- United States

- /

- Health Care REITs

- /

- NYSE:AHR

Is American Healthcare REIT’s US$387 Million Equity Raise Altering The Investment Case For AHR?

Reviewed by Sasha Jovanovic

- American Healthcare REIT, Inc. recently completed a follow-on equity offering, issuing 8,100,000 common shares at US$47.75 each and raising about US$386.78 million.

- This sizable capital raise via an Income Trust structure could meaningfully affect how investors assess the REIT’s funding mix, balance sheet flexibility, and future growth capacity.

- We’ll now examine how this sizeable follow-on equity raise may reshape American Healthcare REIT’s investment narrative and growth assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

American Healthcare REIT Investment Narrative Recap

To own American Healthcare REIT, you need to believe its senior housing and skilled nursing platform can keep translating demographic tailwinds into growing cash flows, even as occupancy and rate growth normalize. The recent US$386.78 million follow-on equity raise looks most relevant for the short term by easing balance sheet constraints and supporting the acquisition pipeline, but it does not remove the key near term risk that growth could slow as Trilogy and SHOP segments approach stabilized occupancy and tougher year-over-year comparisons.

The November 6 guidance increase, which lifted 2025 net income and same store NOI growth expectations, is especially relevant alongside this latest equity issuance. Together, they highlight a business leaning on both internal growth and external acquisitions to support its investment case, while investors weigh reimbursement exposure, outpatient medical softness, and ongoing dilution from frequent capital raises when thinking about how sustainable that growth may prove to be.

But investors should also be aware that frequent equity issuance brings its own trade off for existing shareholders...

Read the full narrative on American Healthcare REIT (it's free!)

American Healthcare REIT's narrative projects $2.7 billion revenue and $203.0 million earnings by 2028. This requires 7.8% yearly revenue growth and about a $235.8 million earnings increase from -$32.8 million today.

Uncover how American Healthcare REIT's forecasts yield a $56.08 fair value, a 11% upside to its current price.

Exploring Other Perspectives

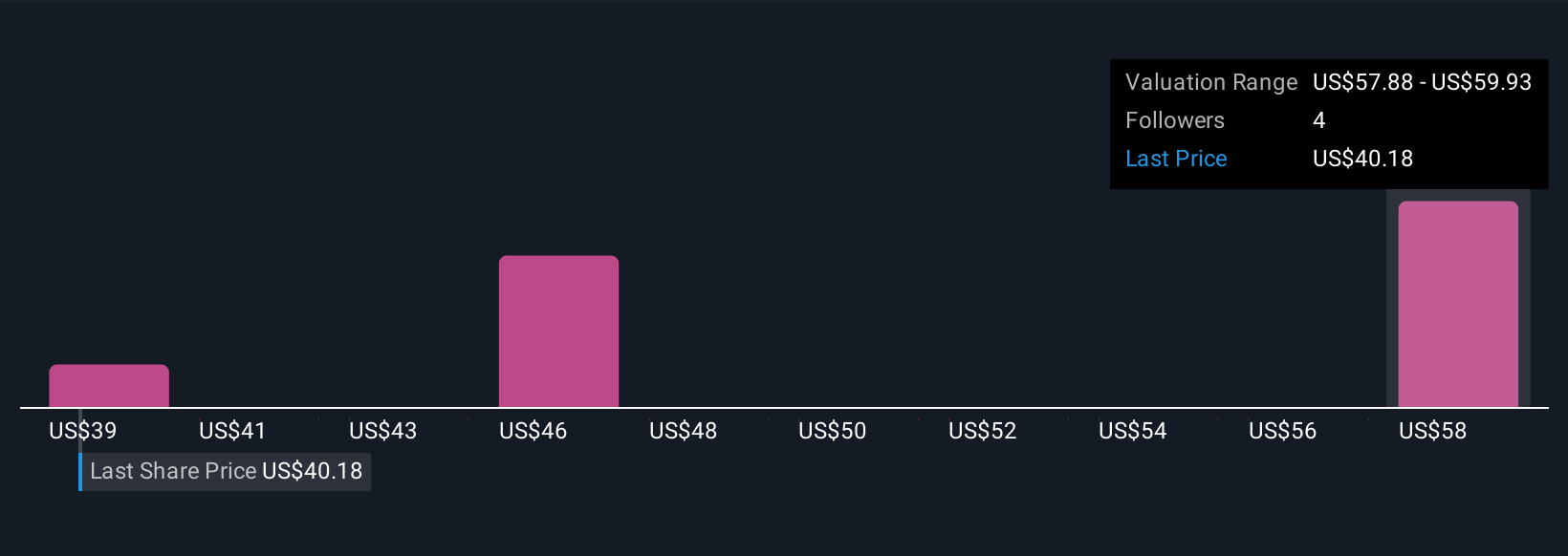

Three fair value estimates from the Simply Wall St Community span roughly US$39 to US$76 per share, underscoring how far apart individual views can be. When you weigh that dispersion against the recent equity issuance and the risk that growth slows as key segments near stabilization, it underlines why many investors look at several viewpoints before deciding how American Healthcare REIT might fit in their portfolio.

Explore 3 other fair value estimates on American Healthcare REIT - why the stock might be worth 22% less than the current price!

Build Your Own American Healthcare REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Healthcare REIT research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free American Healthcare REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Healthcare REIT's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AHR

American Healthcare REIT

A Maryland-based self-managed REIT, owns and operates a diversified portfolio of clinical healthcare real estate across the U.S., U.K., and the Isle of Man.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026