- United States

- /

- Office REITs

- /

- NYSE:DEA

How Investors May Respond To DEA's Acquisition of Defense-Focused Satellite Facility Leased to York Space Systems

Reviewed by Simply Wall St

- Easterly Government Properties, Inc. recently acquired a 138,125 square foot facility in Greenwood Village, Colorado, fully leased to York Space Systems under a triple net lease until 2031, with an option to extend for 10 years at market terms.

- This facility supports York's mass production of standardized satellites for U.S. defense and space programs, underscoring Easterly's increasing exposure to mission-critical, government-adjacent tenants amid heightened demand for specialized infrastructure.

- We'll explore how acquiring a purpose-built, defense-focused facility enhances Easterly's investment narrative centered on secure, long-term government-aligned leases.

Find companies with promising cash flow potential yet trading below their fair value.

Easterly Government Properties Investment Narrative Recap

To see value in Easterly Government Properties, investors need confidence in the enduring demand for highly specialized, mission-critical facilities leased to government and government-adjacent tenants. The acquisition of the York Space Systems satellite production facility reinforces Easterly’s core strategy, but does not materially shift the company's most immediate catalyst, persistent high occupancy driven by long-term leases, nor does it resolve the primary risk of constrained earnings growth from today's elevated cost of capital.

Most relevant to this acquisition is the recent purchase of a 64,000-square foot crime laboratory in Fort Myers, Florida, leased to a state law enforcement agency for 25 years. This announcement, like the York facility, reflects Easterly’s ongoing focus on purpose-built properties serving public sector clients, which is key to supporting stable income but also reinforces exposure to sector-specific trends affecting government real estate demand.

By contrast, investors should also be aware that a key risk is management's own caution about interest rate pressure and higher acquisition costs...

Read the full narrative on Easterly Government Properties (it's free!)

Easterly Government Properties is projected to reach $403.5 million in revenue and $20.4 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 7.7% and a $3.5 million earnings increase from current earnings of $16.9 million.

Uncover how Easterly Government Properties' forecasts yield a $24.08 fair value, a 3% upside to its current price.

Exploring Other Perspectives

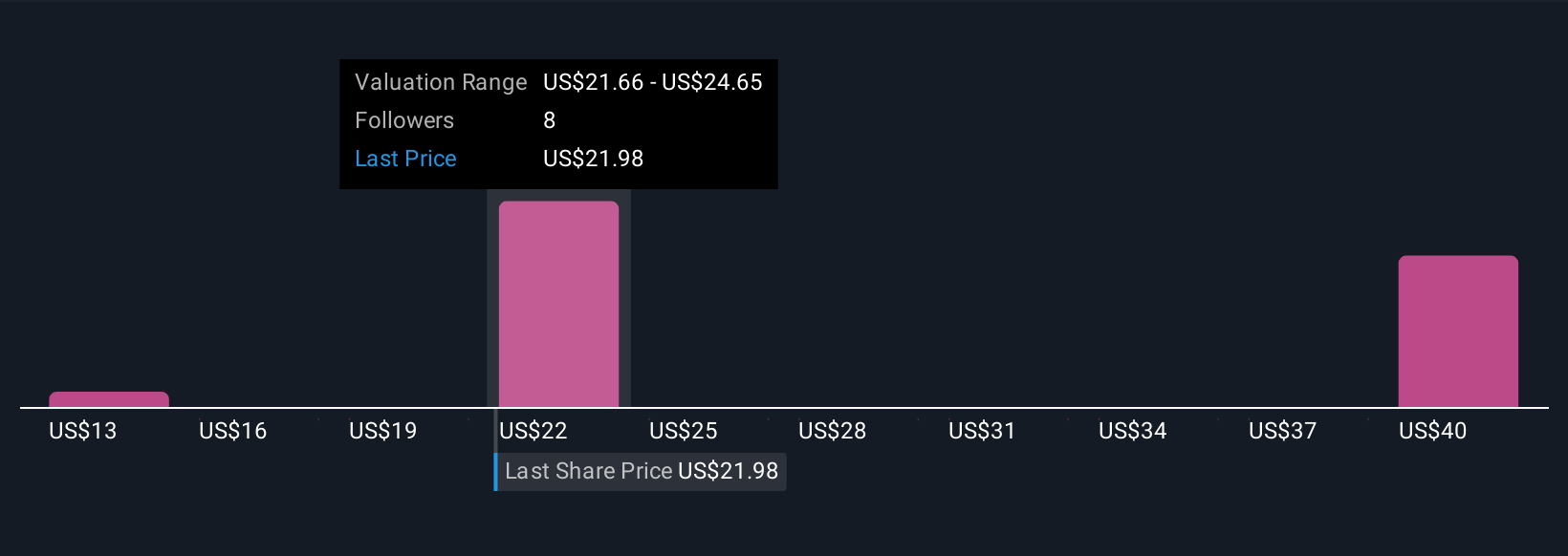

Simply Wall St Community members placed fair value estimates for Easterly Government Properties between US$12.70 and US$42.25, across three independent perspectives. Consider how most see upside, but recent pressure on net income and persistent high capital costs could influence outcomes in either direction.

Explore 3 other fair value estimates on Easterly Government Properties - why the stock might be worth 46% less than the current price!

Build Your Own Easterly Government Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Easterly Government Properties research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Easterly Government Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Easterly Government Properties' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Easterly Government Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEA

Easterly Government Properties

Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives