- United States

- /

- Office REITs

- /

- NYSE:CUZ

How Cousins Properties' (CUZ) Revenue Beat and EPS Miss Could Shape Its Margin Outlook

Reviewed by Sasha Jovanovic

- Cousins Properties announced its third quarter 2025 results, reporting revenue of US$248.33 million, which exceeded analyst expectations, but earnings per share fell short at US$0.05 compared to an estimate of US$0.07.

- The company's recent acquisition of The Link in Uptown Dallas and robust leasing activity in its Sun Belt markets contributed to higher revenue but also raised operating and interest expenses, impacting profit margins.

- We'll examine how the company's revenue outperformance amid higher expenses could affect Cousins Properties' investment narrative moving forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cousins Properties Investment Narrative Recap

To be a shareholder in Cousins Properties, you need to believe in the ongoing demand for high-quality office spaces in Sun Belt markets, driven by business and population shifts. The latest quarterly results support this narrative by showing strong revenue growth and robust leasing, but rising operating and interest expenses continue to weigh on margins, leaving near-term earnings sensitivity as the most important short-term catalyst, while regional economic swings remain the biggest risk. The news does not materially change these key factors.

The recent acquisition of The Link in Uptown Dallas is particularly relevant, as it has enhanced Cousins Properties’ profile in its core Sun Belt strategy and contributed to higher rental income in the latest quarter. However, while this addition has supported revenue growth, it also added to cost pressures, reflecting how expansion can both fuel growth and sharpen margin headwinds during periods of elevated operating expenses.

By contrast, investors need to be aware that persistent cost escalations in operating and interest expenses could...

Read the full narrative on Cousins Properties (it's free!)

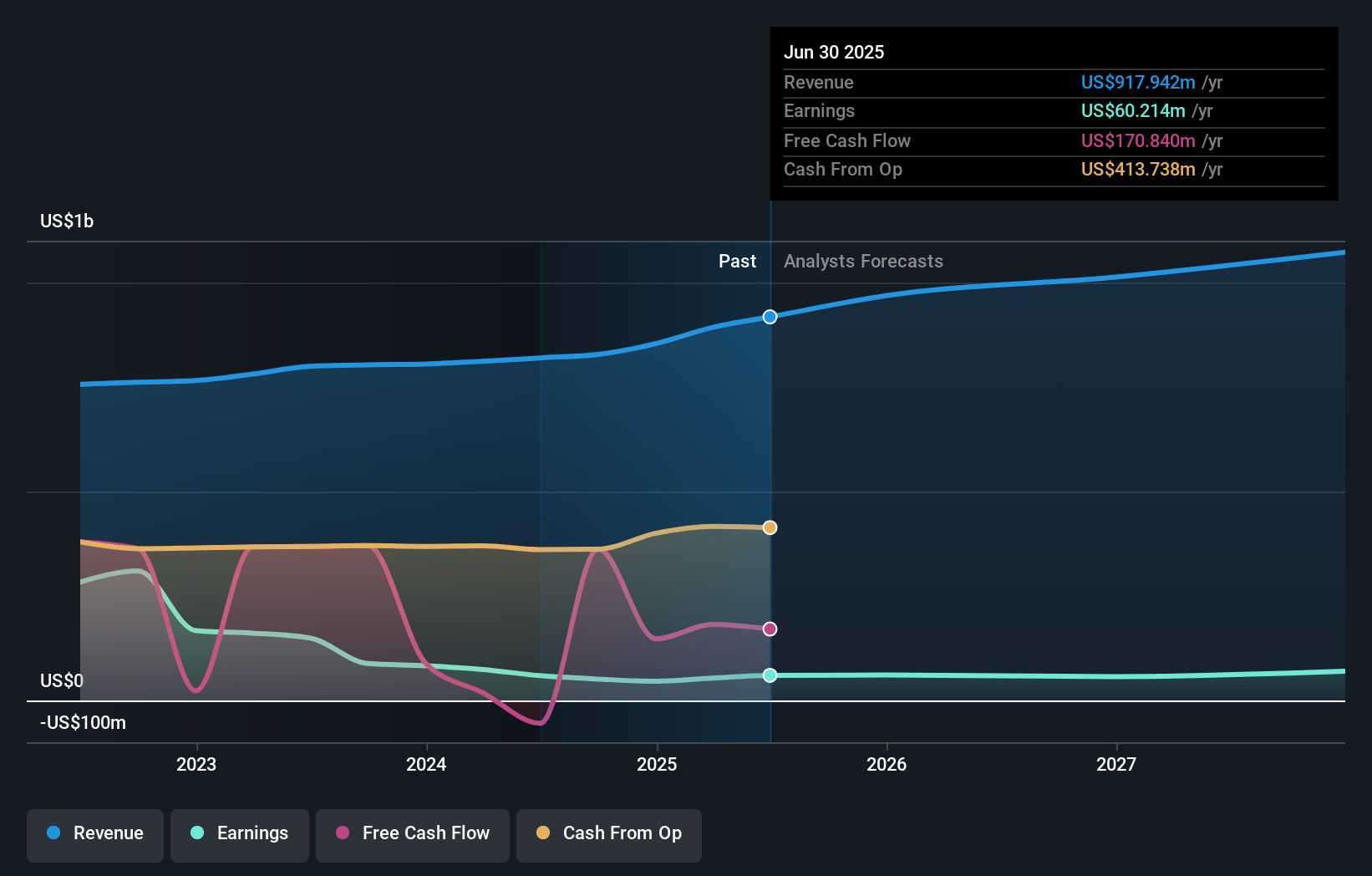

Cousins Properties' outlook anticipates $1.1 billion in revenue and $65.7 million in earnings by 2028. This scenario requires a 5.2% annual revenue growth rate and a $5.5 million earnings increase from current earnings of $60.2 million.

Uncover how Cousins Properties' forecasts yield a $32.83 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Cousins Properties range from US$31.54 to US$32.83 per share. While opinions are tightly grouped, margin pressure from rising costs remains a central focus and could influence future consensus, reviewing multiple viewpoints can inform your decision.

Explore 2 other fair value estimates on Cousins Properties - why the stock might be worth as much as 27% more than the current price!

Build Your Own Cousins Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cousins Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cousins Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cousins Properties' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUZ

Cousins Properties

Cousins Properties is a fully integrated, self-administered and self-managed real estate investment trust (REIT).

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives