- United States

- /

- Retail REITs

- /

- NasdaqGS:PECO

Phillips Edison (PECO): A Fresh Look at Valuation After Recent Share Price Movement

Reviewed by Simply Wall St

Most Popular Narrative: 8.6% Undervalued

According to the most widely followed narrative, Phillips Edison is considered moderately undervalued based on long-term growth drivers. The perspective hinges on a unique mix of suburban demographic trends, robust tenant demand, and a specialized focus on grocery-anchored centers.

Continued population growth and suburbanization are boosting demand for well-located, necessity-based retail centers in attractive demographic areas. With high retention (94%), record-high occupancy (97.4%) and strong tenant relationships, Phillips Edison is positioned for stable, long-term revenue and NOI growth as demand for essential services increases in suburban markets.

What if bullish growth expectations and resilient shopping trends lead to a sky-high valuation, a scenario usually reserved for high-flying sectors? The narrative’s future value all rests on standout projections and a surprising multiple that could catch investors off guard. Want to unravel the math and see what truly powers this price target? The full story is hiding in the numbers.

Result: Fair Value of $39.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising e-commerce trends or shifts in grocery anchor performance could disrupt demand, which may put pressure on Phillips Edison’s occupancy and revenue growth.

Find out about the key risks to this Phillips Edison narrative.Another View: The Multiples Perspective

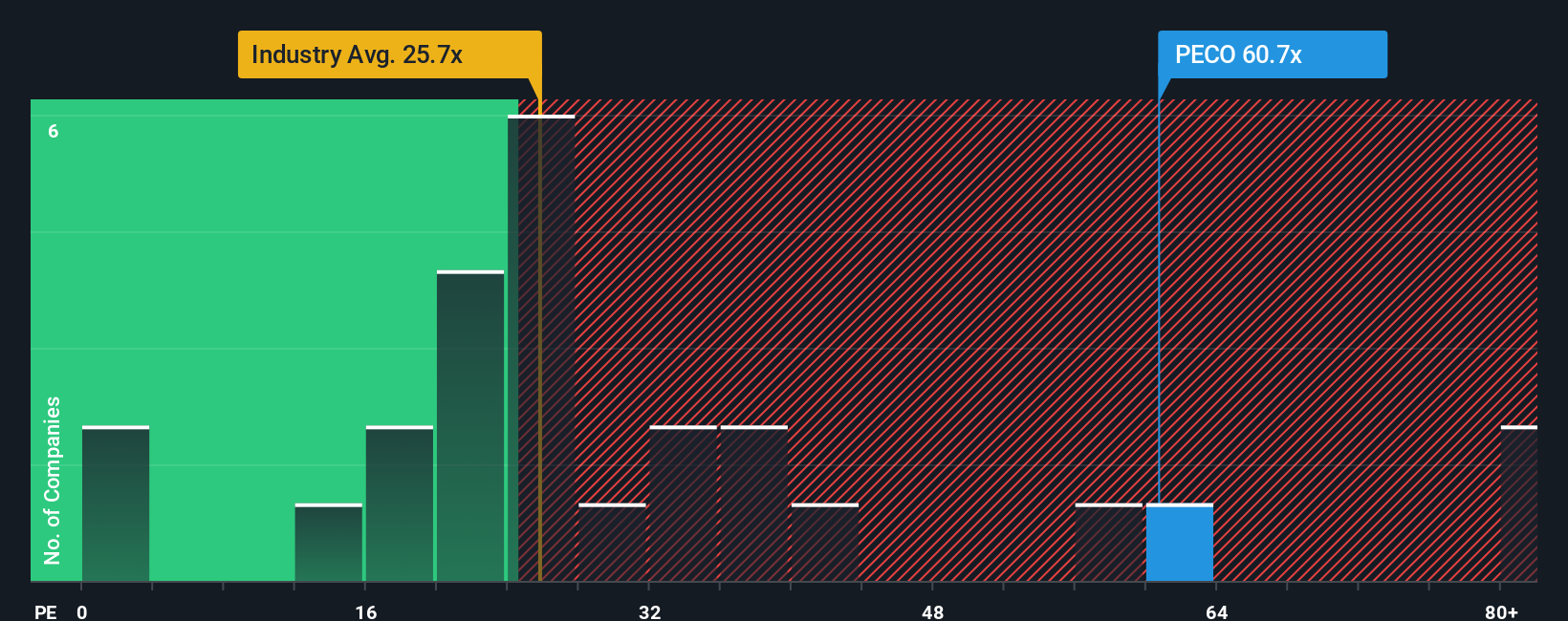

Looking through the lens of the company’s price-to-earnings ratio compared to industry levels, a different story emerges. This approach suggests Phillips Edison could actually be costly. Which outlook better fits today’s reality?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Phillips Edison to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Phillips Edison Narrative

If you see the data differently or enjoy hands-on research, you can easily craft your own take on Phillips Edison in under three minutes. Do it your way

A great starting point for your Phillips Edison research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Every smart investor keeps an eye out for game-changing ideas. Don’t miss your chance to get ahead. Simply Wall Street’s powerful screener tools let you pinpoint unique stocks with strong financials, innovative technology, and compelling growth stories.

- Unearth fresh, undervalued picks poised for a rebound by checking out undervalued stocks based on cash flows and tap into hidden gems the market overlooks.

- Ride the wave of artificial intelligence innovation with AI penny stocks. These small companies are shaping the next tech frontier right now.

- Lock in yield and stability by seeking out dividend stocks with yields > 3% to keep your portfolio strong in any market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:PECO

Phillips Edison

Phillips Edison & Company, Inc. (“PECO”) is one of the nation’s largest owners and operators of high-quality, grocery-anchored neighborhood shopping centers.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion