- United States

- /

- Residential REITs

- /

- NYSE:CPT

Camden Property Trust (CPT): Assessing Valuation After Recent Period of Underperformance

Reviewed by Simply Wall St

Camden Property Trust (CPT) shares have edged slightly higher today, moving up less than 1% after a stretch of lackluster performance over the past month. With the stock trading near $99, investors are weighing recent trends in comparison to long-term prospects.

See our latest analysis for Camden Property Trust.

While Camden’s shares have pulled back 13.3% on a share price basis so far this year, that follows a softer year-over-year total shareholder return of -9.3%. The drop hints at some fading momentum, but long-term holders have still seen a 23% five-year total return.

If recent market shifts have you thinking bigger, now is a great time to discover fast growing stocks with high insider ownership.

With shares now sitting at a notable discount to analyst targets and strong five-year total returns in the rearview mirror, the question arises: Is Camden Property Trust currently trading below its intrinsic value, or are investors already factoring in future growth?

Most Popular Narrative: 17.7% Undervalued

With Camden’s fair value estimated at $120.90, well above today’s close at $99.48, the most closely tracked narrative frames the discount as notable. Anticipated improvements in both margins and rents underpin optimism about future upside.

Record-high apartment demand, improving affordability (wages outpacing rent growth for 31 months), and strong resident retention due to high homeownership costs are strengthening Camden's occupancy and ability to grow revenues. This lays the groundwork for outsized rent growth as supply moderates in 2026 and 2027.

Why do analysts see room for the stock to surge? The secret sauce is a cocktail of margin expansion, top-line acceleration, and rent growth assumptions usually reserved for hotter sectors. The narrative leans on surprisingly strong performance forecasts for the years ahead. Want to know what’s fueling this bullish calculation? Unpack the details and see what’s behind this ambitious fair value.

Result: Fair Value of $120.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened supply in key Sun Belt markets or a broader economic slowdown could quickly erode Camden’s expected momentum and reduce future returns.

Find out about the key risks to this Camden Property Trust narrative.

Another View: High Ratios Signal Valuation Risk

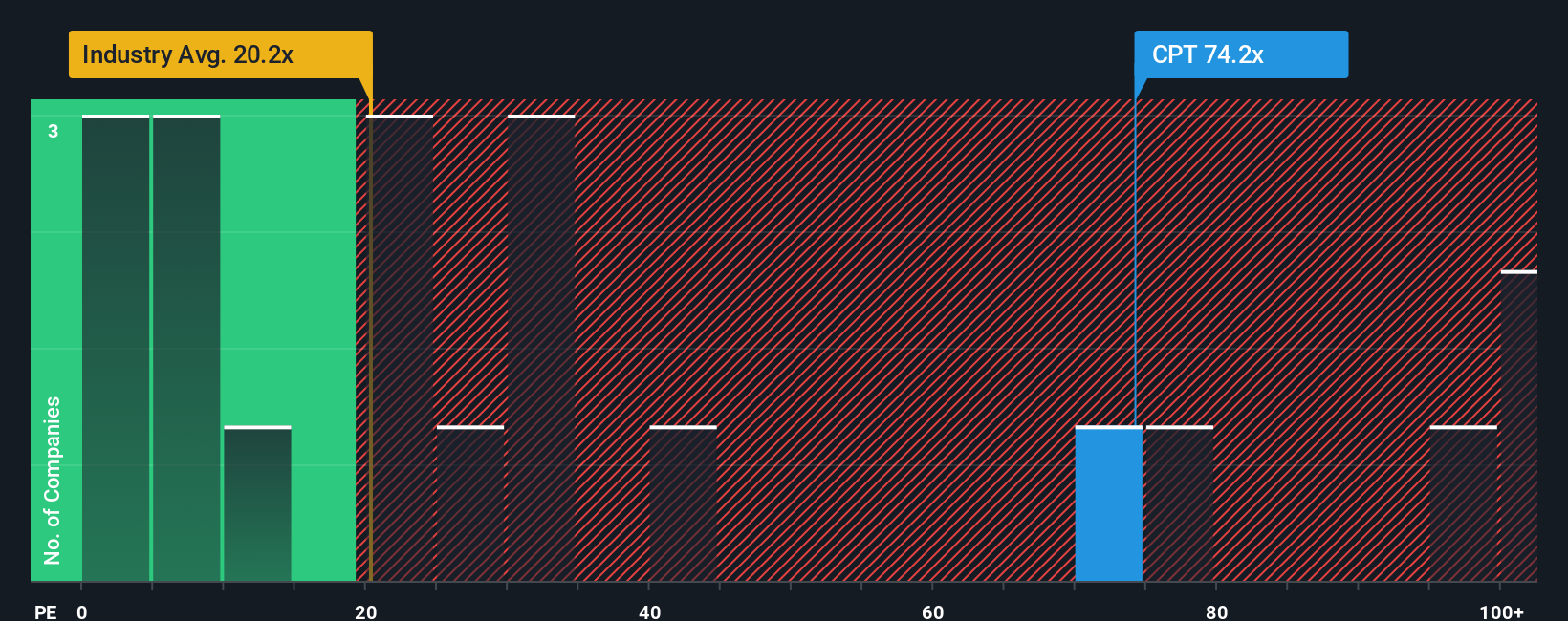

Looking at Camden’s price-to-earnings ratio shows a much higher valuation than its industry and peers. Camden trades at 68.3 times earnings, while similar residential REITs trade at 25.2, and the market’s fair ratio is just 33.9. Such a gap means the stock’s price could face downward risk if sentiment shifts. Do sky-high ratios point to further upside, or are they a warning for the cautious investor?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Camden Property Trust Narrative

If you want to dig into the numbers or chart your own conclusions, you can build your own version of the story in just minutes: Do it your way.

A great starting point for your Camden Property Trust research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stop waiting for the perfect opportunity and take control. Try hand-picking promising stocks with advanced tools built for results. The right screener could introduce you to tomorrow’s winners before the market catches on.

- Tap into stable, recurring income by reviewing these 22 dividend stocks with yields > 3% that offer reliable yields for long-term portfolio growth.

- Gain an edge on Wall Street by scanning these 832 undervalued stocks based on cash flows that have strong cash flow potential and attractive price points.

- Uncover emerging sectors making waves in medicine and technology through these 33 healthcare AI stocks focused on innovation in healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPT

Camden Property Trust

An S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives