- United States

- /

- Real Estate

- /

- NYSE:KW

3 Undervalued Small Caps With Insider Action From Global Markets

Reviewed by Simply Wall St

Over the last 7 days, the United States market has seen a modest rise of 1.2%, contributing to an overall increase of 11% over the past year, with earnings anticipated to grow by 14% annually in the coming years. In this context, identifying stocks that are potentially undervalued yet show insider activity can be a strategic approach for investors looking to capitalize on these favorable market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 33.97% | ★★★★★★ |

| Columbus McKinnon | NA | 0.5x | 36.46% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.5x | 46.87% | ★★★★★☆ |

| Barrett Business Services | 20.5x | 0.9x | 47.49% | ★★★★☆☆ |

| Vital Energy | NA | 0.4x | 10.97% | ★★★★☆☆ |

| MVB Financial | 13.7x | 1.8x | 35.85% | ★★★☆☆☆ |

| Standard Motor Products | 11.8x | 0.4x | -2225.50% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -64.76% | ★★★☆☆☆ |

| BlueLinx Holdings | 14.8x | 0.2x | -80.33% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -373.03% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Kennedy-Wilson Holdings (KW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kennedy-Wilson Holdings is a global real estate investment company with operations in property management, development, and investment, and has a market capitalization of $1.24 billion.

Operations: Kennedy-Wilson Holdings generates revenue primarily through its consolidated operations and co-investments, with the consolidated segment contributing $390.50 million and co-investments adding $99.90 million. Over recent periods, the gross profit margin has shown variability, peaking at 78.25% in early 2022 before declining to 64.08% by mid-2024. Operating expenses have been a significant component of costs, often exceeding $300 million per quarter, impacting overall profitability trends significantly as seen in net income fluctuations over time.

PE: -8.0x

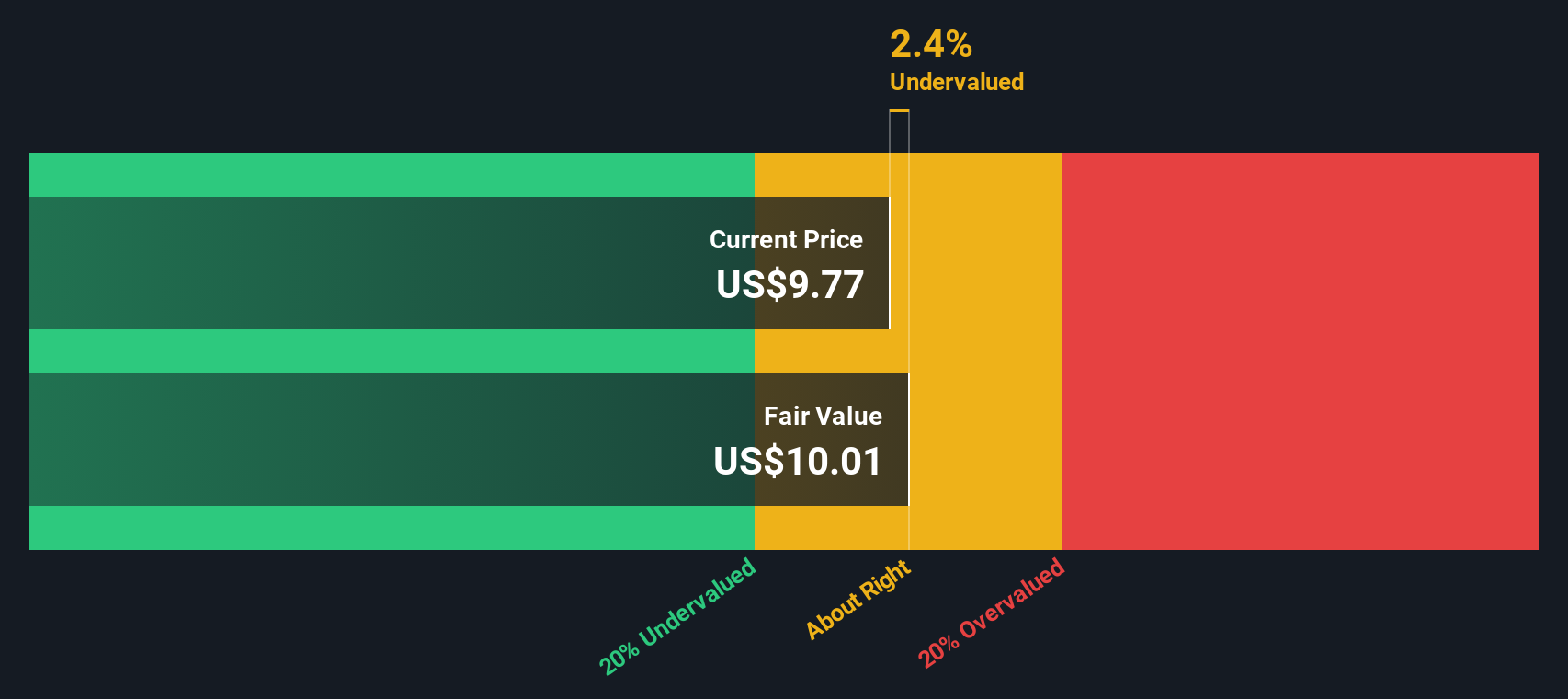

Kennedy-Wilson Holdings, a company with a focus on real estate investments, recently reported a net loss of US$29.9 million for Q1 2025, contrasting with the previous year's net income. Despite this setback, insider confidence is evident as William McMorrow purchased 200,000 shares for approximately US$1.27 million in early April 2025. The company's strategic alliance with Tokyu Land aims to expand its credit platform targeting over US$200 million in preferred equity and mezzanine loans across multifamily and industrial projects nationwide.

- Click here and access our complete valuation analysis report to understand the dynamics of Kennedy-Wilson Holdings.

Learn about Kennedy-Wilson Holdings' historical performance.

Pebblebrook Hotel Trust (PEB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pebblebrook Hotel Trust is a real estate investment trust specializing in the acquisition and management of upscale, full-service hotels and resorts, with a market cap of approximately $2.14 billion.

Operations: Pebblebrook Hotel Trust generates revenue primarily from its hotels and motels segment, amounting to $1.46 billion. The company's cost of goods sold (COGS) is $1.10 billion, leading to a gross profit of $360.29 million with a gross profit margin of 24.69%. Operating expenses are recorded at $282.68 million, while non-operating expenses stand at $129.02 million, contributing to a net income loss of -$51.40 million and a net income margin of -3.52%.

PE: -22.1x

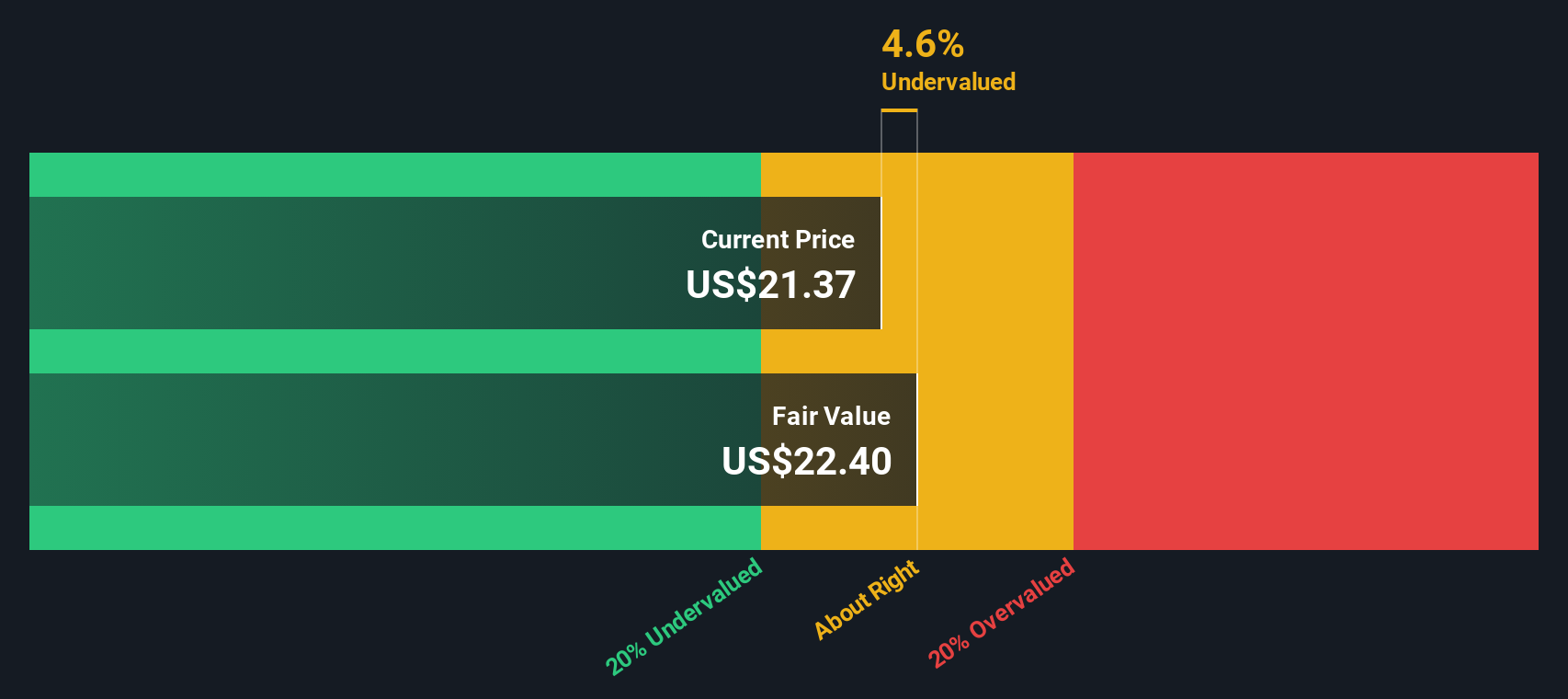

Pebblebrook Hotel Trust, a smaller player in the hospitality sector, has been drawing attention due to insider confidence. In April 2025, Jon Bortz purchased 66,000 shares for US$790,680, indicating belief in the company's potential despite recent challenges. The company reported a net loss of US$32.95 million for Q1 2025 and revised its full-year earnings outlook downward. However, it anticipates net income between US$14.4 million and US$18.4 million for Q2 2025 and completed share repurchases worth US$33.41 million since February 2023, reflecting strategic capital management efforts amidst evolving market conditions.

Vital Energy (VTLE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vital Energy is engaged in the exploration and production of oil and natural gas, with a market capitalization of approximately $1.72 billion.

Operations: The company's revenue primarily stems from exploration and production activities, including midstream and marketing, with a recent figure of $1.98 billion. The gross profit margin has shown variability over time, reaching 67.36% in the most recent period. Operating expenses and non-operating expenses significantly impact net income results, with the latest net income recorded at -$126.53 million.

PE: -5.6x

Vital Energy, a U.S.-based company with small-scale operations, recently reported a revenue increase to US$512.18 million for Q1 2025, up from US$482.34 million the previous year. Despite a net loss of US$18.84 million, this marks an improvement from last year's larger deficit. Insider confidence is evident as President Mikell Pigott acquired 5,500 shares worth approximately US$99K in recent months. The company's production guidance for Q2 suggests stable output levels between 133 and 139 MBOE/d, reflecting potential operational consistency amidst market volatility.

- Get an in-depth perspective on Vital Energy's performance by reading our valuation report here.

Gain insights into Vital Energy's past trends and performance with our Past report.

Next Steps

- Dive into all 93 of the Undervalued US Small Caps With Insider Buying we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennedy-Wilson Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KW

Kennedy-Wilson Holdings

Operates as a real estate investment company in the United States and Europe.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives