- United States

- /

- Specialized REITs

- /

- NYSE:CCI

Analyzing Crown Castle After Recent Strategic Partnerships and a 9.5% Year-to-Date Gain

Reviewed by Bailey Pemberton

If you are holding shares of Crown Castle or considering buying in, you are probably wondering if now is the right time to make a move. After all, Crown Castle has been anything but boring recently. Despite a minor dip of 0.4% in the past week, the stock has climbed 3.6% over the last month and is up a solid 9.5% for the year to date. Yet, the longer view is mixed, as Crown Castle still sits nearly 7% lower than this time last year and down over 21% since five years ago. These numbers raise an important question: does the current price reflect the true value of the stock, or is there an opportunity hiding beneath the surface?

Recently, Crown Castle has made headlines as it continues to adapt to evolving industry dynamics, including changes in demand for wireless infrastructure and adjustments in its asset portfolio. The chatter around its new strategic partnerships and commitments to future network investments points to optimism among investors banking on long-term growth. However, the market has been split. Some see risk, others see potential, and that tension is reflected in the stock’s bumpy ride.

For those trying to size up the opportunity, a closer look at valuation can help cut through the noise. By our checks, Crown Castle scores a 5 out of 6 for being undervalued, a strong result and much better than many peers in the sector. But just looking at a single score does not tell the whole story. Let us break down exactly how we got here by reviewing the major valuation methods investors use, and then stick around for an approach that goes even deeper.

Why Crown Castle is lagging behind its peers

Approach 1: Crown Castle Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a tried and tested valuation approach. It projects a company's future adjusted funds from operations and then discounts these expected cash flows back to today’s dollars. This method aims to estimate what Crown Castle is truly worth based on the money it is expected to generate in the coming years.

For Crown Castle, analysts forecast free cash flows exceeding $2 billion annually over the next five years, with projections crossing $2.8 billion by 2029. These figures are all in US dollars and calculated in billions, highlighting strong growth expectations. After 2029, further estimates are extrapolated, but the central idea remains the same: Crown Castle’s cash flow engine is projected to keep humming along.

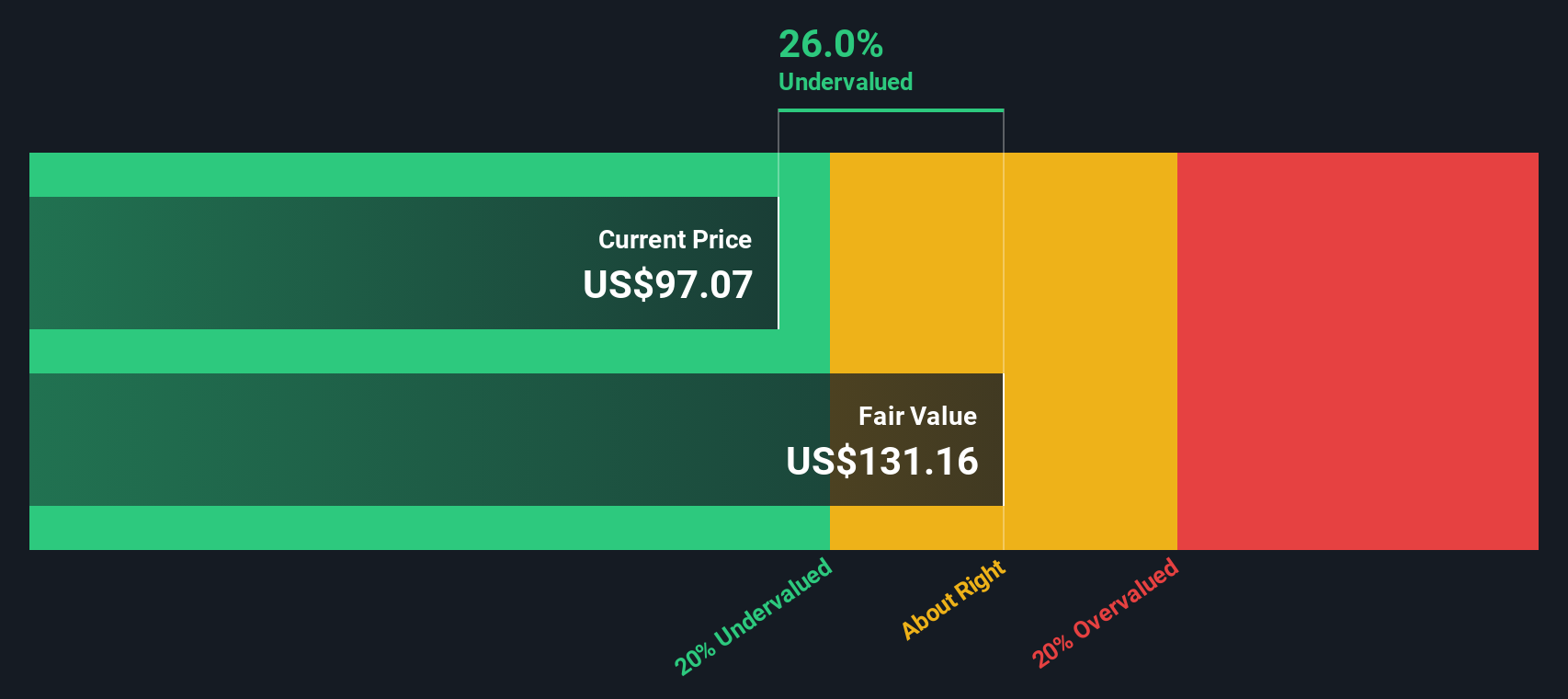

Based on these projections, the model calculates an intrinsic value of $128.40 per share. This figure is roughly 23.9% above the stock’s current price, implying Crown Castle is notably undervalued according to this DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Crown Castle is undervalued by 23.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Crown Castle Price vs Sales

The Price-to-Sales (P/S) ratio is a popular valuation metric for companies like Crown Castle, especially when earnings may be volatile or less meaningful due to unusual factors. The P/S ratio focuses on revenue, making it a useful tool for large, profitable infrastructure businesses where consistent sales provide a solid indicator of underlying value. This approach is well suited for companies with steady cash flows and predictable recurring revenues.

Growth expectations and company-specific risks play a significant role in determining what qualifies as a fair P/S ratio. When a business is expected to grow rapidly, investors are often willing to pay a higher multiple of sales. However, if the company faces industry headwinds or heightened risks, fair multiples tend to be lower. For this reason, the P/S ratio must be evaluated in context, not just in isolation.

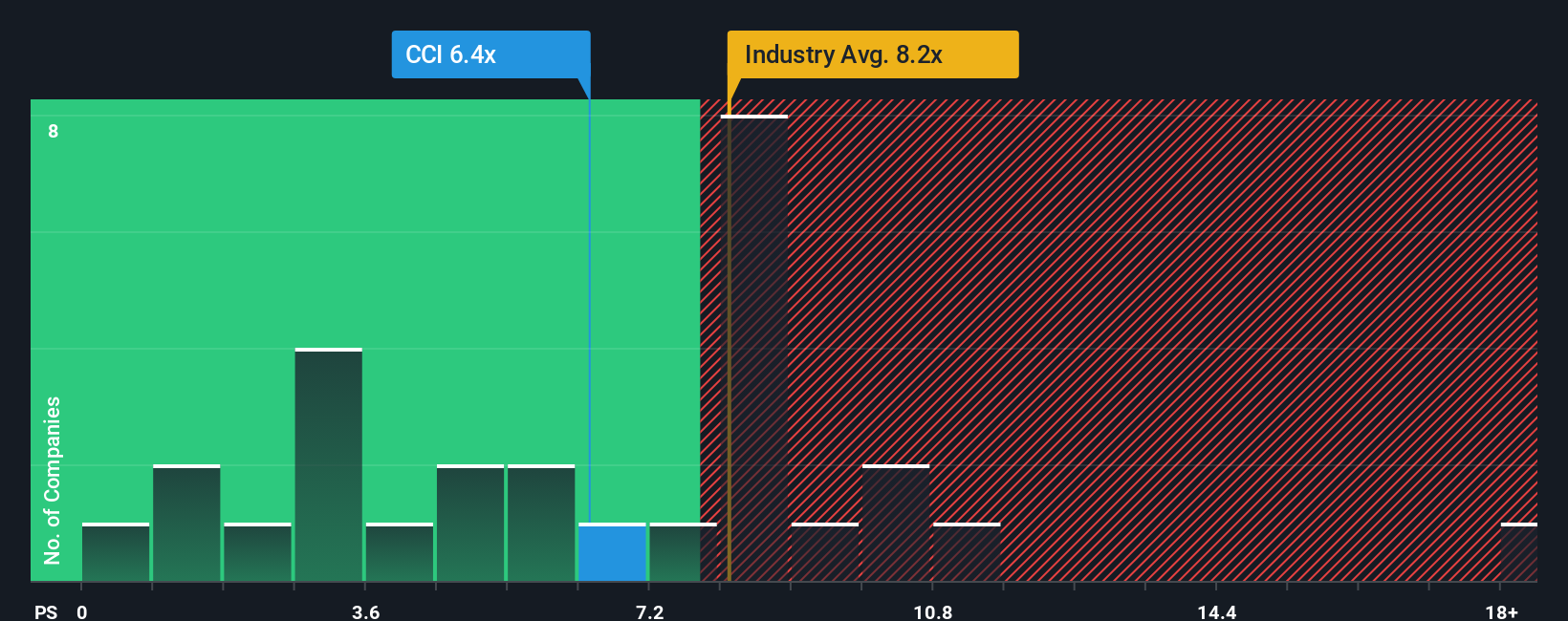

Crown Castle currently trades at a P/S ratio of 6.58x. For comparison, the industry average stands at 8.13x, and the average among its closest peers is an even higher 9.58x. At first glance, Crown Castle appears somewhat cheaper than both benchmarks. However, Simply Wall St’s “Fair Ratio” digs deeper by accounting for Crown Castle's growth outlook, profit margin, market cap, and sector risks. This produces a tailored fair value multiple of 6.94x. This proprietary metric helps investors avoid misleading comparisons by reflecting the company’s unique circumstances rather than just broad averages.

Comparing Crown Castle’s current P/S of 6.58x to the Fair Ratio of 6.94x, the stock is trading at a mild discount to its intrinsic value. This suggests it is modestly undervalued at these levels.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

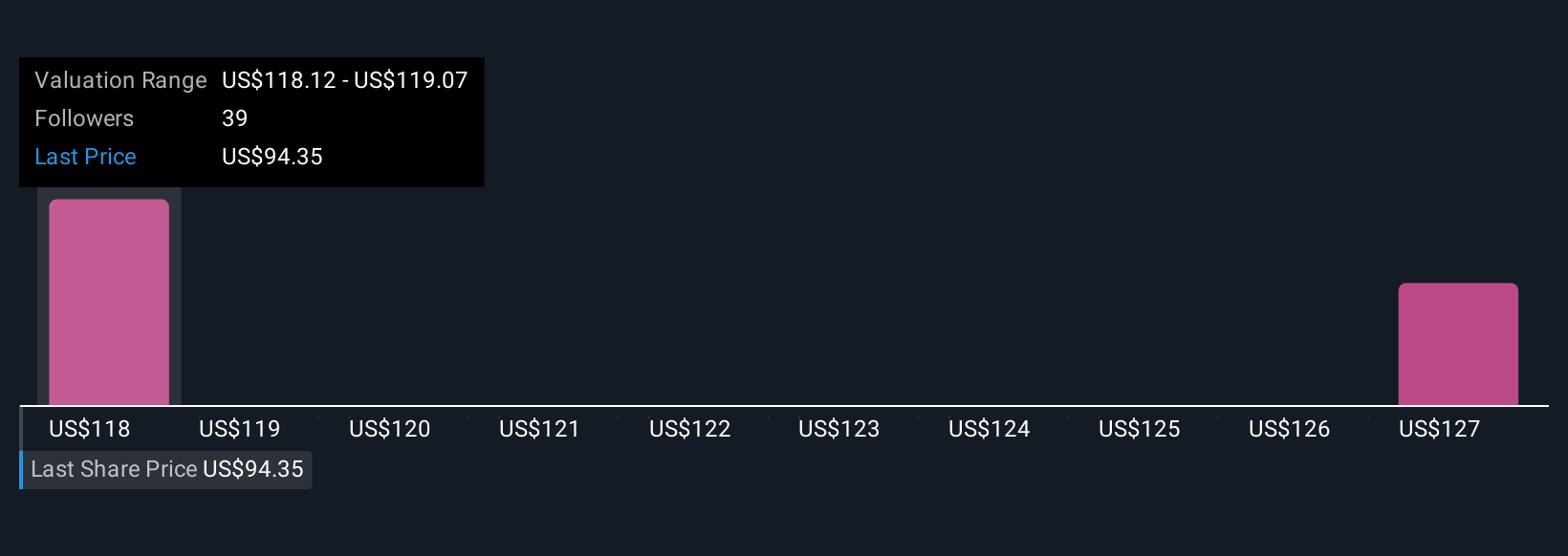

Upgrade Your Decision Making: Choose your Crown Castle Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, accessible way to build your own story about a company like Crown Castle by linking your perspective on its business direction with clear financial forecasts and a resulting fair value. Unlike just relying on ratios or analyst targets, Narratives help you outline the events you expect, your assumptions for future revenue, earnings, and margins, and then instantly connect those to a fair value estimate. This powerful yet easy tool is available right within Simply Wall St’s Community page, which is used by millions of investors. You can craft, share, and compare your views with others. Narratives allow you to quickly see if you think Crown Castle is a buy or sell by comparing your Fair Value to the current market Price, and automatically update as new news or earnings are released. For example, two investors might have totally different Crown Castle Narratives: one expects accelerated growth if the tower-only plan succeeds and assigns a fair value of $127, while another, concerned about revenue decline and industry churn, sees fair value at just $100. Narratives put your story and numbers together, guiding smarter, more dynamic investment decisions.

Do you think there's more to the story for Crown Castle? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives