- United States

- /

- Retail REITs

- /

- NYSE:CURB

What Curbline Properties (CURB)'s US$588.8 Million Shopping Center Acquisition Spree Means For Shareholders

Reviewed by Simply Wall St

- At the BofA Securities 2025 Global Real Estate Conference, Curbline Properties announced the acquisition of 64 convenience shopping centers year-to-date, including 34 closed during the third quarter through September 10th, for a total of US$588.8 million.

- This expansion highlights Curbline's commitment to scaling as the first public real estate company exclusively focused on convenience properties within a fragmented marketplace.

- We will explore how the pace of acquisition activity strengthens Curbline's investment narrative as it targets growth in convenience retail.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Curbline Properties' Investment Narrative?

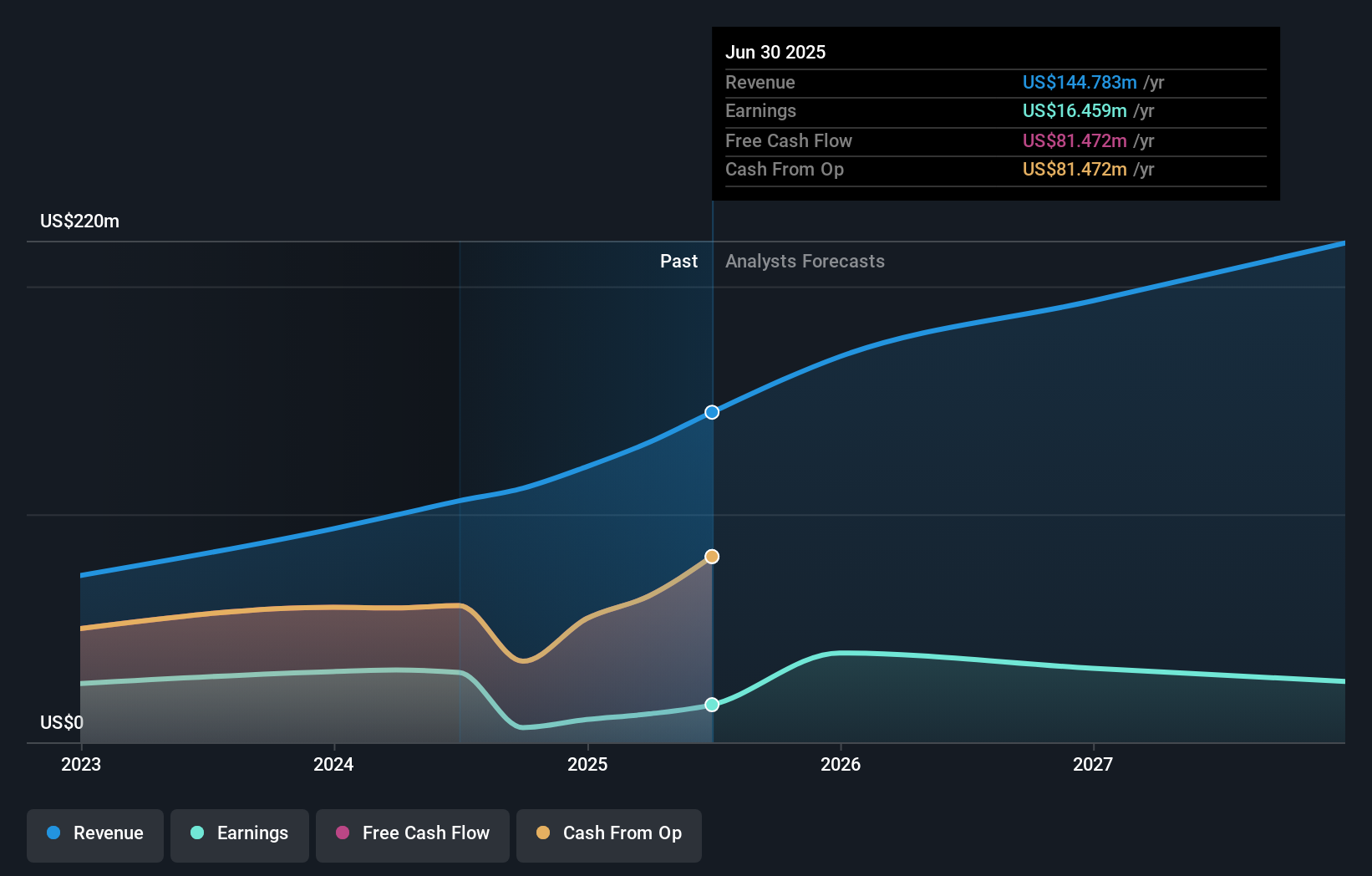

For investors considering Curbline Properties, the big picture centers on the company’s mission to scale as the first public REIT exclusively focused on convenience shopping centers. The recent announcement of acquiring 64 properties for US$588.8 million this year, including 34 in the third quarter alone, marks a significant acceleration in portfolio growth, which could serve as a short-term catalyst by expanding rental income streams. However, the impact on immediate earnings is less clear, especially given two downward revisions to 2025 earnings guidance over the past six months. Key risks have shifted: while portfolio expansion is proceeding at pace, concerns remain around high valuation multiples, recent one-off losses, and relatively low returns on equity. Execution risk also rises as the company rapidly deploys capital in a fragmented sector. Yet, in a market that remains deeply fragmented, rapid acquisitions bring both opportunity and higher stakes.

Despite retreating, Curbline Properties' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Curbline Properties - why the stock might be worth over 2x more than the current price!

Build Your Own Curbline Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Curbline Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Curbline Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Curbline Properties' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CURB

Curbline Properties

Engages in the business of owning, managing, leasing, and acquiring a portfolio of convenience shopping centers in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives