- United States

- /

- Retail REITs

- /

- NasdaqGS:PECO

Phillips Edison (PECO): Evaluating Valuation After Upbeat Q2 Guidance Boost and Ongoing Acquisition Momentum

Reviewed by Kshitija Bhandaru

Phillips Edison (PECO) posted a solid Q2 2025, highlighted by increased full-year guidance due to steady leasing and a series of acquisitions. Its grocery-anchored shopping center strategy continues to deliver high occupancy and healthy lease spreads.

See our latest analysis for Phillips Edison.

Shares of Phillips Edison have seen some ups and downs lately, with a year-to-date share price return of -6.6%. However, the company’s 3-year total shareholder return of over 32% reflects the long-term value many investors have found as momentum changes with ongoing acquisitions and strong leasing results.

If you’re interested in discovering what else is gathering investor attention beyond retail real estate, now is a great time to broaden your search and see which companies are leading the charge among fast growing stocks with high insider ownership.

With Phillips Edison delivering upbeat results and trading at a notable discount to analyst targets, the question is whether today’s price represents an undervalued opportunity for investors or if the market already reflects future growth prospects.

Most Popular Narrative: 11.9% Undervalued

With Phillips Edison closing at $34.51 and the most followed narrative assigning a fair value near $39.18, expectations for future growth are pricing in a meaningful upside from current levels.

Active portfolio recycling and disciplined acquisitions of high-growth, grocery-anchored properties, often below replacement cost and at 6%+ cap rates with 9%+ target IRRs, enhance asset quality and earnings potential. Cash acquisitions and low leverage (5.4x EBITDAre, 5.7 years weighted average maturity, 95% fixed-rate debt) allow for opportunistic external growth without the need for dilutive equity issuance and support long-term FFO/EPS expansion.

Think this price target is ambitious? You haven’t seen the narrative’s aggressive revenue growth and margin expansion assumptions or the bold future profit multiple that underpins this valuation. What else do these projections reveal? Read on for the full story behind these big numbers.

Result: Fair Value of $39.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or a shift toward digital-first grocery models could threaten leasing momentum and impact Phillips Edison's long-term growth potential.

Find out about the key risks to this Phillips Edison narrative.

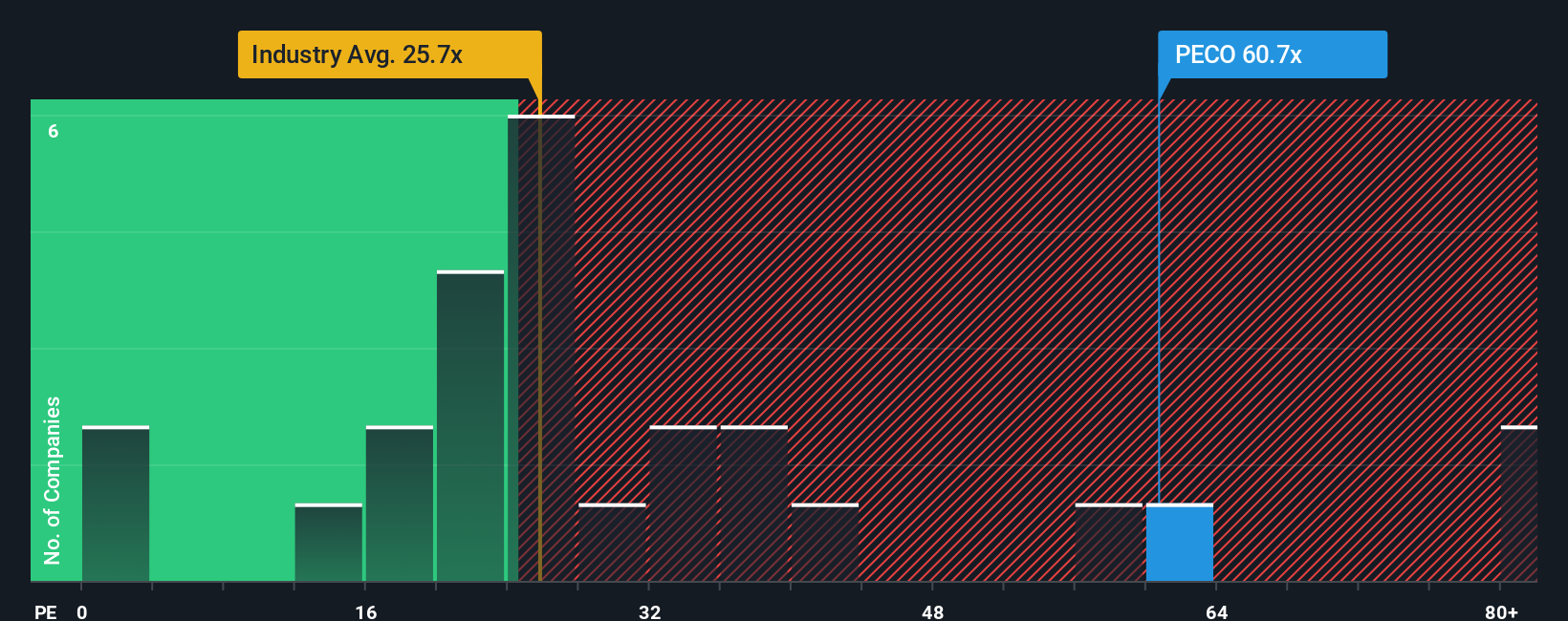

Another View: Market Multiples Paint a Pricier Picture

While some see upside using future earnings projections, the market’s price-to-earnings ratio for Phillips Edison currently stands at 63x. This is much higher than the US Retail REITs industry average of 26.5x and also well above a fair ratio of 34.7x. This premium could signal risk if growth slows or expectations shift. Does the market’s optimism overlook something, or is there a bigger story beneath the numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips Edison Narrative

If you have a different perspective or want to examine the numbers on your own terms, you can quickly craft your own analysis tailored to your insights. Do it your way.

A great starting point for your Phillips Edison research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let the next big opportunity pass you by. Use the Simply Wall Street Screener to uncover promising stocks across sectors that could strengthen your portfolio.

- Uncover untapped value by reviewing these 877 undervalued stocks based on cash flows with strong cash flow potential that may have been overlooked by the market.

- Capitalize on rapid advances in technology with these 24 AI penny stocks where innovative companies are setting new standards in artificial intelligence.

- Boost your income stream with these 18 dividend stocks with yields > 3% providing reliable yields above 3% for investors who value consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PECO

Phillips Edison

Phillips Edison & Company, Inc. (“PECO”) is one of the nation’s largest owners and operators of high-quality, grocery-anchored neighborhood shopping centers.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives