- United States

- /

- Office REITs

- /

- NYSE:DEA

Do Contrasting Analyst Views Signal Shifting Growth Expectations for Easterly Government Properties (DEA)?

Reviewed by Sasha Jovanovic

- In the past week, Easterly Government Properties received mixed analyst actions, with Jefferies downgrading the company to "Hold" and Compass Point upgrading it to "Buy."

- This contrasting analyst sentiment highlights ongoing debates about future growth prospects as the company manages both stable federal leases and rising capital costs.

- We'll explore how these diverging analyst opinions may influence Easterly's long-term growth outlook and risk profile.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Easterly Government Properties Investment Narrative Recap

To own shares in Easterly Government Properties, you need to believe in the enduring strength of government-backed, mission-critical real estate and its ability to generate stable cash flow even when market conditions tighten. The recent contrasting analyst actions do not appear to materially impact the main short-term catalyst, which remains persistent tenant demand and lease renewals, though they do highlight growing concerns over elevated funding costs as the primary risk for the company right now.

Among recent announcements, Easterly's decision to upsize and extend its unsecured term loan to US$200 million stands out. This move supports financial flexibility for future property acquisitions and helps address the risks that come with higher debt costs, especially as the company looks to execute on a disciplined pipeline and maintain earnings growth.

In contrast, one key risk investors should not overlook is the potential for ongoing high capital costs to put pressure on future returns if...

Read the full narrative on Easterly Government Properties (it's free!)

Easterly Government Properties' outlook anticipates $403.5 million in revenue and $20.4 million in earnings by 2028. This is based on an expected 7.7% annual revenue growth and an increase in earnings of $3.5 million from the current $16.9 million.

Uncover how Easterly Government Properties' forecasts yield a $24.08 fair value, a 10% upside to its current price.

Exploring Other Perspectives

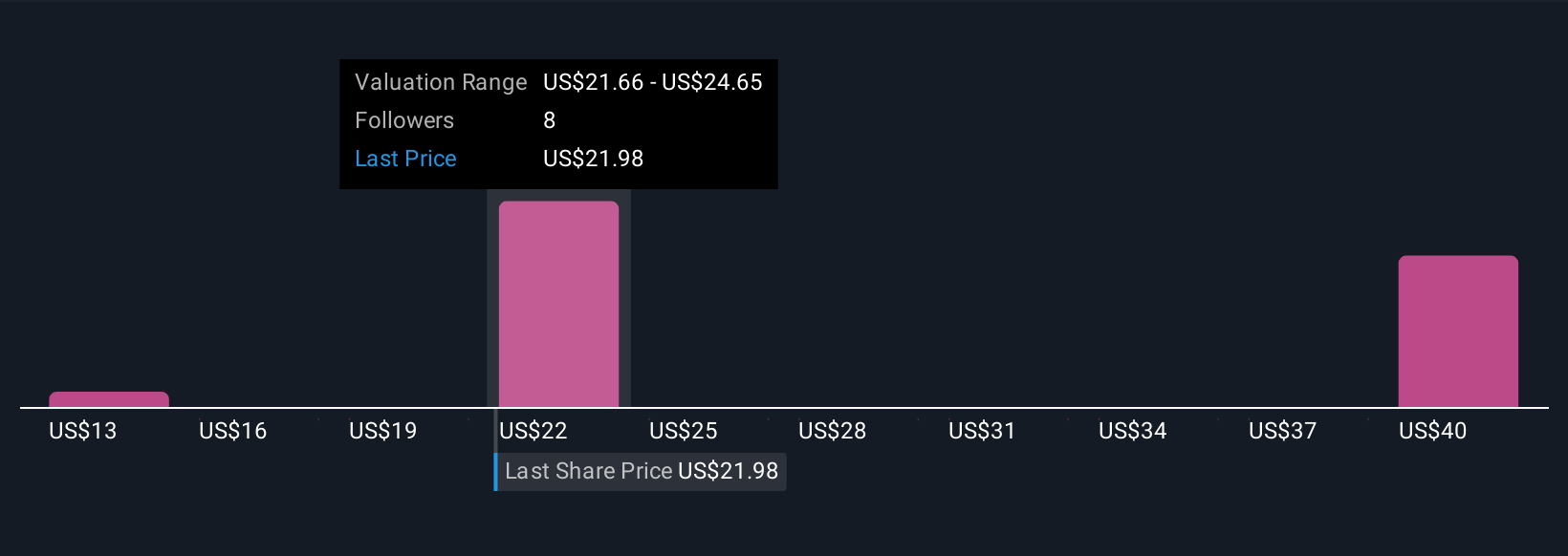

Three Simply Wall St Community estimates place fair value between US$12.70 and US$42.57 per share, showing wide disparity on the company's future. With interest rates remaining a headwind for property acquisitions, consider how differing outlooks might shape your own view on Easterly’s performance.

Explore 3 other fair value estimates on Easterly Government Properties - why the stock might be worth as much as 94% more than the current price!

Build Your Own Easterly Government Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Easterly Government Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Easterly Government Properties' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Easterly Government Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEA

Easterly Government Properties

Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives