- United States

- /

- Residential REITs

- /

- NYSE:CPT

Is Camden Property Trust (CPT) Undervalued? A Fresh Look at Its Current Valuation

Reviewed by Simply Wall St

See our latest analysis for Camden Property Trust.

Over the past year, Camden Property Trust’s share price has drifted lower. Its 12-month total shareholder return of -12.4% points to fading momentum despite a history of solid long-term gains. Recent moves reflect shifting sentiment around growth prospects and risk in the sector.

If you’re weighing opportunities beyond real estate, now is a great time to broaden your perspective and uncover fast growing stocks with high insider ownership

With the stock trading below analyst price targets while recent growth metrics have been mixed, the key question emerges: is Camden Property Trust undervalued at these levels, or is the market already pricing in its future prospects?

Most Popular Narrative: 13.5% Undervalued

With Camden Property Trust’s fair value estimated at $120.90 compared to a last close of $104.64, analysts see substantial room for upside based on forward projections. The current market discount sets the stage for a compelling look at the catalysts that could unlock this value.

Record-high apartment demand, improving affordability (wages outpacing rent growth for 31 months), and strong resident retention due to high homeownership costs are strengthening Camden's occupancy and ability to grow revenues. This dynamic is laying the groundwork for outsized rent growth as supply moderates in 2026 and 2027.

Want to know the secret behind this optimistic fair value? The narrative is fueled by a powerful blend of big growth assumptions and aggressive profit forecasts. Curiosity piqued? The details behind these bold projections will surprise even seasoned REIT investors.

Result: Fair Value of $120.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Camden’s heavy exposure to Sun Belt markets and reliance on strong job growth mean that local slowdowns or broader economic weakness could quickly challenge this outlook.

Find out about the key risks to this Camden Property Trust narrative.

Another View: Multiples Tell a Different Story

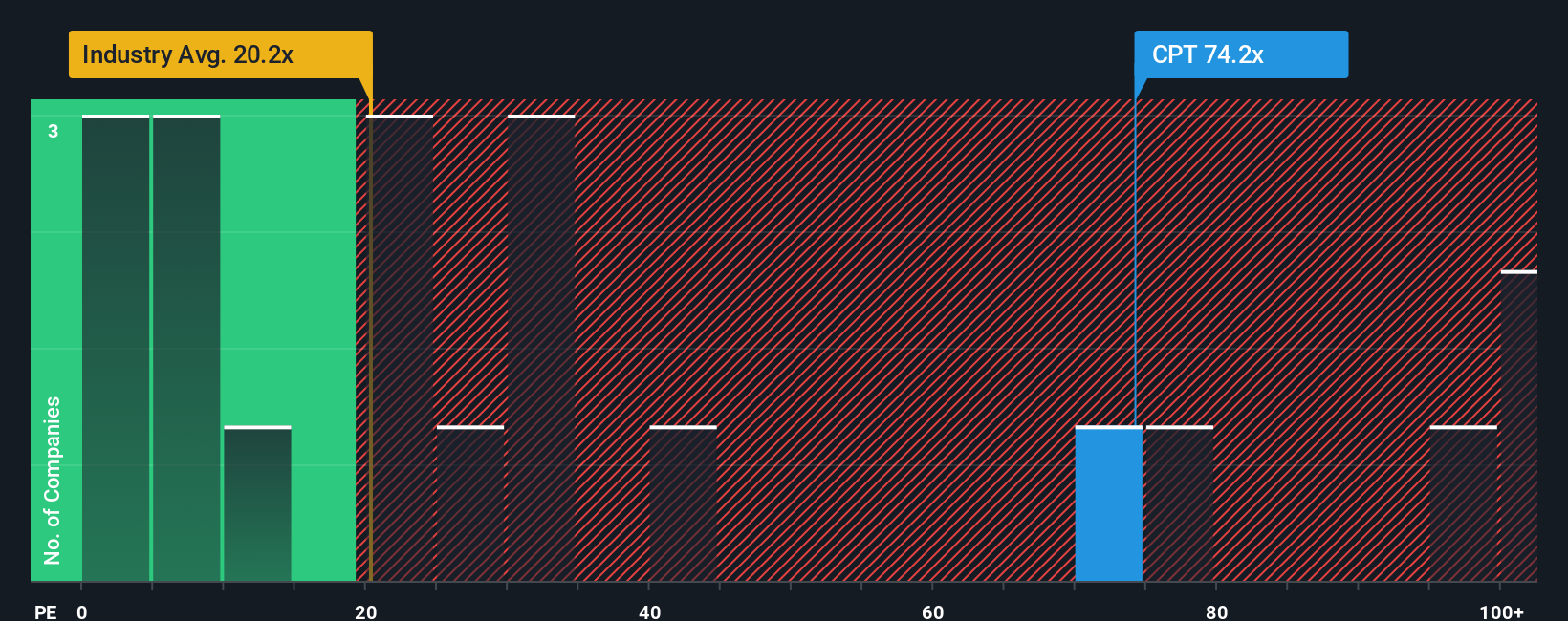

Looking at Camden Property Trust through the lens of its price-to-earnings ratio, things appear less attractive. The company’s ratio stands at 41.5x, which is notably higher than both the industry average of 25.8x and the peer average of 37.3x. Compared to its fair ratio of 25.1x, this suggests the stock is trading at a premium and raises questions about the level of optimism priced in today. Is the market underestimating risk, or is something else at play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Camden Property Trust Narrative

If you'd rather draw your own conclusions or want to test a different scenario, you can craft a unique narrative from scratch in just minutes, and Do it your way

A great starting point for your Camden Property Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your horizons with stock ideas handpicked to match today's hottest themes and tomorrow's potential winners.

- Capture income growth and stability by tapping into these 14 dividend stocks with yields > 3% with yields topping 3%.

- Unlock tomorrow’s disruptors by checking out these 3578 penny stocks with strong financials with strong financials and big upside potential.

- Tap into future medical breakthroughs and innovation through these 30 healthcare AI stocks driving advancements in healthcare technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPT

Camden Property Trust

An S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success