- United States

- /

- Specialized REITs

- /

- NYSE:CCI

How Attractive Is Crown Castle Stock After Recent T-Mobile Tower Asset Sale?

Reviewed by Bailey Pemberton

Thinking about what to do next with Crown Castle stock? You are not alone. After all, this is a company that often draws debate from both cautious holders and value-seeking buyers. If you have glanced at its recent performance, you might feel a mix of curiosity and hesitation. Over the past week, the price barely budged, eking out a 0.1% gain, while the month has seen a more noticeable dip of 1.7%. Yet, zoom out to the year-to-date view and Crown Castle is up 6.9%. Over longer horizons, though, the stock shows some bruises, with a five-year return of -28.3% that certainly gives pause. Some of these moves echo broader shifts in sentiment around infrastructure assets as the market weighs everything from interest rates to infrastructure spending priorities.

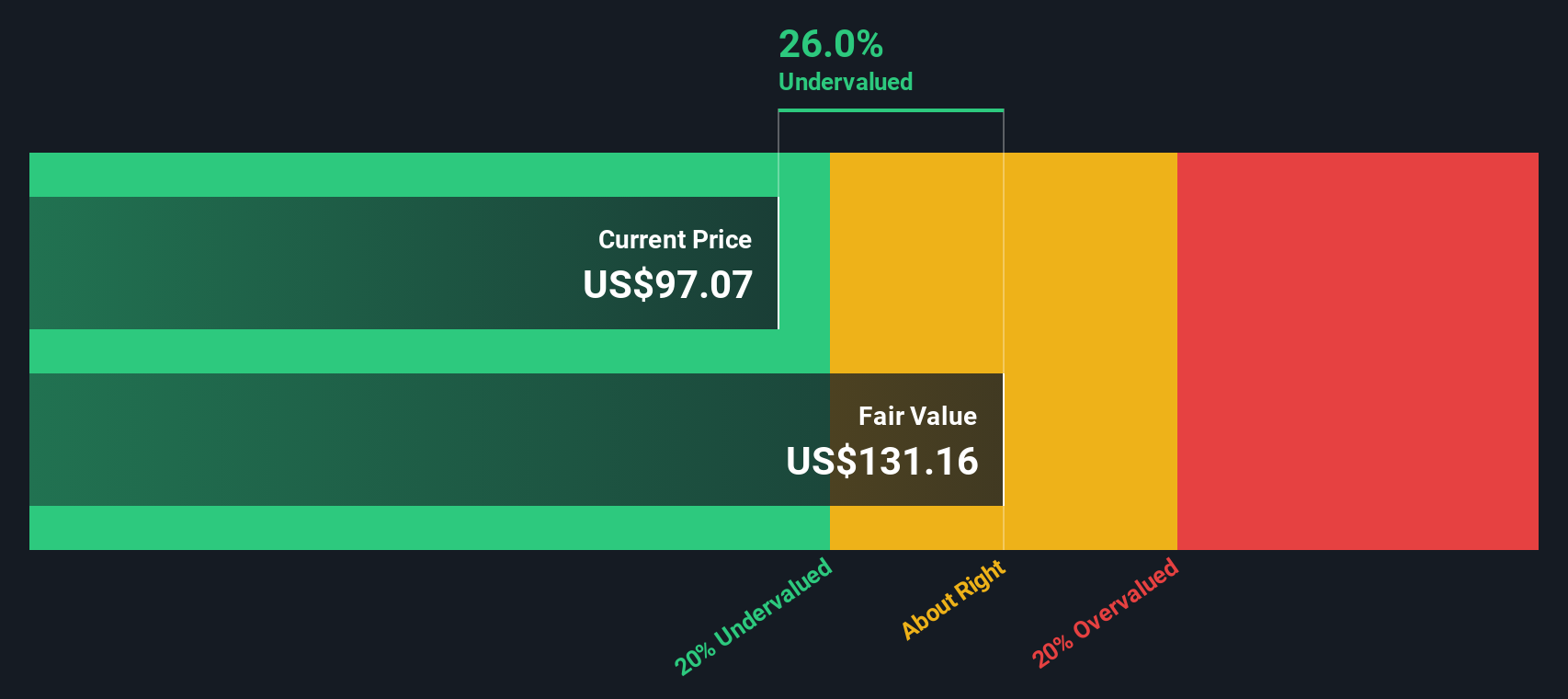

So, is all the negativity overdone, or is there real risk lurking here? When it comes to valuation, Crown Castle actually passes every single one of the six key checks used to screen for undervalued stocks, earning a value score of 6 out of 6. That is a rare result in a steady dividend payer and it hints at more growth or a rebound potential than many investors might expect from the recent price swings alone.

Stick with me as we break down each piece of the valuation puzzle using tried-and-true approaches. And just when you think you know the score, I will reveal a perspective that could change the way you look at Crown Castle’s value for good.

Why Crown Castle is lagging behind its peers

Approach 1: Crown Castle Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects Crown Castle’s future adjusted funds from operations and then discounts those cash flows back to present value using a conservative required return. This approach gives investors a snapshot of what the company’s business is truly worth, based on its ability to deliver cash to shareholders over time.

While Crown Castle’s latest reported Free Cash Flow figure is not available, analysts estimate its future annual free cash flows will continue to rise. Projections show free cash flow growing from roughly $2.2 Billion in 2026 to $2.85 Billion by the year 2029, with further steady growth extrapolated out to 2035. These long-term estimates combine both five-year analyst forecasts and extended projections by Simply Wall St, all denominated in $.

Based on these assumptions, the DCF model calculates an intrinsic value of $127.77 per share. That is around 25.3% higher than the current trading price, suggesting Crown Castle is undervalued by a meaningful margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Crown Castle is undervalued by 25.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

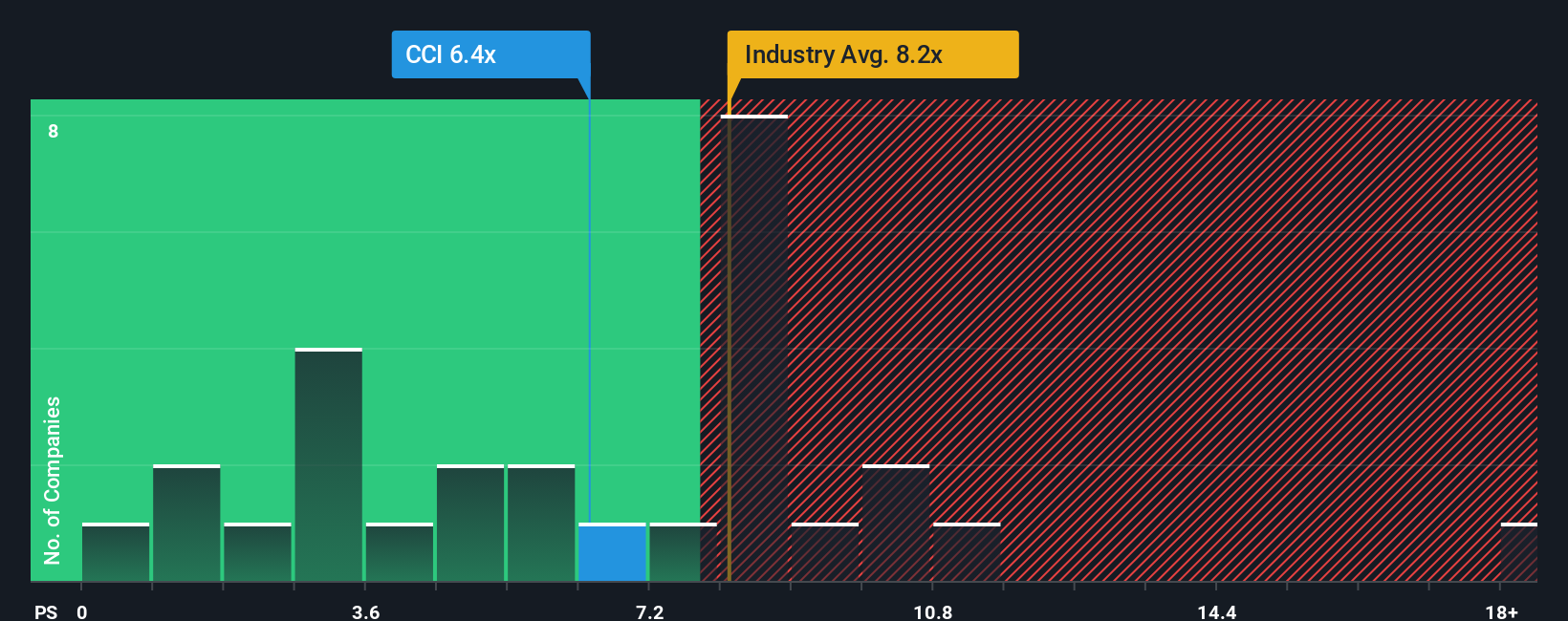

Approach 2: Crown Castle Price vs Sales

For companies like Crown Castle, which may have volatile or negative earnings, the Price-to-Sales (P/S) ratio is an especially helpful valuation metric. Unlike earnings, revenue tends to be more stable and less susceptible to accounting swings. This gives investors a clearer gauge of how much the market is paying for each dollar of sales. This approach is particularly informative for real estate investment trusts and infrastructure plays, where cash flows and profits can fluctuate due to heavy investment cycles or interest rate movements.

A company’s P/S multiple is usually judged against sector norms, growth outlook, and perceived risks. Higher growth or safer business models often justify a higher P/S ratio, while increased risks or muted prospects can push it lower. As of now, Crown Castle trades at 6.43x sales. For comparison, the average among its industry peers stands at 7.97x, while the broader Specialized REITs industry averages 8.37x. On a simple read, Crown Castle appears less expensive than both its direct competitors and the wider market group.

Simply Wall St’s proprietary “Fair Ratio” refines this assessment by adjusting for factors such as Crown Castle’s expected growth, industry type, profit margin, market capitalization, and risk profile. This delivers a nuanced benchmark of 6.87x for Crown Castle, reflecting its unique business mix rather than generic comparisons. Because the Fair Ratio is tailored to the company’s actual prospects and risk, it offers a deeper, more reliable guide than relying solely on broad averages or peer groups.

With Crown Castle’s current P/S ratio of 6.43x just 0.44 below the Fair Ratio, the stock looks undervalued based on this approach, but not dramatically so.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Crown Castle Narrative

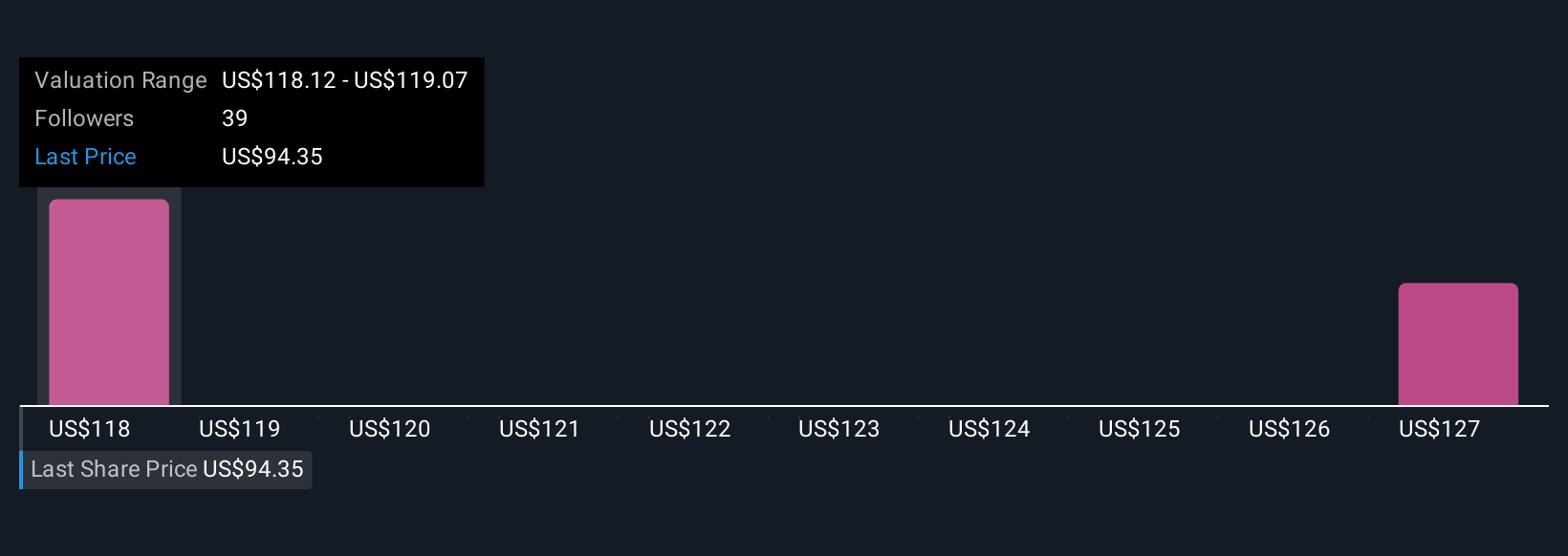

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story for a company; it is a way to connect what you believe about Crown Castle’s future with your numbers, linking your unique perspective on where the business is headed to a personalized financial forecast and an estimate of fair value. Narratives help you bridge the gap between headlines and hard data, making it easier to decide when to buy or sell by comparing your Fair Value to the current share price.

On Simply Wall St's Community page, used by millions of investors, creating or following a Narrative makes the complex world of investment analysis more approachable and interactive. Narratives are kept up to date whenever fresh news or earnings come out, so your thinking adjusts as the story changes. For instance, some investors believe Crown Castle could reach a fair value as high as $127 per share based on operational improvements, while others see more risk and estimate a lower figure around $100, all using their own revenue and margin expectations within a Narrative framework.

Do you think there's more to the story for Crown Castle? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives