- United States

- /

- Health Care REITs

- /

- NYSE:CHCT

I Ran A Stock Scan For Earnings Growth And Community Healthcare Trust (NYSE:CHCT) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Community Healthcare Trust (NYSE:CHCT), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Community Healthcare Trust

How Fast Is Community Healthcare Trust Growing Its Earnings Per Share?

In the last three years Community Healthcare Trust's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Community Healthcare Trust's EPS shot from US$0.37 to US$0.80, over the last year. You don't see 114% year-on-year growth like that, very often.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Community Healthcare Trust's revenue last year was revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that Community Healthcare Trust is growing revenues, and EBIT margins improved by 6.2 percentage points to 37%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

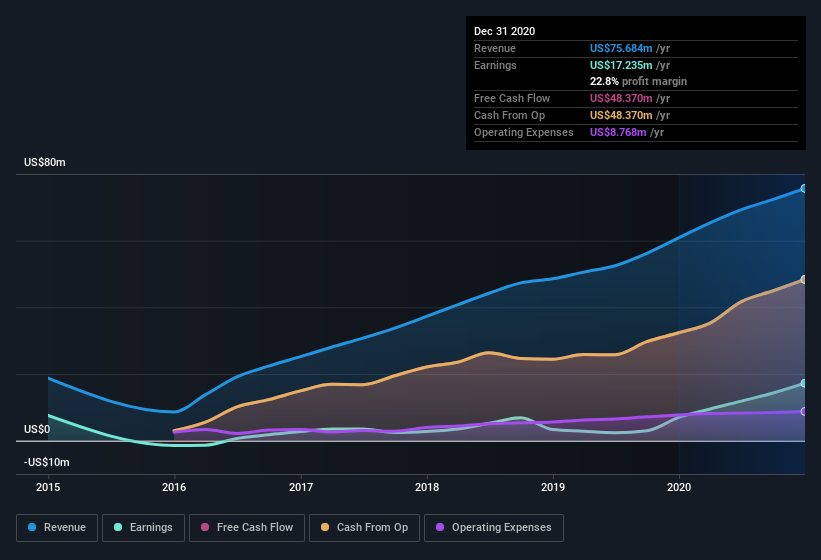

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Community Healthcare Trust's future profits.

Are Community Healthcare Trust Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Community Healthcare Trust insiders refrain from selling stock during the year, but they also spent US$197k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. Zooming in, we can see that the biggest insider purchase was by Independent Director Robert Hensley for US$100k worth of shares, at about US$38.02 per share.

On top of the insider buying, it's good to see that Community Healthcare Trust insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at US$77m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Should You Add Community Healthcare Trust To Your Watchlist?

Community Healthcare Trust's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Community Healthcare Trust belongs on the top of your watchlist. You still need to take note of risks, for example - Community Healthcare Trust has 3 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Community Healthcare Trust, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Community Healthcare Trust, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:CHCT

Community Healthcare Trust

A real estate investment trust that focuses on owning income-producing real estate properties associated primarily with the delivery of outpatient healthcare services in our target sub-markets throughout the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives