- United States

- /

- REITS

- /

- NYSE:ALEX

Does ALEX’s Upbeat Guidance Reflect a New Phase of Strategic Expansion in Hawaii?

Reviewed by Sasha Jovanovic

- Alexander & Baldwin, Inc. announced its third-quarter 2025 financial results, raised earnings guidance for the year, and highlighted ongoing development projects as well as active pursuit of new acquisition opportunities in Hawaii’s investment market.

- A key insight from the announcement is management’s confidence in both internal growth, seen in strong leasing and construction progress, and external expansion, as the company seeks to leverage increased acquisition momentum to support its long-term strategic plans.

- We’ll look at how the company’s raised earnings outlook and focus on acquisitions could influence its future growth expectations.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Alexander & Baldwin Investment Narrative Recap

To be a shareholder in Alexander & Baldwin, you must believe in the unique value of owning Hawaii-focused commercial real estate, benefiting from high occupancy rates and limited supply. The company's raised earnings guidance, combined with active pursuit of acquisitions, may positively affect the most important short-term catalyst, external growth through portfolio expansion, while persistent risks like escalating redevelopment costs remain material considerations.

Among the recent announcements, the increase in 2025 earnings guidance stands out. By raising its expected net income range per share, Alexander & Baldwin is signaling continued confidence in property leasing, development progress, and the ability to capitalize on market opportunities, which supports key growth catalysts.

Yet, investors should be aware that, in contrast, ongoing capital expenditures tied to maintaining and redeveloping older assets could still...

Read the full narrative on Alexander & Baldwin (it's free!)

Alexander & Baldwin is projected to have $174.8 million in revenue and $40.7 million in earnings by 2028. This outlook assumes a 9.8% annual revenue decline and a $37.8 million decrease in earnings from current levels of $78.5 million.

Uncover how Alexander & Baldwin's forecasts yield a $21.25 fair value, a 33% upside to its current price.

Exploring Other Perspectives

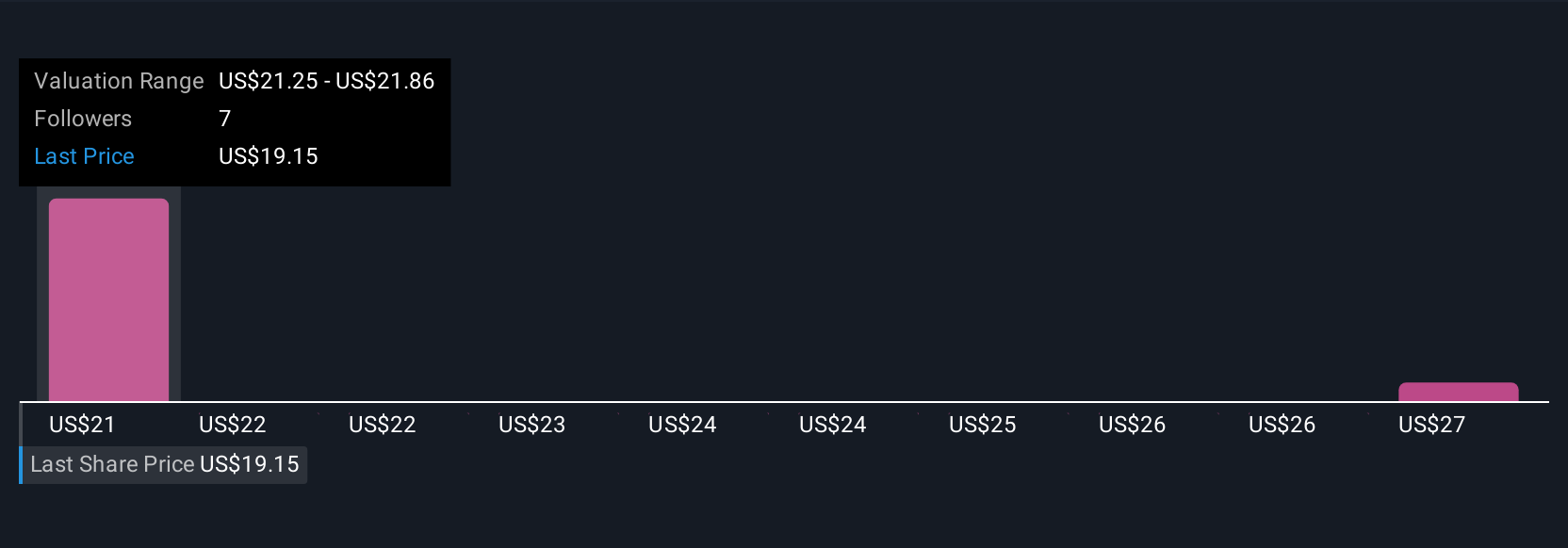

Simply Wall St Community estimates put Alexander & Baldwin's fair value between US$21.25 and US$26.49, based on two retail investors' projections. While portfolio expansion is a focus, recurring redevelopment costs highlighted by analysts could shape future performance, see how other investors approach these tradeoffs.

Explore 2 other fair value estimates on Alexander & Baldwin - why the stock might be worth just $21.25!

Build Your Own Alexander & Baldwin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alexander & Baldwin research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Alexander & Baldwin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexander & Baldwin's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALEX

Alexander & Baldwin

Alexander & Baldwin, Inc. (NYSE: ALEX) (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai'i commercial real estate and is the state's largest owner of grocery-anchored, neighborhood shopping centers.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives