- United States

- /

- Specialized REITs

- /

- OTCPK:CORR.Q

A Look At CorEnergy Infrastructure Trust's (NYSE:CORR) Share Price Returns

CorEnergy Infrastructure Trust, Inc. (NYSE:CORR) shareholders will doubtless be very grateful to see the share price up 31% in the last quarter. But that isn't much consolation for the painful drop we've seen in the last year. During that time the share price has plummeted like a stone, down 84%. So the rise may not be much consolation. Only time will tell if the company can sustain the turnaround.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for CorEnergy Infrastructure Trust

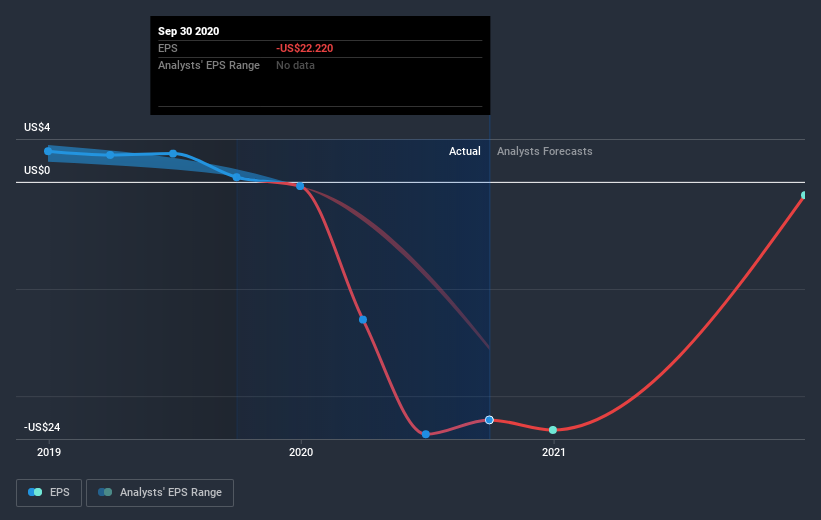

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

CorEnergy Infrastructure Trust fell to a loss making position during the year. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. Of course, if the company can turn the situation around, investors will likely profit.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While the broader market gained around 25% in the last year, CorEnergy Infrastructure Trust shareholders lost 83% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for CorEnergy Infrastructure Trust that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading CorEnergy Infrastructure Trust or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:CORR.Q

CorEnergy Infrastructure Trust

CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA) is a real estate investment trust that owns and operates or leases regulated natural gas transmission and distribution lines and crude oil gathering, storage and transmission pipelines and associated rights-of-way.

Good value with imperfect balance sheet.

Market Insights

Community Narratives