- United States

- /

- Office REITs

- /

- NYSE:CDP

Does COPT Defense Properties’ Expanded Credit Facility and New Notes Shift the Growth Story for CDP?

Reviewed by Sasha Jovanovic

- On October 6, 2025, COPT Defense Properties announced it amended its credit agreement, expanding its unsecured revolving credit facility commitment from US$600 million to US$800 million, and extended its maturity to 2029, alongside pricing a new US$400 million public senior notes offering.

- This combination of increased credit capacity and extended debt maturity enhances the company’s ability to fund development projects and manage liquidity for future growth.

- We’ll now explore how the increased revolving credit facility and longer debt maturity may impact COPT Defense Properties’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

COPT Defense Properties Investment Narrative Recap

To be a shareholder in COPT Defense Properties, you need to believe in the resilience and growth of specialized defense and government-focused real estate, underpinned by continued strength in federal spending and secure facility demand. The recent credit facility expansion and longer debt maturities support the company’s flexibility in funding development, but do not meaningfully change the most important near-term catalyst, strong federal budgets, or the biggest ongoing risk, which remains tenant concentration in the government and defense contractor space.

Of the latest announcements, the scheduled Q3 earnings release on October 30, 2025, stands out as the most relevant. Results will offer investors a chance to assess whether new liquidity and financial flexibility have bolstered leasing and earnings momentum, especially within the company’s core defense-oriented markets where future funding and occupancy remain the primary focus for performance.

But in contrast, investors should keep in mind the risk of delayed or reduced government contract awards in concentrated regions...

Read the full narrative on COPT Defense Properties (it's free!)

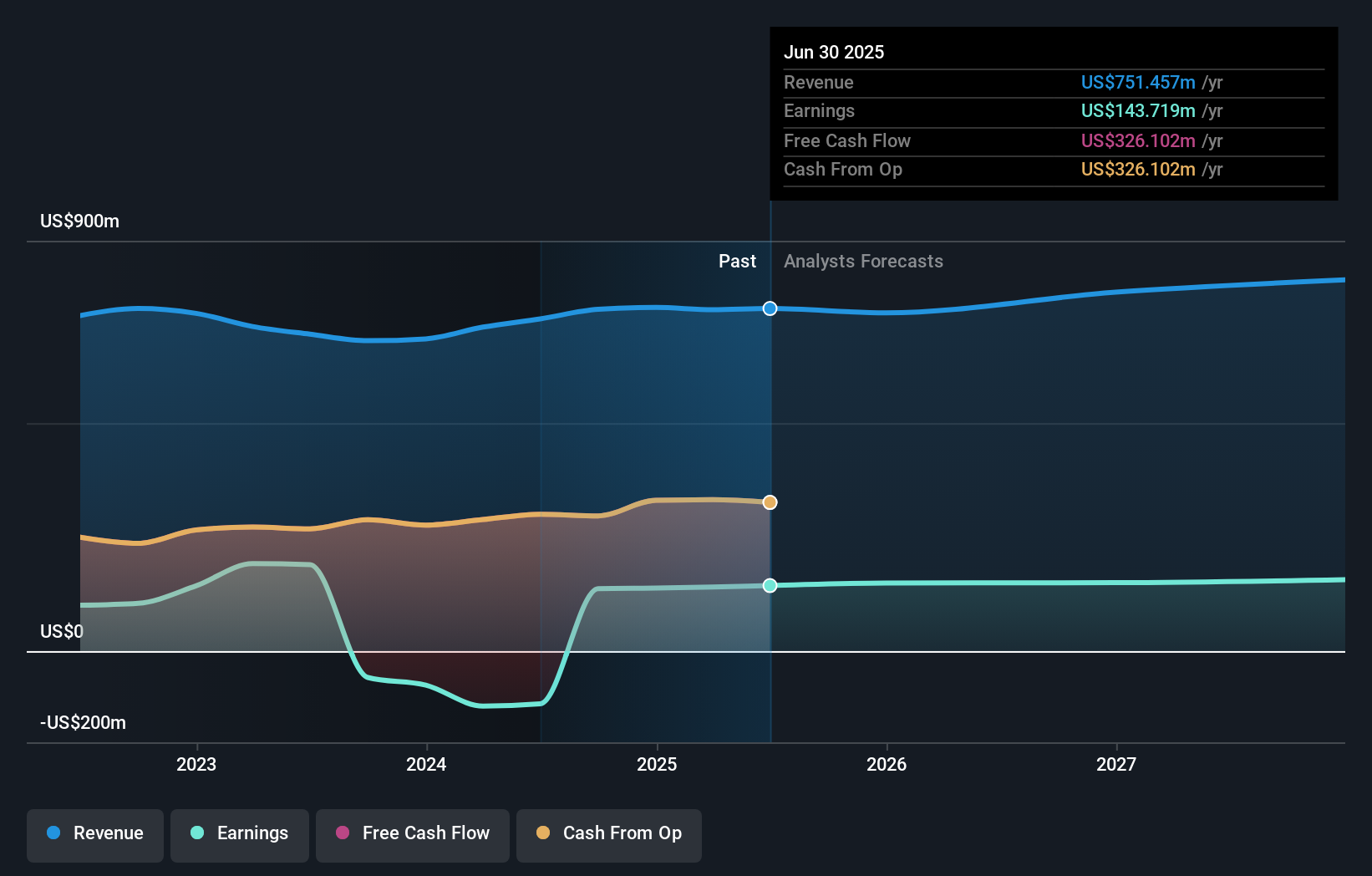

COPT Defense Properties is projected to achieve $821.6 million in revenue and $152.6 million in earnings by 2028. This outlook relies on a 3.0% annual revenue growth rate and represents a $8.9 million increase in earnings from the current $143.7 million.

Uncover how COPT Defense Properties' forecasts yield a $32.57 fair value, a 17% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided one fair value estimate at US$38.52, showing strong conviction. Against this, the company’s high tenant concentration risk could materially impact performance if government priorities shift, inviting you to explore more viewpoints.

Explore another fair value estimate on COPT Defense Properties - why the stock might be worth as much as 38% more than the current price!

Build Your Own COPT Defense Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your COPT Defense Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free COPT Defense Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate COPT Defense Properties' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDP

COPT Defense Properties

COPT Defense, an S&P MidCap 400 Company, is a self-managed REIT focused on owning, operating and developing properties in locations proximate to, or sometimes containing, key U.S.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives