Last Update 26 Nov 25

Fair value Decreased 2.54%CUZ: Shares Will Benefit From Upgraded JPMorgan Model And Overweight Rating

Narrative Update on Cousins Properties

Analysts have modestly lowered the price target for Cousins Properties from $32.83 to $32.00, reflecting updated projections of revenue growth and profit margins.

Analyst Commentary

Recent Street Research has highlighted key areas of optimism and caution regarding the outlook for Cousins Properties. The following summarizes the main themes from current analyst coverage, including both bullish and bearish perspectives.

Bullish Takeaways- Bullish analysts note that upward adjustments to price targets reflect confidence in Cousins Properties' ability to improve operational execution and drive sustained revenue growth.

- The Overweight rating signals belief in competitive positioning and the potential for above-average shareholder returns as market conditions evolve.

- Updates to company financial models suggest anticipated improvement in profit margins as management pursues efficiencies and cost controls.

- Valuation upside is cited as analysts see current shares trading below intrinsic value based on revised cash flow and growth projections.

- Bearish analysts maintain a cautious view, citing concerns that operational enhancements may take longer to materialize amid broader sector uncertainty.

- There are ongoing risks to profit margins if leasing momentum slows or operating expenses rise more than forecast.

- Uncertainty remains over the pace of recovery in key markets, which could weigh on near-term revenue growth.

What's in the News

- Cousins Properties is actively seeking acquisition opportunities that match the quality of its current portfolio and contribute positively to earnings and cash flow (Key Developments).

- The company remains focused on maintaining geographic diversity and rigorous asset quality standards as it searches for new investments (Key Developments).

- Executives are considering selective property sales to fund new acquisitions and potential future developments in response to changing debt conditions and market underwriting criteria (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased modestly from $32.83 to $32.00.

- Discount Rate has fallen from 8.07 percent to 7.68 percent as a result of updated risk assessments.

- Revenue Growth expectations have declined from 5.23 percent to 3.67 percent.

- Net Profit Margin has improved from 6.14 percent to 7.01 percent, which indicates stronger profitability forecasts.

- Future P/E has dropped significantly from 129.38x to 89.97x. This suggests revised market expectations for earnings multiples.

Key Takeaways

- Demand for premium office space in key Sun Belt markets remains strong, boosting occupancy, rent growth, and positioning for higher revenue.

- Strategic upgrades to the portfolio and disciplined financial management drive profitability, earnings stability, and long-term value enhancement.

- Dependence on a concentrated tenant base and Sun Belt markets, along with industry shifts and aging assets, creates heightened risk to occupancy, cash flow, and revenue stability.

Catalysts

About Cousins Properties- Cousins Properties is a fully integrated, self-administered and self-managed real estate investment trust (REIT).

- The migration of businesses and populations to Sun Belt cities is continuing to drive above-average demand for high-quality office space in Cousins' core markets (Atlanta, Austin, Dallas, Charlotte, Tampa, Phoenix), as evidenced by robust leasing activity, strong net absorption, and new-to-market tenant requirements. This is likely to support higher occupancy rates and drive revenue growth.

- Sustained expansion in financial services, technology, legal, and healthcare sectors-coupled with urbanization and tenant interest in vibrant mixed-use environments-has led to broad-based increases in rent roll-ups (notably double-digit increases in several markets), positioning Cousins to benefit from rising market rents and higher net operating income.

- The company's continued capital recycling out of older, low-occupancy/high CapEx assets and reinvestment into trophy lifestyle office properties in premier Sun Belt submarkets (e.g., Uptown Dallas, Austin Domain) is elevating portfolio quality and generating accretive growth, improving FFO and net margins.

- A tightening supply/demand dynamic in key markets-driven by limited new development, high absorption, and accelerated inventory removals/conversions-is producing a more landlord-favorable environment; this should support occupancy improvement and potential for premium rental rates, bolstering future revenue and earnings.

- Conservative balance sheet management (industry-leading leverage, strong liquidity, favorable debt maturity schedule) and thoughtful funding through unsecured notes and selective asset sales allow Cousins to capitalize on growth opportunities while reducing interest expense risks, supporting earnings stability and margin expansion.

Cousins Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cousins Properties's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.6% today to 6.1% in 3 years time.

- Analysts expect earnings to reach $65.7 million (and earnings per share of $0.39) by about September 2028, up from $60.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 129.4x on those 2028 earnings, up from 79.9x today. This future PE is greater than the current PE for the US Office REITs industry at 37.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

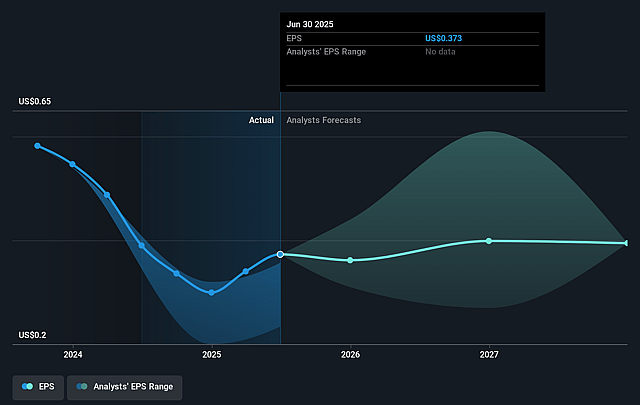

Cousins Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's concentration in Sun Belt markets exposes it to regional economic risks and tenant migration trends; a regional downturn, overbuilding, or weakening local economies could negatively impact occupancy rates and revenues.

- Large move-outs (e.g., OneTrust, Bank of America) and reliance on several key tenants heighten volatility and future earnings risk if these or similar tenants downsize or leave, directly affecting revenue stability.

- The office sector's vulnerability to long-term secular shifts, such as the sustained rise in remote and hybrid work models, threatens structural demand for office space and may lead to elevated vacancies, pressure on rental rates, and negative impacts on net operating income.

- Older vintage assets and redevelopment requirements entail significant capital expenditures; if capital recycling is not managed optimally, higher CapEx burdens could depress net margins and strain cash flow.

- The broader industry faces ongoing excess supply and competitive pressures from modern, flexible leasing models (such as co-working and flex space), potentially resulting in lower retention, shorter lease terms, and greater unpredictability in revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.833 for Cousins Properties based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $65.7 million, and it would be trading on a PE ratio of 129.4x, assuming you use a discount rate of 8.1%.

- Given the current share price of $28.64, the analyst price target of $32.83 is 12.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.