- United States

- /

- Retail REITs

- /

- NYSE:AKR

Acadia Realty Trust (AKR): $46M One-Off Loss Challenges Bullish Margin Recovery Narratives

Reviewed by Simply Wall St

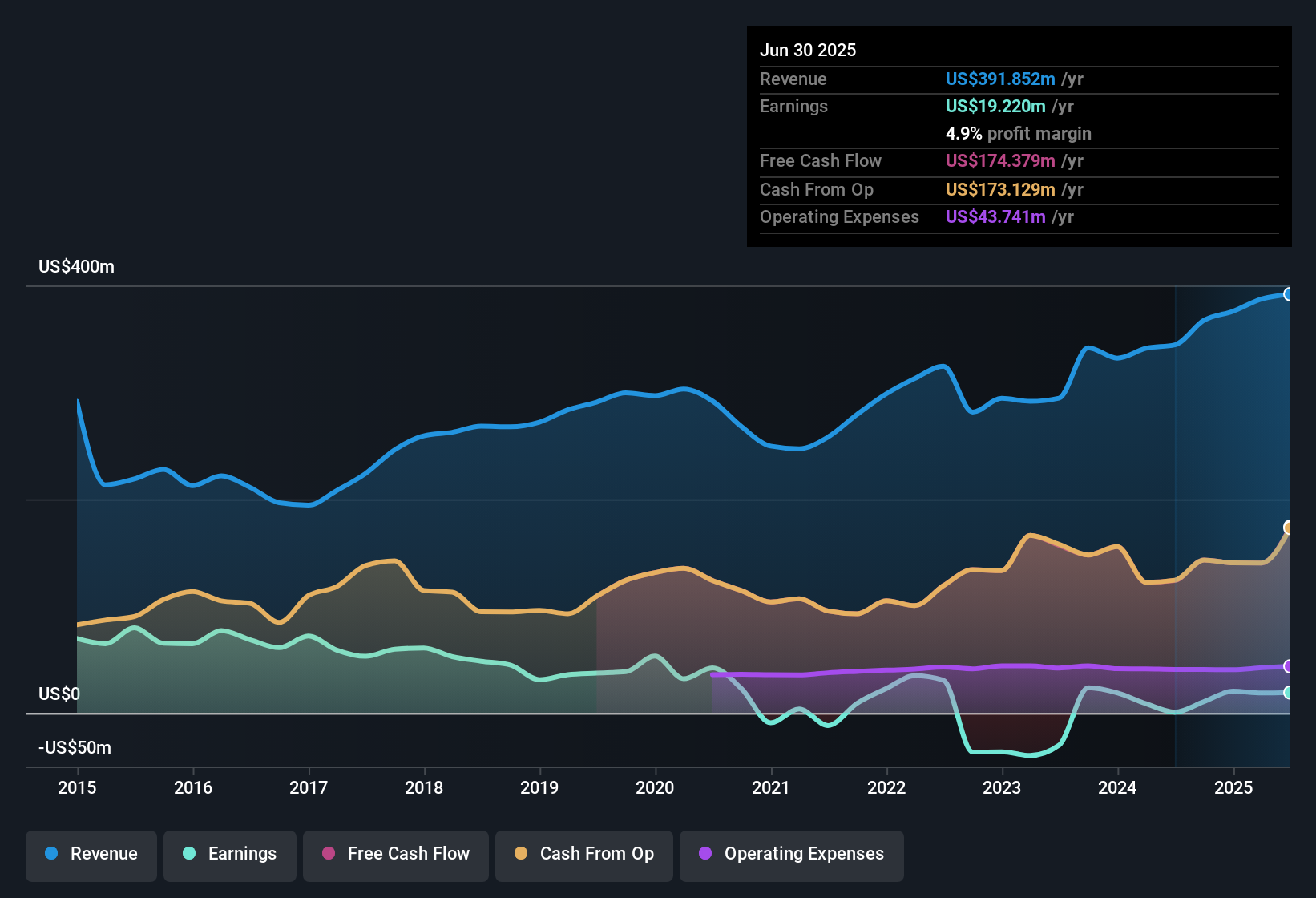

Acadia Realty Trust (NYSE:AKR) posted a 10.33% annual revenue growth forecast and a 2.1% projected EPS growth rate, lagging behind the broader US market’s expected earnings pace. Over the past five years, the company’s earnings have grown by 10.6% per year, and net profit margins reached 3.7% in the latest period, up from 2.9% last year. This was despite a significant one-off loss of $46.0 million impacting the most recent results. With these profit and revenue growth trends, investors continue to weigh the upsides of strong operating momentum against the risks highlighted by recent unusual losses and flagged financial concerns.

See our full analysis for Acadia Realty Trust.Next, we will see how these headline results hold up when compared to the mix of bullish and bearish narratives in the Simply Wall St community.

See what the community is saying about Acadia Realty Trust

Profit Margins Hold Above 3% Despite One-Off Hit

- Net profit margins reached 3.7% in the most recent period, up from 2.9% last year, even with a $46.0 million one-off loss factored into the results.

- According to the analysts' consensus view, Acadia's ability to command premium rents in dense urban corridors helps support margins, but those positive effects are partly offset by the company's exposure to urban regulatory shifts and evolving consumer shopping habits.

- Consensus notes that operational leverage from controlling critical mass in top neighborhoods helps keep occupancy strong and margins resilient, as seen in this margin improvement.

- However, risks remain, since any downturn in affluent urban retail demand or increased capital expenditures for repositioning could pressure profitability going forward.

Consensus points to resilient profit margins as a bright spot, but the backdrop of capital requirements and exposure to affluent urban trends keeps the outlook nuanced. 📊 Read the full Acadia Realty Trust Consensus Narrative.

Share Growth and Dilution on the Horizon

- Analysts expect Acadia Realty Trust’s shares outstanding to rise by 7% annually over the next three years, a pace that may lead to ownership dilution and pressure on per-share earnings metrics.

- The consensus narrative contends that while this level of share issuance supports flexibility for acquisitions and redevelopment initiatives,

- It could limit upside for existing shareholders if asset growth does not generate more than offsetting value per share.

- This tradeoff reflects Acadia’s reliance on raising external capital for future growth, which is crucial for tapping into urban portfolio opportunities, but not without dilution risks.

Stock Trades at a Discount to DCF Fair Value

- With a current share price of $19.09, Acadia Realty Trust trades noticeably below both the DCF fair value of $24.89 and its peer group’s average Price-to-Sales Ratio (6x vs. peer average of 8.7x).

- Analysts' consensus perspective suggests that this valuation gap reflects a combination of favorable earnings growth outlook and persistent concerns about dividend sustainability and financial risks:

- The stock’s discount to DCF fair value encourages value-oriented buyers, especially given ongoing net profit margin expansion and revenue growth forecasts.

- Yet, flagged risks around earnings quality and dividend sustainability weigh on how much of that valuation upside investors deem reliable.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Acadia Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a different angle? Share your take and craft your own narrative in just a few minutes. Do it your way

A great starting point for your Acadia Realty Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Acadia Realty Trust's expanding margins are balanced by ongoing risks related to earnings quality, dividend sustainability, and exposure to regulatory and financial pressures.

Worried about financial fragility? Use our solid balance sheet and fundamentals stocks screener (1980 results) to find companies with strong fundamentals and healthier balance sheets built for long-term resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AKR

Acadia Realty Trust

An equity real estate investment trust focused on delivering long-term, profitable growth.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives