- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Digital Realty Trust (DLR): Evaluating Valuation After Launch of Data Center Innovation Lab for AI and Cloud Workloads

Reviewed by Simply Wall St

If you have been watching Digital Realty Trust (DLR), there is a fresh development that might be changing the conversation: the company just introduced its Data Center Innovation Lab, or DRIL, at its Northern Virginia campus. This lab gives partners and customers the chance to test and optimize AI and hybrid cloud workloads in a real data center environment, using infrastructure from big names like AMD and Cisco. For a business helping power the world’s AI explosion, this looks like a move designed to attract the next wave of enterprise customers who want to de-risk AI investments before scaling up.

The launch of DRIL arrives in the midst of a year of ups and downs for Digital Realty Trust. While the company has expanded its global footprint and notched double-digit annual revenue growth, its share price momentum has been more modest. DLR returned just over 11% in the past year, even as it underperformed the S&P 500 in recent weeks. Investors seem to be weighing long-term expansion plans and data center demand against near-term performance and shifting risk perceptions as the AI sector evolves.

With DRIL now on the scene and AI-driven workloads set to be a growth engine, is the market undervaluing Digital Realty Trust's potential, or has future growth already been baked into the price?

Most Popular Narrative: 57.1% Overvalued

According to the narrative by Unike, Digital Realty Trust is currently viewed as significantly overvalued based on its current price compared to fair value estimates.

“Digital Realty trades at a reasonable valuation (approximately 17x P/FFO) relative to its AI and cloud-driven growth. Given its growth catalysts (AI, cloud, global expansion), long-term investors could see solid returns. However, interest rates and competition remain risks.”

The secret behind this valuation? The narrative reveals big assumptions about continued double-digit growth, high future margins, and a bold forecast for where profit multiples could land. Want to unlock the projections and see which growth levers are pushing the fair value sky-high? Discover what is driving the most aggressive price target for DLR and see how expectations stack up against current performance.

Result: Fair Value of $110.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising interest rates and tough competition from major tech players remain pressing risks that could challenge Digital Realty Trust’s growth narrative.

Find out about the key risks to this Digital Realty Trust narrative.Another View: SWS DCF Model Says Undervalued

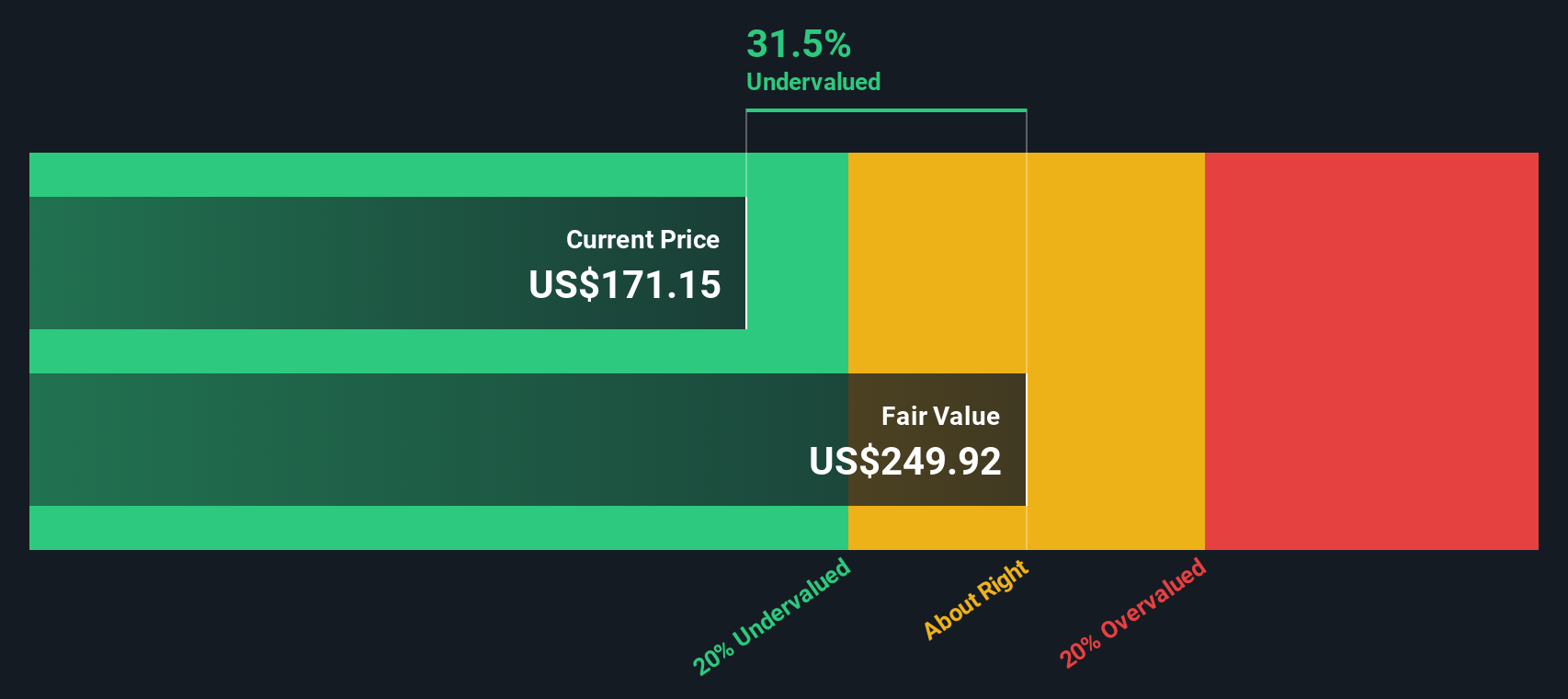

While the popular narrative points to Digital Realty Trust trading above fair value, our DCF model presents a different perspective and suggests the stock may in fact be undervalued. Could the real opportunity be flying under the radar?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Digital Realty Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Digital Realty Trust Narrative

If you have your own take or want to dive deeper into the data, it only takes a few minutes to build and share your personal perspective. Do it your way.

A great starting point for your Digital Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Moves?

Don’t let opportunity pass you by. Put your research into action with fresh stock picks and unique strategies tailored for bold investors.

- Uncover stocks with solid balance sheets and serious value potential by using our tool for undervalued stocks based on cash flows.

- Tap into emerging trends powering healthcare’s digital transformation by checking out companies at the forefront of medical technology and AI: healthcare AI stocks.

- Capture consistent income and stability by scanning a list of companies boasting yields above 3% thanks to our resource for dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives