- United States

- /

- Specialized REITs

- /

- NasdaqGS:GLPI

What Does the Recent 5% Pullback Mean for GLPI Stock in 2025?

Reviewed by Bailey Pemberton

If you’re looking at Gaming and Leisure Properties today and wondering whether the dip is a red flag or an opportunity, you’re not alone. The stock has dipped a little over 4% in the last week and remains down nearly 5.6% for the past month. These numbers might make some investors hesitate. But take a step back, and you’ll notice this real estate powerhouse is still up nearly 65% over five years. That track record isn’t luck; it suggests something is working here, despite recent volatility.

Much of the recent price movement has come as real estate investment trusts face broader questions about consumer spending and regional gaming trends. While the near-term pullback might feel discouraging, keep in mind that Gaming and Leisure Properties has scored highly in our valuation review. With a value score of 5 out of a possible 6, it stands out as undervalued in most of the key checks analysts use to gauge opportunity.

So, is this a classic case of market overreaction, or are there warning signs beneath the surface? Let’s break down what those valuation signals really mean. At the end, I’ll show you a more powerful way to think about a stock’s value beyond the usual methods.

Approach 1: Gaming and Leisure Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model takes Gaming and Leisure Properties’ adjusted funds from operations, projects how much cash the company will generate in the years ahead, and then discounts those future cash flows back to today’s dollar value. This approach helps estimate what the business is truly worth, based on its ability to keep producing cash over time.

Currently, Gaming and Leisure Properties is generating around $1.06 billion in free cash flow. According to forecasts, analysts expect this number to climb steadily each year, reaching an estimated $1.63 billion by 2028. Further cash flow projections, carried out through extrapolation, suggest consistent increases out to 2035. All of these figures are stated in US dollars.

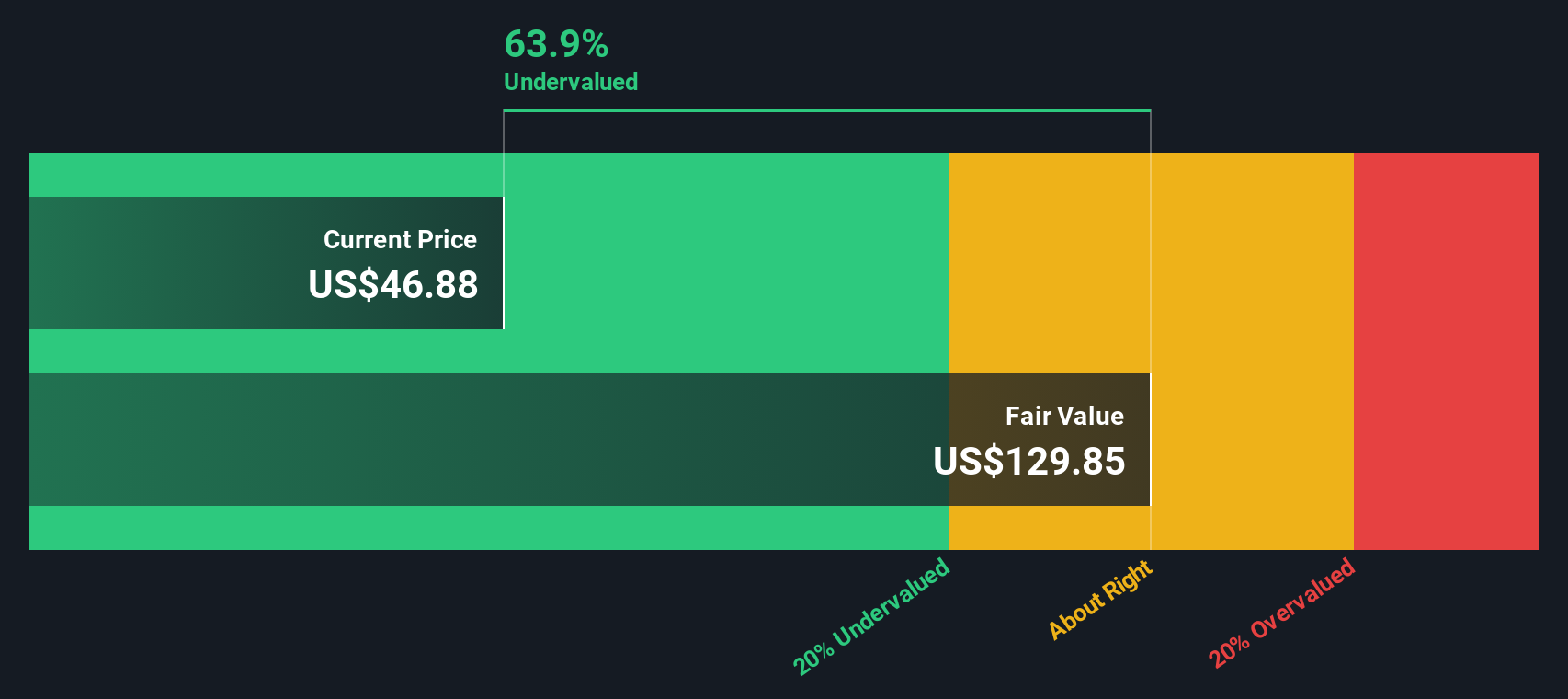

Based on the DCF analysis, the estimated intrinsic value for the company stands at $129.09 per share, which is 64.9% above its current trading price. This level of undervaluation indicates significant potential upside according to this cash flow model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gaming and Leisure Properties is undervalued by 64.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Gaming and Leisure Properties Price vs Earnings

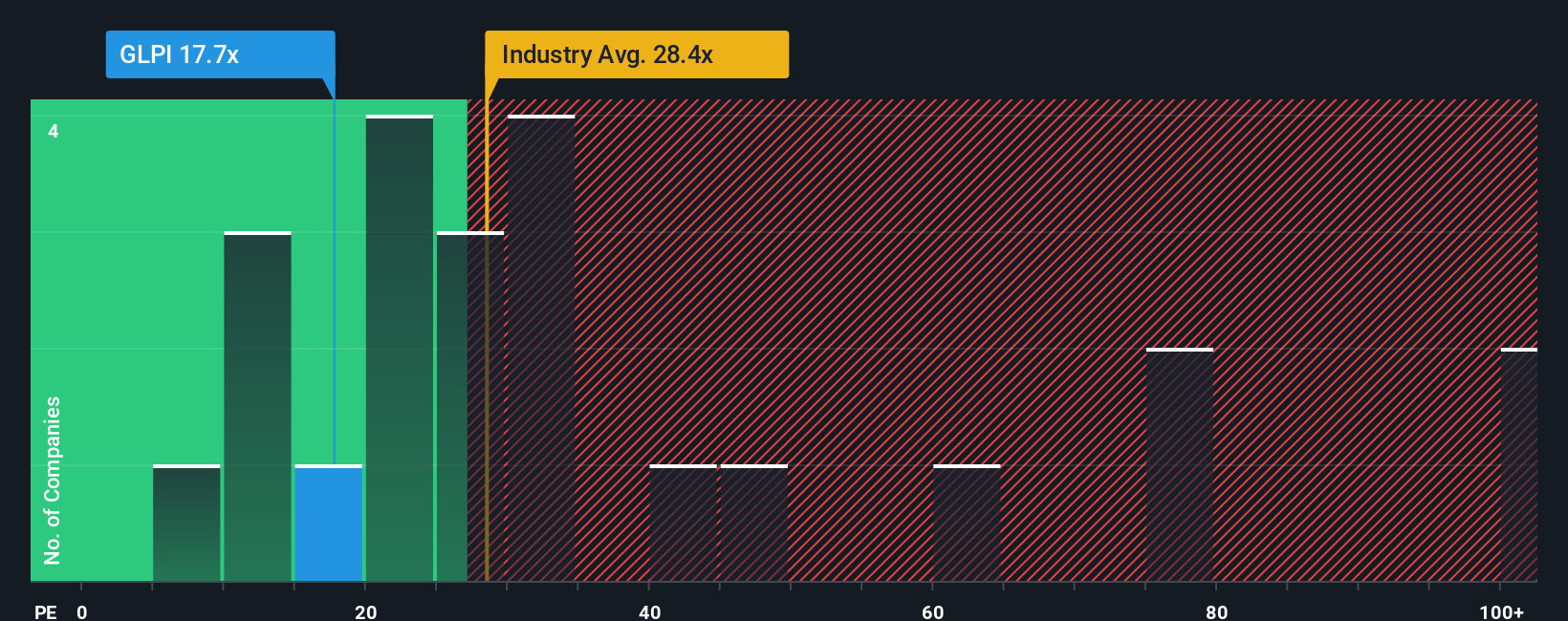

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it measures how much investors are willing to pay per dollar of earnings. For businesses with steady profits, the PE ratio helps put their current share price in the context of real-world earnings power. This provides a straightforward sense of value versus output.

It is important to note that what counts as a “normal” or “fair” PE ratio can vary depending on expectations about future growth and risk. Companies with higher growth prospects or more stability tend to command higher PE ratios, while those with unpredictable earnings or more risk typically trade at lower multiples.

Gaming and Leisure Properties currently trades at a PE ratio of 17.8x. For context, this is slightly above the average for companies in the Specialized REITs industry, which sits at 17.5x, but well below the group of closest peers, who average a much higher 44.9x.

To give a clearer sense of value, Simply Wall St’s proprietary “Fair Ratio” estimates what a company’s multiple should be, based on factors like earnings growth, profit margin, industry trends, company size, and risk. This approach goes beyond a simple comparison to peers or industry averages by blending in the underlying factors that actually drive fair value.

Using this Fair Ratio, Gaming and Leisure Properties’ fair PE is calculated at 36.1x, significantly above where shares are trading today. This suggests that, given the company’s risk profile, growth outlook, and profitability, the current market price likely represents an attractive value opportunity on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gaming and Leisure Properties Narrative

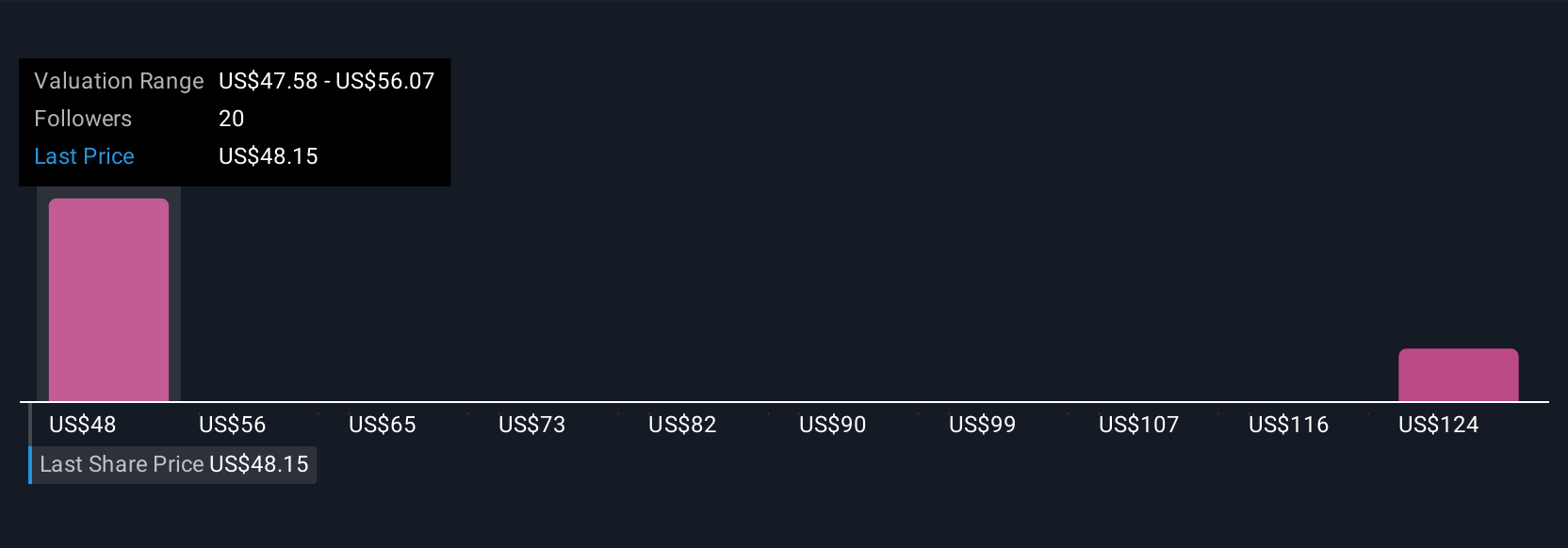

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own personal story about a company, combining your assumptions and perspective with hard numbers, such as predicted future revenues, earnings, and margins, to reach a fair value that makes sense to you.

With Narratives, you link a company’s story to a financial forecast and quickly see how that vision translates into a fair value, letting you move beyond one-size-fits-all metrics. Narratives are easy to create on Simply Wall St’s Community page, where millions of investors are already sharing and updating theirs with each new earnings result, major news item, or industry trend.

This approach helps you decide when to buy or sell by continuously comparing your personalized Fair Value against the company’s current market price. For example, regarding Gaming and Leisure Properties, some investors currently see long-term rental growth and marquee projects driving a price target as high as $60.0, while others highlight risk and project a value closer to $46.0. Your assumptions and narrative have a real, measurable impact.

In short, using Narratives puts you in control, ensuring your investing decisions are both dynamic and deeply informed by your own research and beliefs, rather than just following the crowd.

Do you think there's more to the story for Gaming and Leisure Properties? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLPI

Gaming and Leisure Properties

GLPI is engaged in the business of acquiring, financing, and owning real estate property to be leased to gaming operators in triple-net lease arrangements, pursuant to which the tenant is responsible for all facility maintenance, insurance required in connection with the leased properties and the business conducted on the leased properties, taxes levied on or with respect to the leased properties and all utilities and other services necessary or appropriate for the leased properties and the business conducted on the leased properties.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)