- United States

- /

- Retail REITs

- /

- NasdaqGS:REG

How Investors Are Reacting To Regency Centers (REG) Upbeat Q3 Earnings and Raised 2025 Guidance

Reviewed by Sasha Jovanovic

- Regency Centers recently reported strong third-quarter results, including a 4.8% year-over-year increase in same-property Net Operating Income and a 7.5% rise in Funds From Operations per share, while also raising its full-year 2025 guidance for earnings.

- Despite these positive developments, the company completed no share repurchases during the most recent quarter, and an executive sold 15,000 shares for US$1.05 million amid continued optimism and a robust development pipeline.

- To assess how this improved financial outlook and dividend increase may shape Regency Centers' investment narrative, let's examine the implications of the latest results.

Find companies with promising cash flow potential yet trading below their fair value.

Regency Centers Investment Narrative Recap

To be a shareholder in Regency Centers is to believe in the sustained demand for necessity-based, grocery-anchored suburban retail centers, driven by favorable demographic trends and resilient tenant demand. The latest earnings report delivers reassuring growth and raised guidance, but the absence of share repurchases and an executive sale are not material to the short-term catalyst of rental growth from strong occupancy and development completion; however, risks such as tenant bankruptcies remain persistent.

Regency’s recent 7.1% dividend increase stands out, emphasizing its confidence in cash flow and underlying portfolio health. For investors watching near-term drivers, this dividend boost closely aligns with raised earnings guidance, reinforcing the importance of operational and financial resilience as pivotal catalysts for shareholder value.

However, investors should also be aware that, if tenant distress or retail bankruptcies accelerate, that resilience may be tested...

Read the full narrative on Regency Centers (it's free!)

Regency Centers' narrative projects $1.7 billion revenue and $506.7 million earnings by 2028. This requires 2.3% yearly revenue growth and a $116.8 million earnings increase from $389.9 million currently.

Uncover how Regency Centers' forecasts yield a $80.05 fair value, a 15% upside to its current price.

Exploring Other Perspectives

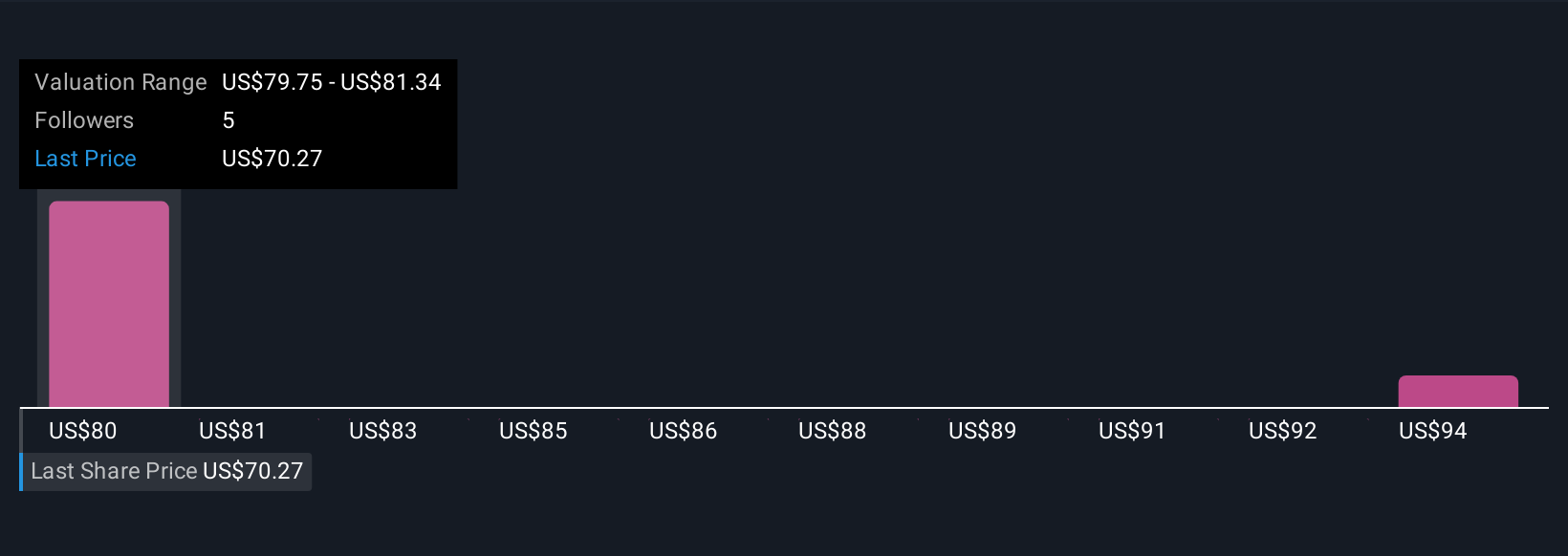

Simply Wall St Community members posted two fair value estimates ranging from US$80.05 to US$98.95 per share. While many expect resilient rental demand, opinions differ on the risks posed by changing tenant credit quality, reminding you to weigh several independent viewpoints when analyzing Regency Centers.

Explore 2 other fair value estimates on Regency Centers - why the stock might be worth just $80.05!

Build Your Own Regency Centers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regency Centers research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Regency Centers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regency Centers' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REG

Regency Centers

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives