Narrative

If you want to see things from a fresh angle or prefer your own deep dive into the numbers, creating your own narrative takes less than three minutes. Do it your way

A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Uncover a world of potential by tapping into market trends and strategies that could put you ahead of the curve. Don’t let exciting opportunities pass you by.

- Capture high yields and stability when you check out these 19 dividend stocks with yields > 3% offering attractive returns with consistent performance.

- Unlock the future of medicine by reviewing these 31 healthcare AI stocks transforming patient care and diagnostics through advanced artificial intelligence.

- Seize the momentum in digital finance as you explore these 78 cryptocurrency and blockchain stocks delivering exposure to disruptive innovation in blockchain and cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EastGroup Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EGP

EastGroup Properties

EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 2000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in high-growth markets throughout the United States with an emphasis in the states of Texas, Florida, California, Arizona and North Carolina.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives