- United States

- /

- Office REITs

- /

- NYSE:CDP

Senior Notes Offering Might Change the Case for Investing in COPT Defense Properties (CDP)

Reviewed by Sasha Jovanovic

- COPT Defense Properties recently completed a US$400 million Senior Notes offering due 2030 to bolster its financial flexibility and support ongoing operations, including debt repayment.

- Analyst attention has increased following the offering, with several firms highlighting COPT’s specialized role in providing secure facilities for the defense and government sectors amid rising defense budgets.

- We'll explore how COPT’s strengthened balance sheet from the Senior Notes offering supports its mission-critical leasing model and investment case.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

COPT Defense Properties Investment Narrative Recap

To be a shareholder in COPT Defense Properties, you need to believe in the persistent growth of U.S. defense and government infrastructure spending, which underpins demand for COPT's secure, mission-critical facilities and stable lease base. The recent US$400 million Senior Notes offering strengthens the balance sheet and supports ongoing operations, but doesn't significantly alter the most important short-term catalyst, securing new high-value government leases, nor does it materially reduce the biggest underlying risk: reliance on continued robust defense budgets.

Among recent announcements, COPT’s dividend growth and its steady yield of over 4% stand out. This provides income-oriented investors with visible cash returns, yet the attractive payout depends on the company maintaining high occupancy and stable leasing in its defense and IT portfolios, the very areas most influenced by those new lease wins fueled by higher government spending.

By contrast, what investors should be aware of is the risk that shifts in federal spending priorities could suddenly...

Read the full narrative on COPT Defense Properties (it's free!)

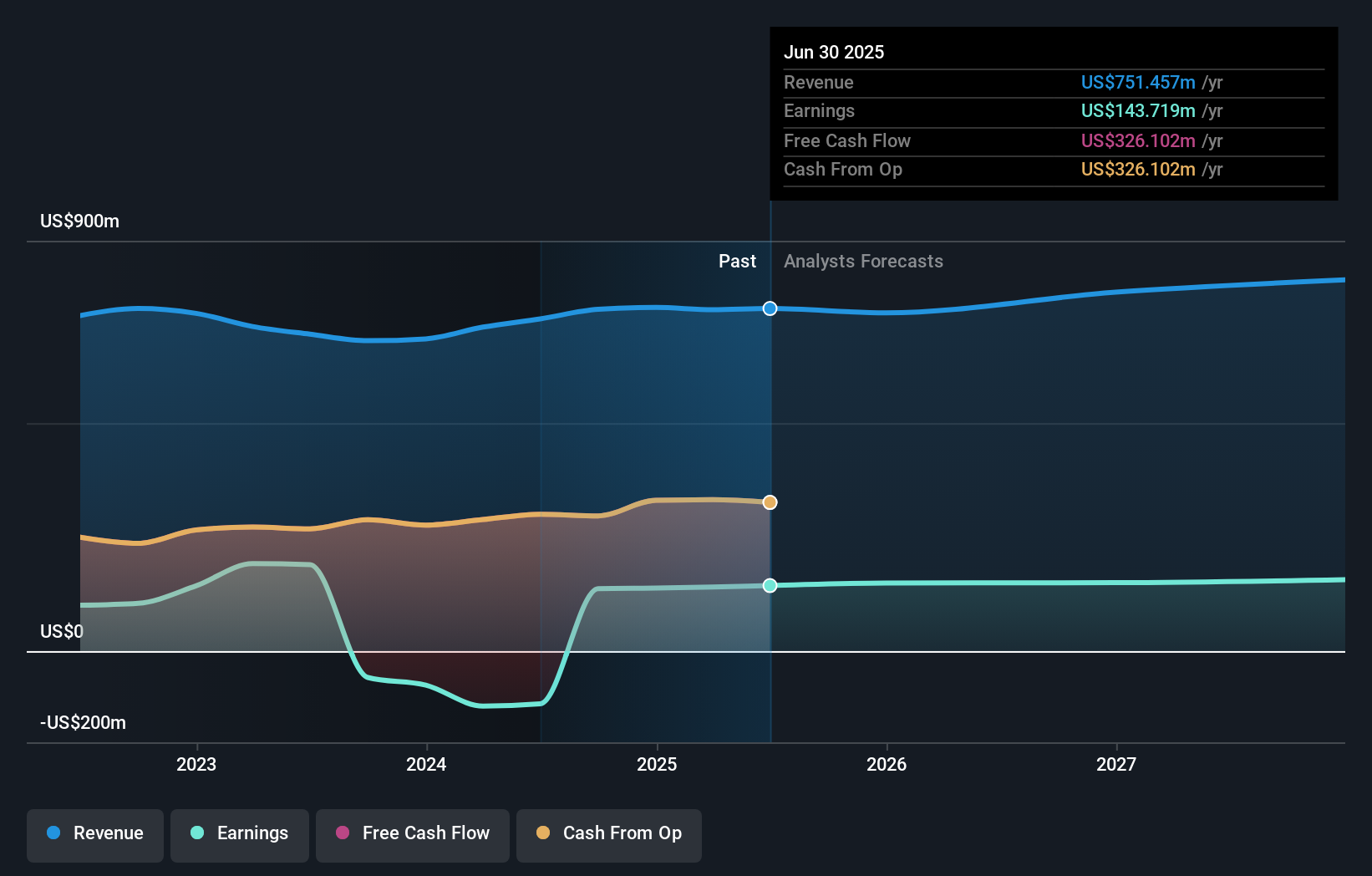

COPT Defense Properties' outlook anticipates $821.6 million in revenue and $152.6 million in earnings by 2028. This projection is based on a 3.0% annual revenue growth rate and represents an $8.9 million earnings increase from the current $143.7 million.

Uncover how COPT Defense Properties' forecasts yield a $32.57 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided just 1 fair value estimate of US$38.44 for COPT Defense Properties. With optimism around expanding government IT and defense budgets boosting major lease activity, it is worth considering why individual investor viewpoints can vary so much.

Explore another fair value estimate on COPT Defense Properties - why the stock might be worth as much as 33% more than the current price!

Build Your Own COPT Defense Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your COPT Defense Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free COPT Defense Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate COPT Defense Properties' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDP

COPT Defense Properties

COPT Defense, an S&P MidCap 400 Company, is a self-managed REIT focused on owning, operating and developing properties in locations proximate to, or sometimes containing, key U.S.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives