- United States

- /

- Specialized REITs

- /

- NasdaqGS:LAMR

Lamar Advertising (LAMR): Evaluating Valuation After $1.1 Billion Balance Sheet Refinancing

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 6.6% Undervalued

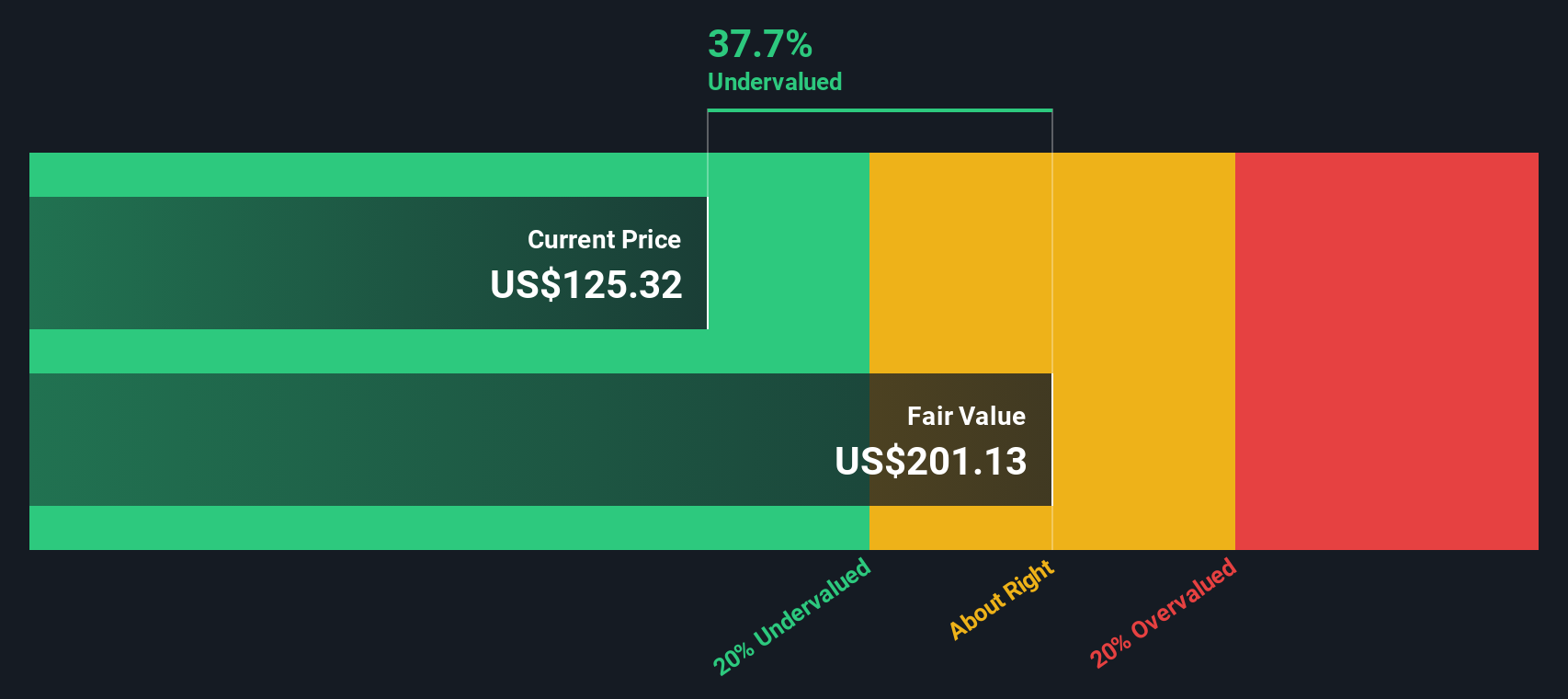

According to the most widely followed narrative, Lamar Advertising is trading below its calculated fair value, suggesting untapped upside potential in the current share price. Analysts use a specific discount rate and a mix of assumptions to support this position.

Accelerating expansion of Lamar's digital billboard portfolio, evidenced by the addition of 325-350 new digital units expected this year and a strengthening second-half outlook, positions the company to capitalize on rising demand for dynamic, high-impact ad solutions and supports both revenue growth and net margin expansion through premium inventory and dynamic pricing.

Curious what’s fueling this valuation call? The secret lies in ambitious projections: future cash flows, profit margins, and a dramatic shift in the company’s growth approach. Want to unravel the exact financial leap analysts are betting on for Lamar Advertising’s next chapter? Don’t miss the numbers and logic powering this upside case.

Result: Fair Value of $130.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, softer company guidance and contract renewal risks may threaten the pace of growth projected in Lamar’s upbeat valuation case.

Find out about the key risks to this Lamar Advertising narrative.Another Perspective: Our DCF Model Points to Further Upside

Taking a different approach, the SWS DCF model also suggests Lamar Advertising is trading at a discount to its estimated worth. This adds another layer to the valuation story presented by analysts. Could the true upside be even greater than many expect?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lamar Advertising Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can shape your own take in just a few minutes by using Do it your way.

A great starting point for your Lamar Advertising research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities don’t wait around. Widen your investing lens right now and get ahead of the crowd with some of the market's standout growth and value screens:

- Uncover hidden value by targeting businesses proven to be undervalued with strong cash flow potential through our undervalued stocks based on cash flows.

- Ride the wave of breakthrough technology and innovation by finding companies making real advances in artificial intelligence via our AI penny stocks.

- Make your next move toward reliable income by zeroing in on companies generating healthy returns with over 3% yields using our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAMR

Lamar Advertising

Founded in 1902, Lamar Advertising (Nasdaq: LAMR) is one of the largest outdoor advertising companies in North America, with over 366,000 displays across the United States and Canada.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives