- United States

- /

- Residential REITs

- /

- NYSE:AVB

AvalonBay Communities (AVB): Assessing Valuation After Truist Upgrade and Dividend Confirmation

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 12.2% Undervalued

The most widely discussed fair value scenario sees AvalonBay trading at a significant discount relative to calculated fair value. The narrative suggests the fundamentals are not currently priced in by the market.

Record-low levels of new multifamily supply in AvalonBay's core markets through at least 2026, alongside high barriers to entry and permitting, are expected to alleviate competitive pressures and support higher margins and same-store NOI growth.

Curious what’s fueling this bullish target valuation? The calculation hangs on ambitious revenue and margin forecasts, a disciplined profit multiple typically reserved for market darlings, and some bold calls about where future earnings are headed. Think you know the numbers? You might be surprised at just how aggressive the narrative’s assumptions are compared with recent results.

Result: Fair Value of $219.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory hurdles and slower job growth in core markets could challenge AvalonBay’s bullish outlook. These factors may pressure rental demand and future earnings.

Find out about the key risks to this AvalonBay Communities narrative.Another View: What About the Market Multiple?

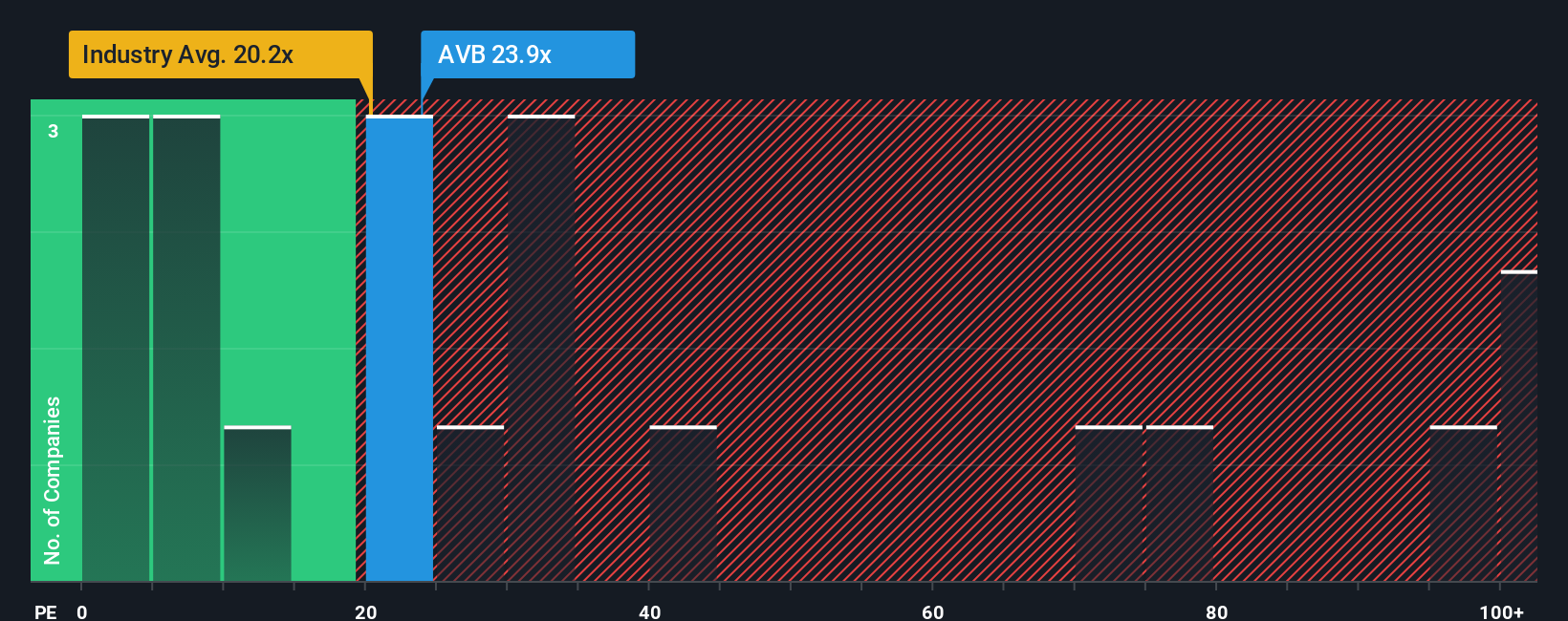

Looking at things from a different perspective, AvalonBay’s current valuation appears high compared to similar companies, based on its price-to-earnings ratio. This raises the question: could the recent optimism be moving the price too far?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding AvalonBay Communities to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own AvalonBay Communities Narrative

If you do not see your perspective reflected here, or want to test your own assumptions, you can easily construct your own narrative in just a few minutes. Do it your way

A great starting point for your AvalonBay Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on powerful opportunities. Smart investors are constantly scanning the market for tomorrow’s winners. With Simply Wall Street’s screener, you can easily hunt down strategies that fit your goals and act before the market catches on.

- Tap into lucrative income streams by checking out dividend stocks offering yields above 3% through dividend stocks with yields > 3%.

- Get ahead of tech innovation by scanning the market for promising AI-driven companies using AI penny stocks.

- Hunt for hidden gems trading below their real value with this tool for undervalued stocks based on cash flows based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVB

AvalonBay Communities

A member of the S&P 500, is an equity REIT that develops, redevelops, acquires and manages apartment communities in leading metropolitan areas in New England, the New York/New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in the Company's expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives