- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

How Investors Are Reacting To Equinix (EQIX) SEC Clearance And New Merck AI Supercomputer Deal

Reviewed by Sasha Jovanovic

- The U.S. Securities and Exchange Commission recently ended its investigation into Equinix without recommending enforcement action, while Merck KGaA selected Equinix’s AI-ready German data center to host a new high-performance computing supercomputer.

- Together with Equinix’s plan to roughly double AI-focused data center capacity by 2029, these developments clarify regulatory risk and underline its role in supporting enterprise AI infrastructure demand.

- Next, we’ll examine how the cleared SEC investigation and new Merck AI supercomputer deployment shape Equinix’s long-term investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Equinix Investment Narrative Recap

To own Equinix, you need to believe that global AI, cloud, and interconnection demand will keep filling its premium, power-dense data centers despite high capital needs and leverage. The SEC closing its investigation removes a regulatory overhang, but it does not materially change the core near term catalyst, which remains execution on Equinix’s multi year “Build Bolder” expansion against the backdrop of rising debt costs and elevated valuation multiples.

The Merck KGaA AI supercomputer deployment at an Equinix AI ready German facility is the clearest recent proof point for that thesis, reinforcing the idea that large enterprises are leaning on third party colocation for intensive AI workloads. It sits directly alongside Equinix’s plan to roughly double AI focused capacity by 2029, highlighting the opportunity, but also amplifying execution risk around multi billion US$ buildouts, energy access, and utilization.

Yet behind the AI capacity story, investors still need to watch how Equinix manages its rising debt load and interest rate exposure...

Read the full narrative on Equinix (it's free!)

Equinix's narrative projects $11.4 billion revenue and $1.7 billion earnings by 2028. This requires 8.5% yearly revenue growth and an earnings increase of about $700 million from $994.0 million today.

Uncover how Equinix's forecasts yield a $965.56 fair value, a 33% upside to its current price.

Exploring Other Perspectives

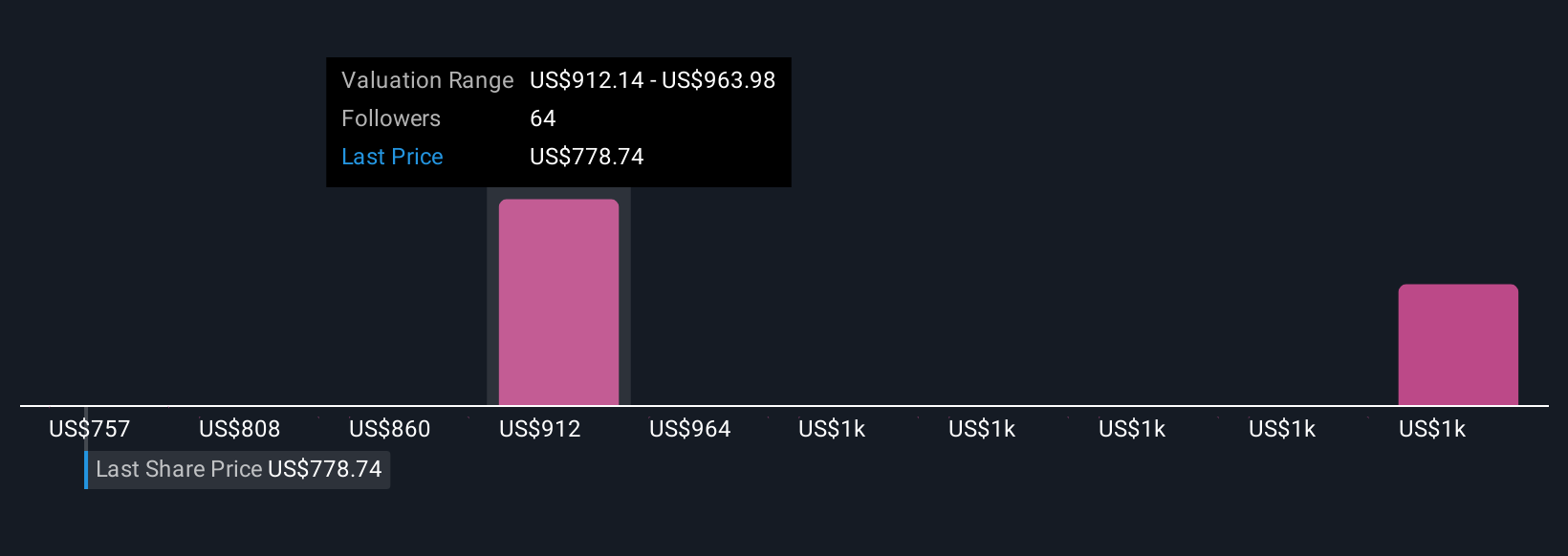

Six fair value estimates from the Simply Wall St Community range from about US$758 to US$1,241 per share, showing how far apart individual views can be. Against that backdrop, Equinix’s ambition to double AI focused data center capacity by 2029 raises important questions about execution, capital intensity, and how different investors think those factors could shape long term performance.

Explore 6 other fair value estimates on Equinix - why the stock might be worth as much as 71% more than the current price!

Build Your Own Equinix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equinix research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Equinix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equinix's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix, Inc. (Nasdaq: EQIX) shortens the path to boundless connectivity anywhere in the world.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026