- United States

- /

- Industrial REITs

- /

- NasdaqGS:LINE

A Fresh CFO for Lineage (LINE): Assessing Valuation as New Leadership Targets a Turnaround

Reviewed by Simply Wall St

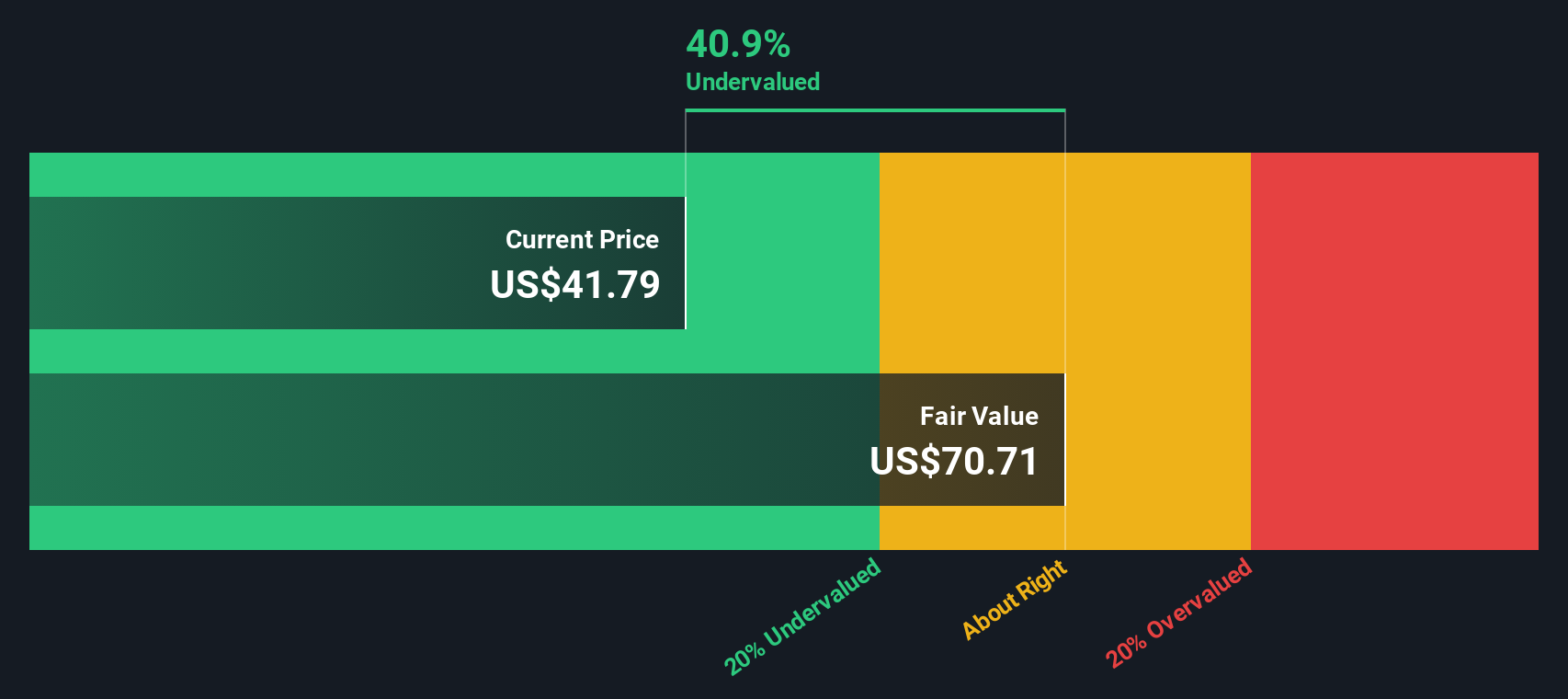

Lineage (LINE) is shaking up its executive team, announcing Robb LeMasters as its new Chief Financial Officer and expanding its investor relations leadership. These changes come as the stock trades at a sizable discount to NAV.

See our latest analysis for Lineage.

Lineage's appointment of a new CFO comes on the heels of a challenging stretch for shareholders. Total return over the past year sits at -46.94%, and the stock now hovers near all-time lows since its 2024 IPO. While short-term momentum has yet to recover, the leadership shake-up signals a proactive effort to rebuild investor confidence and unlock value. This comes as the company continues to invest in growth through partnerships and acquisitions and maintains a healthy dividend yield.

If you're keen for fresh opportunities as leadership transitions play out at major firms, now's a perfect moment to discover fast growing stocks with high insider ownership.

With the stock trading far below its net asset value, and given management changes and a secure dividend, investors must consider whether the current share price reflects undervaluation or if future growth is already factored in.

Price-to-Sales Ratio of 1.7x: Is it justified?

Lineage is trading at a price-to-sales ratio of 1.7x, which is substantially lower than both peer and industry levels based on the latest closing price of $40.10. This steep discount compared to comparables may signal undervaluation, especially given the company’s market position and recent strategic moves.

The price-to-sales multiple is a fundamental metric that compares a company’s market capitalization to its annual revenue. For a business like Lineage, especially in the Real Estate Investment Trusts (REITs) sector, it is a relevant tool since profit margins can fluctuate and sales remain a steady indicator of operating scale.

A price-to-sales of 1.7x means the market is valuing Lineage’s sales stream much less aggressively than the peer average (10.9x) and the broader industrial REITs industry average (8.7x). This large gap suggests the market is deeply discounting future potential. Notably, the market also values Lineage below its fair price-to-sales ratio, estimated at 2.6x, indicating possible upside if sentiment shifts toward the company’s fundamentals.

Explore the SWS fair ratio for Lineage

Result: Price-to-Sales Ratio of 1.7x (UNDERVALUED)

However, persistent negative net income and sluggish short-term price action could limit near-term gains. This highlights the need for caution despite current valuation levels.

Find out about the key risks to this Lineage narrative.

Another View: SWS DCF Model Signals Deeper Discount

Looking at Lineage from a different angle, our SWS DCF model points to an even more pronounced undervaluation. With the shares trading 41.8% below the estimated fair value of $68.92, the DCF approach suggests the market may be pricing in greater uncertainty than fundamentals justify. But is the gap a true opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lineage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lineage Narrative

If you see the story differently or want to analyze the numbers yourself, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your strategy by looking beyond the usual picks. The right opportunities could transform your next portfolio move. Don’t miss these handpicked ideas:

- Capture the income potential of companies offering attractive yields by assessing these 17 dividend stocks with yields > 3% with consistently robust payout histories.

- Zero in on promising tech breakthroughs when you review these 24 AI penny stocks making waves in artificial intelligence, automation, and digital disruption.

- Stay ahead of market trends by scanning these 27 quantum computing stocks, where innovators in quantum computing are shaping the next leap in processing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LINE

Lineage

Lineage, Inc. (NASDAQ: LINE) is the world’s largest global temperature-controlled warehouse REIT with a network of over 485 strategically located facilities totaling approximately 88 million square feet and approximately 3.1 billion cubic feet of capacity across countries in North America, Europe, and Asia-Pacific.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives