- United States

- /

- Specialized REITs

- /

- NYSE:CCI

How the DISH Wireless Contract Dispute Could Influence Crown Castle's (CCI) Revenue Stability

Reviewed by Sasha Jovanovic

- In late November 2025, Crown Castle filed a lawsuit against EchoStar's DISH Wireless, alleging that DISH is improperly seeking to terminate key infrastructure agreements by invoking a force majeure clause after an FCC Notice of Inquiry on spectrum usage.

- The dispute introduces uncertainty for Crown Castle, as it threatens a significant customer relationship and raises questions about future contractually based revenue streams.

- We'll examine how the legal uncertainty surrounding the DISH Wireless dispute may affect Crown Castle's future revenue outlook and investment case.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Crown Castle Investment Narrative Recap

To be a Crown Castle shareholder, you need to believe in the company’s core U.S. tower business and its ability to provide stable, long-term rental revenues, particularly as mobile data demand grows. The recent legal dispute with DISH Wireless brings some immediate uncertainty to a significant customer relationship, but this currently does not alter the biggest risk: successful execution of the fiber segment sale and redeployment of capital into the tower business.

Among recent announcements, management’s plan for a $3 billion share repurchase program stands out in relation to the DISH issue, as it signals clear capital allocation priorities even amid legal headwinds. Taken together, these moves reinforce the company’s focus on operational efficiency and shareholder returns, which remain the central catalysts for the stock.

However, in contrast, investors should also be aware of execution risks from the fiber segment sale process, especially if...

Read the full narrative on Crown Castle (it's free!)

Crown Castle's outlook anticipates $4.6 billion in revenue and $1.6 billion in earnings by 2028. This assumes an annual revenue decline of 10.7% and a $5.5 billion increase in earnings from the current -$3.9 billion.

Uncover how Crown Castle's forecasts yield a $116.06 fair value, a 28% upside to its current price.

Exploring Other Perspectives

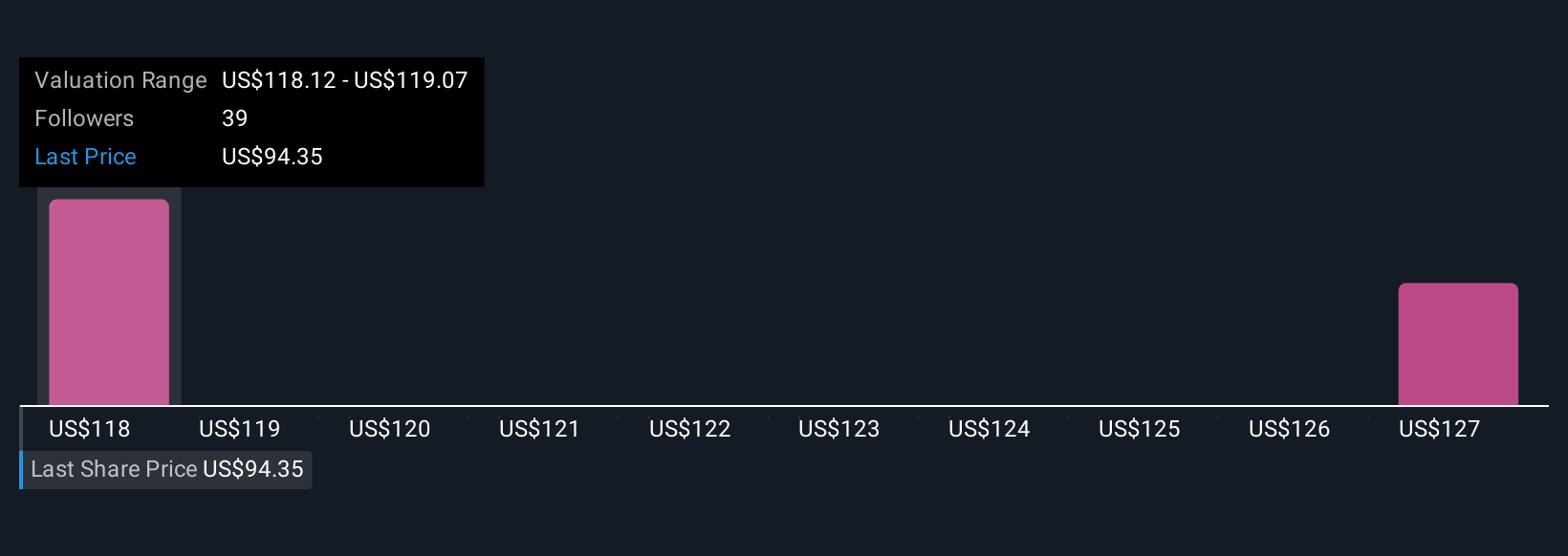

Simply Wall St Community members provided three fair value estimates for Crown Castle, spanning US$102.56 to US$130.22 per share. Alongside these diverse opinions, the ongoing dispute with a key customer may reshape Crown Castle’s revenue stability, so consider several views before making up your mind.

Explore 3 other fair value estimates on Crown Castle - why the stock might be worth just $102.56!

Build Your Own Crown Castle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Castle research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Crown Castle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Castle's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.