- United States

- /

- Retail REITs

- /

- NasdaqGS:PECO

Phillips Edison (PECO) Profit Margin Beats, Premium Valuation Sparks Debate on Future Growth

Reviewed by Simply Wall St

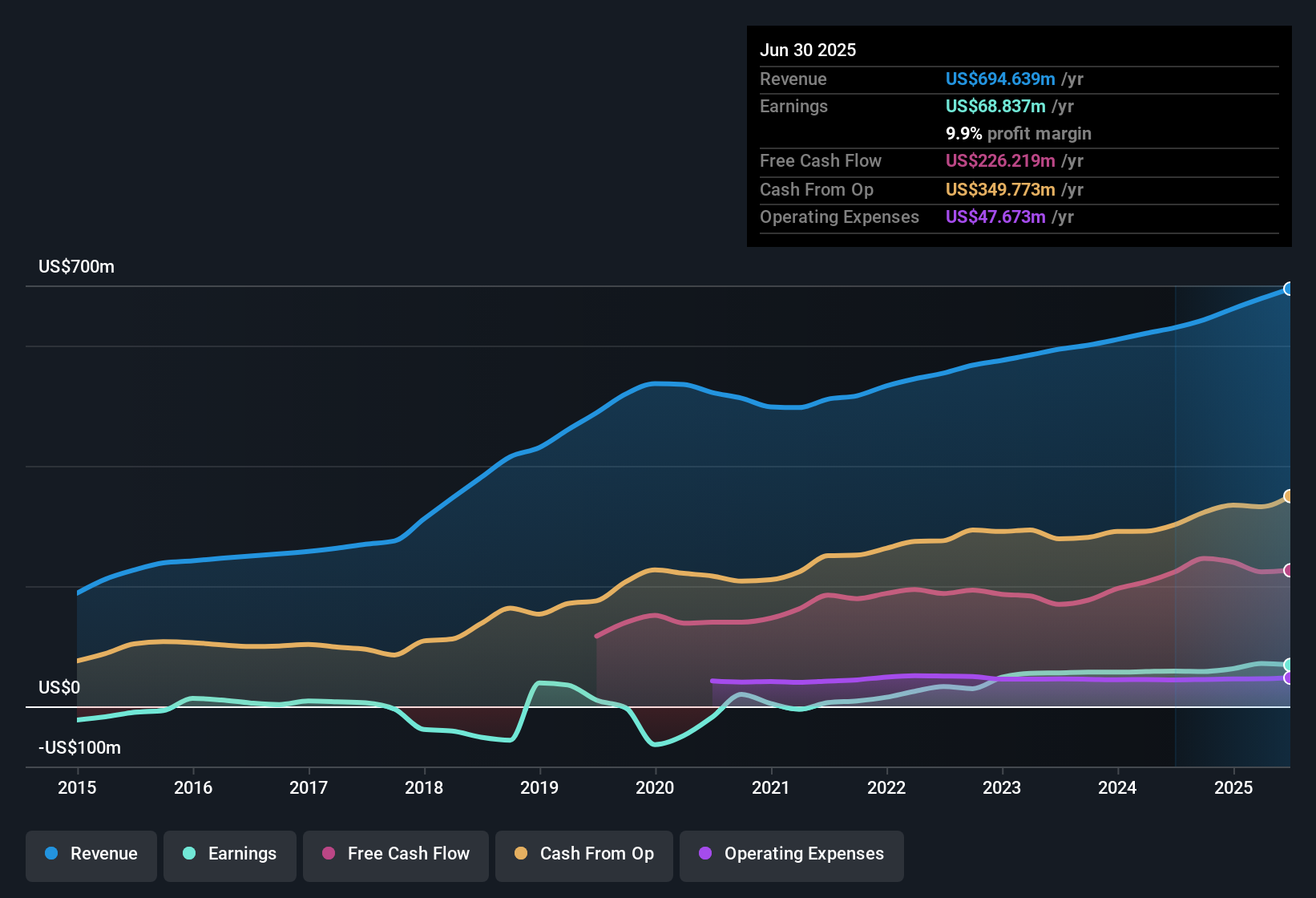

Phillips Edison (PECO) posted an 11.5% profit margin for the latest period, up from last year’s 9%. The company also delivered earnings growth of 41.1% in the past year, outpacing its five-year annualized rate of 36.9%. Although forward-looking forecasts point to annual earnings growth of 3.95% and revenue growth of 5% per year, both figures trail behind the broader US market estimates. This highlights tempered expectations for the company’s continued expansion. Investors may view these results as a sign of robust operational performance and improving profitability, but it is also notable that PECO’s premium valuation and slower projected growth could make the path ahead more challenging.

See our full analysis for Phillips Edison.Now, let's see how these headline numbers stack up against the most widely followed narratives and expectations in the market to find out what story the data really tells.

See what the community is saying about Phillips Edison

Analyst Price Target Exceeds Market Price

- With Phillips Edison currently trading at $34.66, the average analyst price target stands notably higher at $39.17. This suggests a potential upside of about 13% based on current pricing.

- According to analysts' consensus view, ongoing demand for grocery-anchored retail centers and recurring rental income are expected to support stable revenue growth, helping justify this price target.

- Record-high occupancy of 97.4% and strong tenant retention rates provide a safety net to earnings, reinforcing the rationale behind the consensus price target.

- The company’s active management of its portfolio is highlighted as a driver for both recurring income and incremental net margin expansion. This gradually improves returns in a competitive real estate environment.

See how the latest results feed into a balanced outlook on growth and value in the full Consensus Narrative for Phillips Edison. 📊 Read the full Phillips Edison Consensus Narrative.

Premium Valuation Outpaces Industry Peers

- Phillips Edison trades at a Price-to-Earnings ratio of 53.1x, nearly double the US Retail REITs industry average of 26.9x. This highlights a significant valuation premium.

- Consensus narrative notes this premium is justified in part by resilience to e-commerce, stable occupancy, and the ability to achieve robust renewal leasing spreads above 20%.

- Bulls point to demographic trends and a focus on necessity-based retail as reasons why the market may assign a higher multiple, despite slower projected revenue growth compared to peers.

- Catalysts such as portfolio recycling and high-quality acquisitions are intended to further support the company’s pricing power and reinforce its leadership position among suburban retail landlords.

Debt Structure and Asset Management Mitigate Risks

- PECO maintains a low leverage profile, with a 5.4x EBITDAre and extending 95% of its debt at fixed rates. This creates financial stability even as operating and refinancing costs rise industry-wide.

- Analysts' consensus view highlights that although sector concentration exposes PECO to shifts in grocery anchor tenant performance, its disciplined approach to portfolio expansion, high acquisition IRRs of over 9%, and a 5.7-year average debt maturity help offset these risks.

- Persistent inflation and the threat of rising interest rates are acknowledged risks, but a long debt maturity profile cushions the impact on cash flows and net margins.

- Concentration in grocery-anchored centers does increase exposure to sector-specific risks. However, active management and asset recycling are designed to minimize potential vacancies and revenue losses.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Phillips Edison on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think these results tell a different story? Shape your own view in just a few minutes and add to the discussion by using Do it your way.

A great starting point for your Phillips Edison research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Phillips Edison’s premium valuation and slower projected growth rates mean investors face a higher price without the faster expansion seen in peers.

If you want better value for your next investment, focus on opportunity using these 881 undervalued stocks based on cash flows where pricing looks more attractive against future growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PECO

Phillips Edison

Phillips Edison & Company, Inc. (“PECO”) is one of the nation’s largest owners and operators of high-quality, grocery-anchored neighborhood shopping centers.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.