- United States

- /

- Retail REITs

- /

- NYSE:CURB

Curbline Properties (CURB): Evaluating Valuation After Share Buyback, Equity Offering, and Analyst Upgrade

Reviewed by Kshitija Bhandaru

Curbline Properties (CURB) just rolled out a $250 million share repurchase program along with a $250 million at-the-market equity offering, aiming to boost its financial flexibility and deliver value for shareholders.

See our latest analysis for Curbline Properties.

Fresh off a well-received share repurchase program and equity offering, Curbline Properties is making waves in the retail REIT space by closing significant acquisitions and drawing positive attention from analysts. After a year marked by renewed momentum and new growth strategies, the company’s 1-year total shareholder return of 3.7% suggests steady progress rather than a breakout run. However, investor sentiment appears to be rising as management doubles down on expansion and shareholder value initiatives.

If Curbline’s latest moves have you thinking bigger, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership.

With analyst upgrades, strong acquisition activity, and new capital programs pushing Curbline’s shares higher, the key question now is whether the current price offers hidden upside for investors or if the market has already factored in the company’s growth plans.

Price-to-Sales Ratio of 17.1x: Is it justified?

Curbline Properties is currently trading at a price-to-sales (P/S) ratio of 17.1x, which suggests investors are paying a premium relative to its revenue. The last close price stands at $23.55, indicating the market's strong sentiment toward future growth prospects. At the same time, this raises questions about valuation discipline when compared to both peers and industry averages.

The price-to-sales ratio is a measure of how much investors are willing to pay per dollar of revenue. For retail REITs, this metric can reflect confidence in recurring income streams and real estate asset appreciation. However, an elevated P/S multiple can also be an indication of excessive optimism, especially if growth or margins do not keep pace with expectations.

Compared to the US Retail REITs industry average of 6.2x, Curbline’s 17.1x multiple appears significantly stretched. Even against its direct peers, which average 7.1x, the premium is considerable. The estimated fair price-to-sales ratio is just 7.3x, which suggests a level the market could ultimately revert toward if fundamentals disappoint.

Explore the SWS fair ratio for Curbline Properties

Result: Price-to-Sales of 17.1x (OVERVALUED)

However, slowing revenue growth or a downturn in retail property demand could quickly undermine the optimistic outlook that is currently priced into Curbline’s shares.

Find out about the key risks to this Curbline Properties narrative.

Another View: Discounted Cash Flow Signals Opportunity

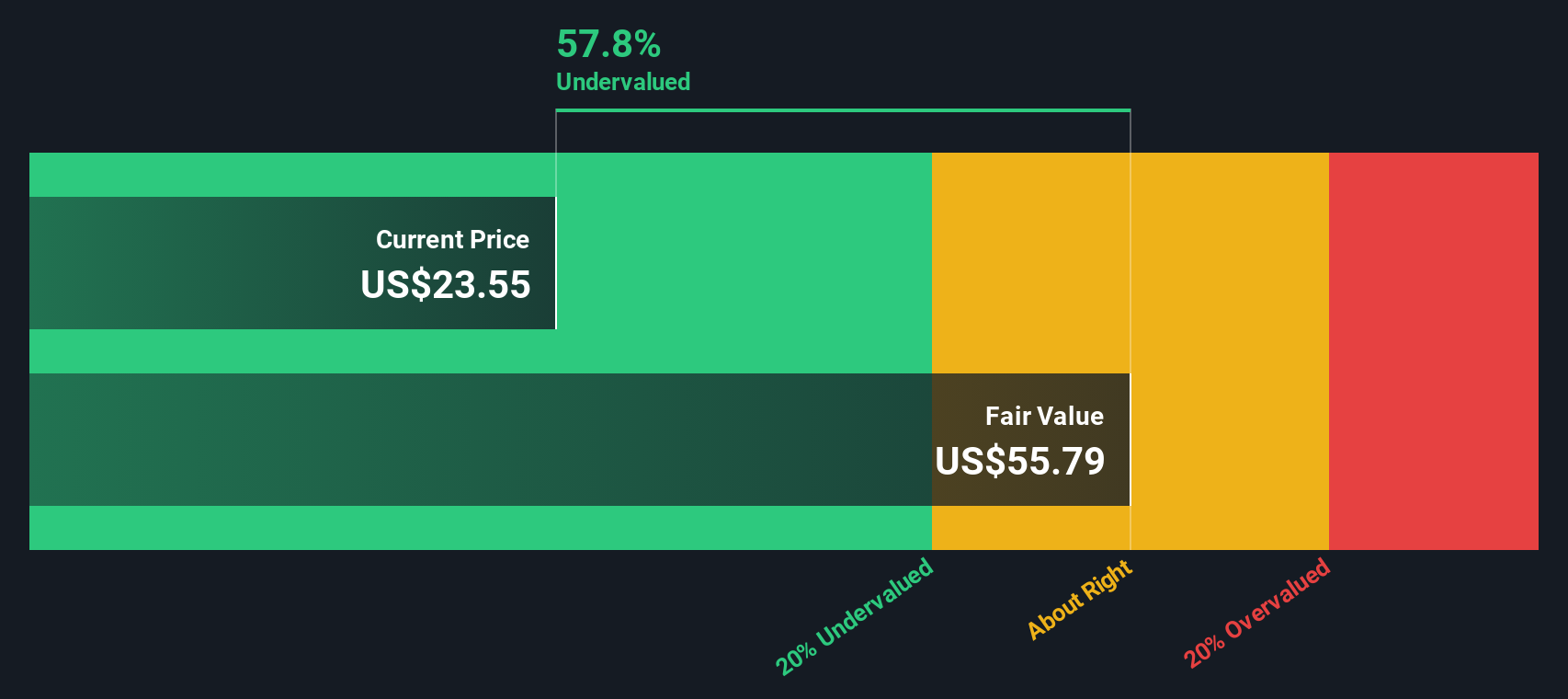

While the price-to-sales ratio paints Curbline Properties as significantly overvalued, our SWS DCF model offers a compelling counterpoint. By estimating future cash flows, this model suggests shares are actually 57.8% below fair value, which points to a sizeable undervaluation. Which method truly reflects reality for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Curbline Properties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Curbline Properties Narrative

If you see the story differently or want to dig into the numbers on your own, you can build your own perspective in just a few minutes, then Do it your way.

A great starting point for your Curbline Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game instead of missing out on the next big opportunity. Use Simply Wall Street’s powerful screeners to spot what others overlook.

- Capture regular income by selecting from these 19 dividend stocks with yields > 3% with strong yields above 3%, putting consistent cash flow at your fingertips.

- Get ahead of trends in healthcare and technology. Target growth with these 32 healthcare AI stocks transforming patient care and enhancing innovation.

- Secure bargains and boost your portfolio’s long-term value by finding these 893 undervalued stocks based on cash flows powered by robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CURB

Curbline Properties

Engages in the business of owning, managing, leasing, and acquiring a portfolio of convenience shopping centers in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives