- United States

- /

- Retail REITs

- /

- NasdaqGS:PECO

Phillips Edison (PECO): Evaluating Valuation After Recent Real Estate Sector Cooling

Reviewed by Kshitija Bhandaru

Phillips Edison (PECO) has drawn investor attention lately, as its stock performance has moved in response to shifts in the broader real estate sector. Investors are keeping an eye on recent momentum and considering how fundamentals could shape the next few months.

See our latest analysis for Phillips Edison.

Phillips Edison’s share price has drifted slightly lower over recent months, reflecting a sector-wide cooling in real estate sentiment. However, longer-term total shareholder returns are still up over the last three years. The performance suggests steady fundamentals and measured momentum rather than a dramatic shift in risk outlook.

If you’re looking to expand your perspective beyond real estate, now is a good time to explore fast growing stocks with high insider ownership.

Recent declines may hint at an undervalued opportunity. However, Phillips Edison’s strong fundamentals and steady returns suggest growth expectations could already be factored in. Is there untapped upside for buyers, or is the market a step ahead?

Most Popular Narrative: 13.9% Undervalued

With the most popular narrative estimating fair value at $39.18, Phillips Edison’s last close price of $33.75 suggests room for upside if assumptions prove out.

Sustained preference for omnichannel shopping and last-mile convenience is reinforcing leasing momentum at grocery-anchored properties. This supports robust leasing spreads (20%+ on renewals, 30%+ on new leases) and embedded rent escalations, which drive recurring revenue and gradual net margin expansion as tenants prioritize locations that fit hybrid consumer behavior.

Want to know what ambitious expectations are powering Phillips Edison’s valuation? This narrative relies on bold forecasts about future rent increases, margins, and growth dynamics. Wondering just how aggressive the financial projections are? Unlock the numbers and see which key assumptions drive that target price.

Result: Fair Value of $39.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a rapid shift toward digital shopping and rising operating costs could threaten Phillips Edison’s growth story and put the resilience of its retail centers to the test.

Find out about the key risks to this Phillips Edison narrative.

Another View: Market Multiples Pose a Different Picture

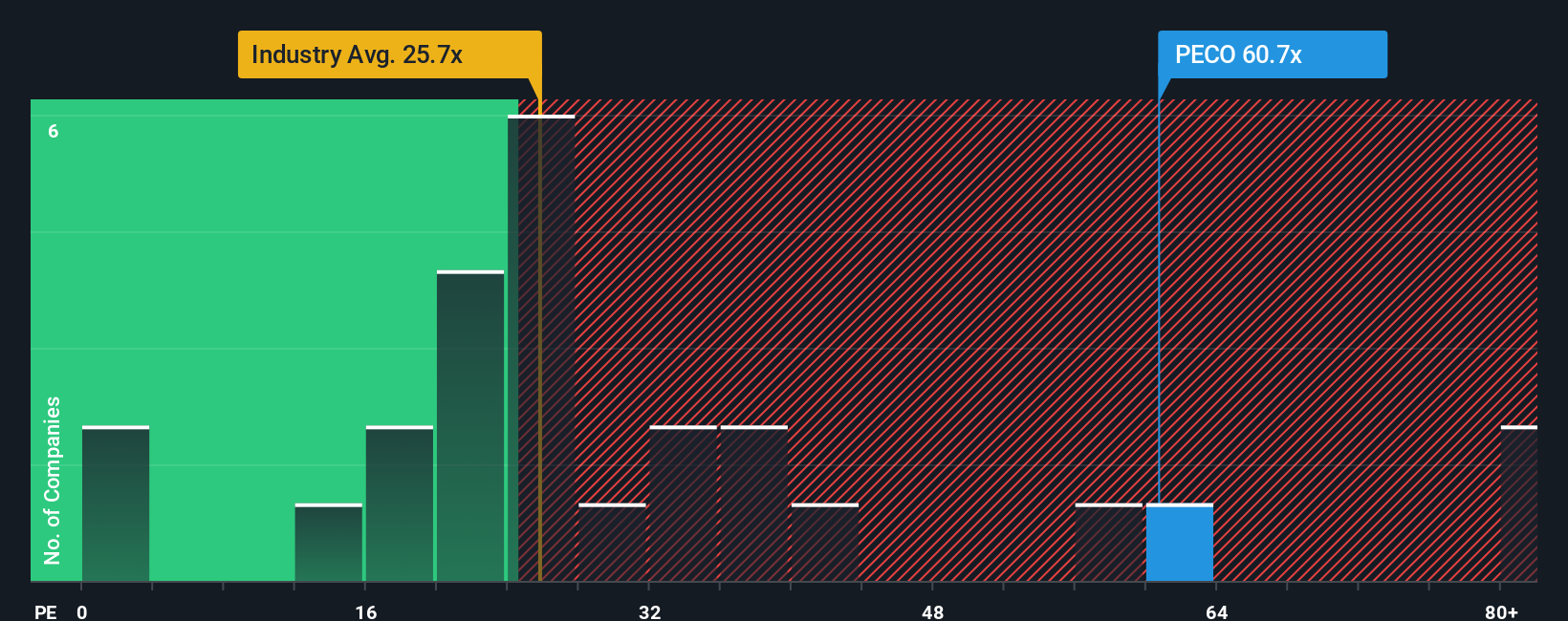

Taking a look at the market’s favored price-to-earnings ratio, Phillips Edison stands out as expensive. Its current PE ratio of 61.6x is more than double both the peer average (55.9x) and the broader US Retail REITs industry (25.9x), and it is also well above the fair ratio of 34.7x. This gap highlights valuation risk. Could the stock’s premium be justified, or is there room for a reset ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips Edison Narrative

If you want to dig into the numbers yourself or carve out your own perspective on Phillips Edison, you can do so quickly and easily. Your version of the story is just minutes away: Do it your way.

A great starting point for your Phillips Edison research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons and access unique investment opportunities with the Simply Wall Street Screener. You’ll regret missing out on these fast-moving trends and hidden gems.

- Capitalize on the future of healthcare by targeting innovative companies in artificial intelligence with these 31 healthcare AI stocks, which are making groundbreaking medical advances.

- Boost your passive income by finding companies that consistently deliver yields over 3% through these 19 dividend stocks with yields > 3% right now.

- Tap into the world of digital finance and technology disruption by reviewing these 78 cryptocurrency and blockchain stocks, positioned at the forefront of blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PECO

Phillips Edison

Phillips Edison & Company, Inc. (“PECO”) is one of the nation’s largest owners and operators of high-quality, grocery-anchored neighborhood shopping centers.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives