- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Reassessing Alexandria Real Estate Equities After a 50% Share Price Slide in 2025

Reviewed by Bailey Pemberton

- If you have ever looked at Alexandria Real Estate Equities and wondered whether this beaten down life sciences landlord is quietly turning into a bargain, this breakdown is for you.

- The stock has slid hard, with shares down 9.6% over the last week, 13.1% over the past month, and more than 50% year to date, which naturally has investors asking whether the risks have risen or the market has simply overreacted.

- Recent headlines have focused on shifting demand in the life sciences and biotech real estate market, as venture funding cools and some tenants reassess their space needs. At the same time, longer term themes around specialized lab space, high quality research hubs, and the difficulty of replicating Alexandria’s key campuses are still front and center in analyst commentary and industry coverage.

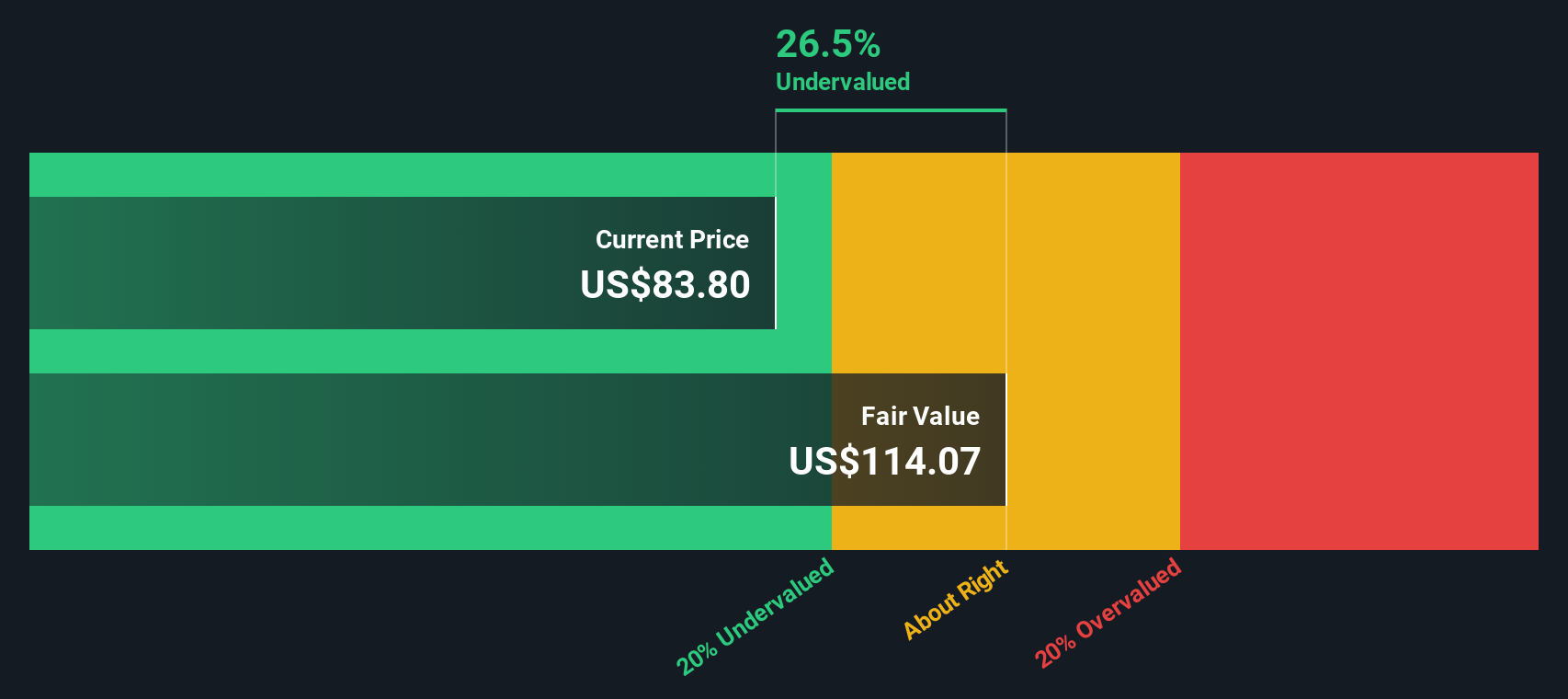

- Today, Alexandria scores a 5/6 valuation check, suggesting it screens as undervalued on most of the metrics tracked. This breakdown will unpack what that means using different valuation lenses, then finish with a more holistic way to think about what the stock may be worth.

Approach 1: Alexandria Real Estate Equities Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes Alexandria Real Estate Equities adjusted funds from operations, projects them into the future, and then discounts those cash flows back to today in $ to estimate what the business is worth now.

Alexandria is currently generating around $1.63 billion of free cash flow, and analysts plus Simply Wall St projections see this remaining robust, with forecast free cash flow of roughly $0.94 billion by 2028. Extending those projections out a full decade, the model assumes a gradual increase in annual free cash flow, with values in the $0.9 billion to $1.2 billion range between 2028 and 2035 as growth normalizes.

When all of those future cash flows are discounted back to today using a 2 Stage Free Cash Flow to Equity model based on adjusted funds from operations, the estimated intrinsic value comes out to about $81.95 per share. Compared to the current share price, this implies the stock is roughly 40.9% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alexandria Real Estate Equities is undervalued by 40.9%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Alexandria Real Estate Equities Price vs Sales

For a REIT like Alexandria that generates meaningful revenue but can have volatile or accounting skewed earnings, the price to sales ratio is a useful way to compare what investors are paying for each dollar of revenue across the sector. In general, faster expected growth and lower perceived risk justify a higher multiple, while slower growth or elevated risk usually call for a discount to the market.

Alexandria currently trades on a price to sales multiple of about 2.74x, well below both the Health Care REITs industry average of roughly 6.75x and a peer group average of about 6.04x. Simply Wall St also calculates a Fair Ratio of 4.26x, a proprietary estimate of the price to sales multiple Alexandria might reasonably deserve once factors like expected growth, profit margins, balance sheet risk, market cap, and its specific industry dynamics are all considered together.

Because this Fair Ratio explicitly adjusts for the company’s own strengths and weaknesses, it offers a more tailored yardstick than a simple comparison with peers or the wider industry. When set against the current 2.74x multiple, the 4.26x Fair Ratio indicates that Alexandria’s shares are trading at a meaningful discount to what its fundamentals could justify.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alexandria Real Estate Equities Narrative

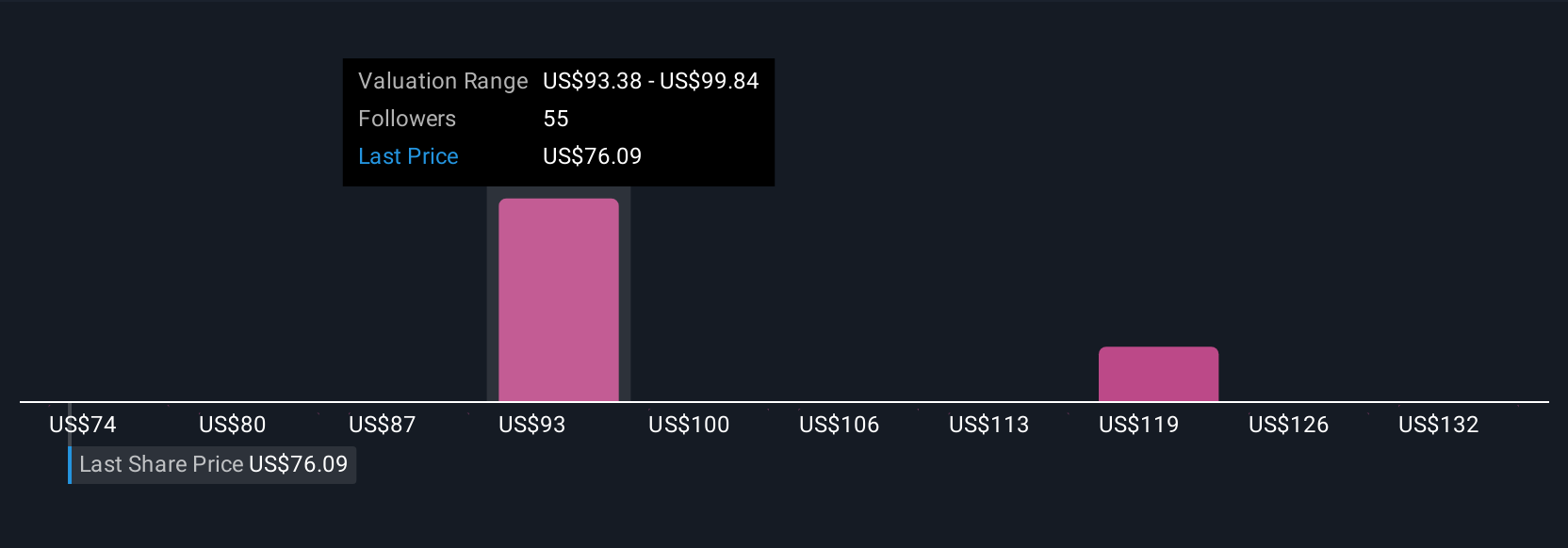

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Alexandria Real Estate Equities with the numbers by turning your assumptions about its future revenue, earnings, and margins into a clear story that flows into a financial forecast and then a fair value estimate.

On Simply Wall St, Narratives live inside the Community page and are designed to be accessible, letting millions of investors quickly see how a company’s story translates into expected cash flows and a fair value they can compare to today’s share price. Investors can then decide whether Alexandria looks like a buy, hold, or sell.

Because Narratives are updated dynamically as new information arrives, such as impairment charges, buybacks, or fresh leasing news, your fair value view for Alexandria can evolve automatically without you needing to rebuild a spreadsheet every time the situation changes.

For example, one Narrative might lean optimistic, assuming that biotech demand normalizes, premium campus leases stay sticky, and a fair value closer to the higher analyst target is justified. A more cautious Narrative might focus on weak leasing, rising discount rates, and a fair value closer to the most bearish target, giving you a clear, side by side view of how different perspectives lead to different conclusions about what the stock is really worth today.

Do you think there's more to the story for Alexandria Real Estate Equities? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026