- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Digital Realty (DLR): Valuation Check After Earnings Beat, Raised Guidance and AI Data Center Expansion

Reviewed by Simply Wall St

Digital Realty Trust (DLR) just delivered better than expected earnings and raised its full year guidance, a timely update as it pours capital into AI ready data centers and deepens partnerships such as its new Oracle Cloud connectivity in Singapore.

See our latest analysis for Digital Realty Trust.

Those stronger earnings and fresh Oracle initiatives come after a choppy stretch, with the share price down 8.05% year to date. Yet a 62.91% three year total shareholder return shows long term momentum is still very much intact.

If AI ready infrastructure is on your radar, now is a good moment to see how Digital Realty compares with other high growth tech and AI stocks that could benefit from the same demand wave.

With shares still below analyst targets despite upgraded guidance and accelerating AI investments, investors face a key question: is this a rare chance to buy Digital Realty at a discount, or is the market already pricing in its future growth?

Most Popular Narrative: 18.3% Undervalued

Digital Realty Trust's most followed narrative pegs fair value at about $199.22 per share versus a last close of $162.76. This frames a sizable upside gap.

The successful formation of Digital Realty's first U.S. hyperscale fund is expected to fuel future growth with up to $10 billion in investments, leading to enhanced revenue and returns through fees, highlighting its significant potential impact on long term earnings sustainability.

Curious how one aggressive growth pipeline, shrinking margins, and a lofty future earnings multiple can still add up to a higher fair value? The narrative walks through the exact revenue path, profitability reset, and valuation bridge that justify this target.

Result: Fair Value of $199.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply potentially outpacing demand in key U.S. markets and higher financing costs could undermine leasing momentum and pressure Digital Realty's long-term margin profile.

Find out about the key risks to this Digital Realty Trust narrative.

Another Lens on Valuation

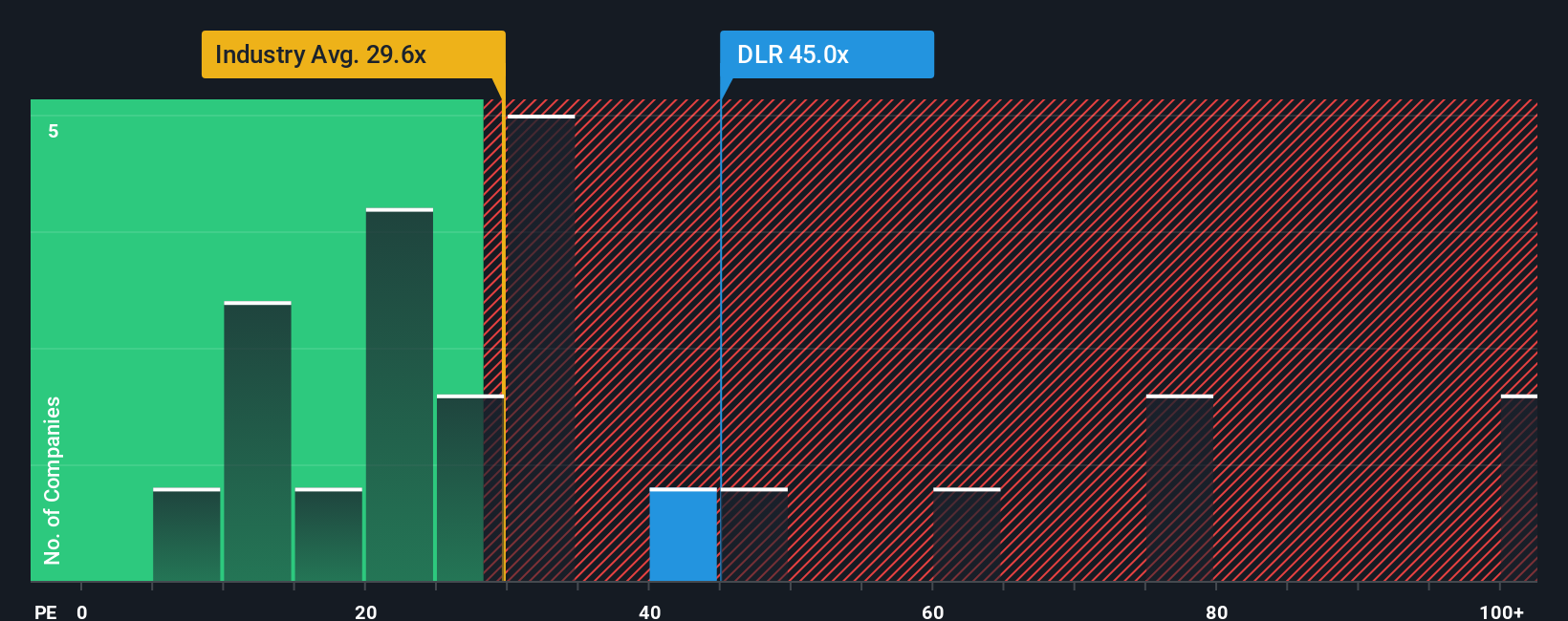

Analysts and narratives see upside, but our valuation checks flag a riskier picture. Digital Realty trades on a 41.1x price to earnings ratio versus a 27.9x industry average and a fair ratio of 28.9x, suggesting investors are already paying up for future AI growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digital Realty Trust Narrative

If you see the numbers differently or want to stress test your own assumptions, build a personalized view of Digital Realty in just minutes, Do it your way.

A great starting point for your Digital Realty Trust research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Use the Simply Wall St Screener to pinpoint fresh opportunities that match your strategy, so you are not relying on just one AI infrastructure story.

- Capture potential turnaround stories by targeting these 3589 penny stocks with strong financials that pair low share prices with improving fundamentals and room for re-rating.

- Position ahead of the next technology wave by focusing on these 27 AI penny stocks that could benefit as AI infrastructure and applications scale globally.

- Lock in attractive entry points with these 894 undervalued stocks based on cash flows that our models flag as trading below their estimated intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026