- United States

- /

- Media

- /

- NasdaqGM:CDLX

3 Promising Penny Stocks With Market Caps Over $90M

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 2.8%, and over the past 12 months, it is up 9.3%, with earnings forecasted to grow by 14% annually. In such a climate, identifying stocks with strong financials becomes crucial for those seeking value and growth potential. Penny stocks, though often considered niche due to their smaller size or newer status, can present unique opportunities when they demonstrate robust financial health and long-term promise.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.45 | $361.71M | ✅ 4 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.39 | $1.44B | ✅ 3 ⚠️ 3 View Analysis > |

| Perfect (NYSE:PERF) | $1.86 | $189.44M | ✅ 3 ⚠️ 1 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $1.05 | $18.66M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.315 | $9.95M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.65 | $46.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.56 | $77.65M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.8294 | $6.02M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.594 | $80.24M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.7957 | $71.73M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 748 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Blade Air Mobility (NasdaqCM:BLDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blade Air Mobility, Inc. offers air transportation and logistics services for hospitals both in the United States and internationally, with a market cap of $234.27 million.

Operations: The company generates revenue from two main segments: Medical services, which contributed $146.82 million, and Passenger services, which brought in $101.88 million.

Market Cap: $234.27M

Blade Air Mobility, Inc. has shown resilience despite being currently unprofitable, with a net loss of US$27.31 million for 2024, an improvement from the previous year's US$56.08 million loss. The company benefits from a robust financial position with no debt and short-term assets of US$160.7 million exceeding liabilities significantly, providing a cash runway for over three years based on free cash flow. Recent initiatives include a pilot program in partnership with Skyports Infrastructure aimed at expanding urban air mobility services in New York City, potentially enhancing future revenue streams and operational efficiencies as they transition to electric vertical aircraft operations.

- Dive into the specifics of Blade Air Mobility here with our thorough balance sheet health report.

- Evaluate Blade Air Mobility's prospects by accessing our earnings growth report.

Cardlytics (NasdaqGM:CDLX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cardlytics, Inc. operates an advertising platform in the United States and the United Kingdom, with a market cap of approximately $960 million.

Operations: The company's revenue is primarily derived from its Cardlytics Platform, generating $255.62 million, and its Bridg Platform, contributing $22.68 million.

Market Cap: $96M

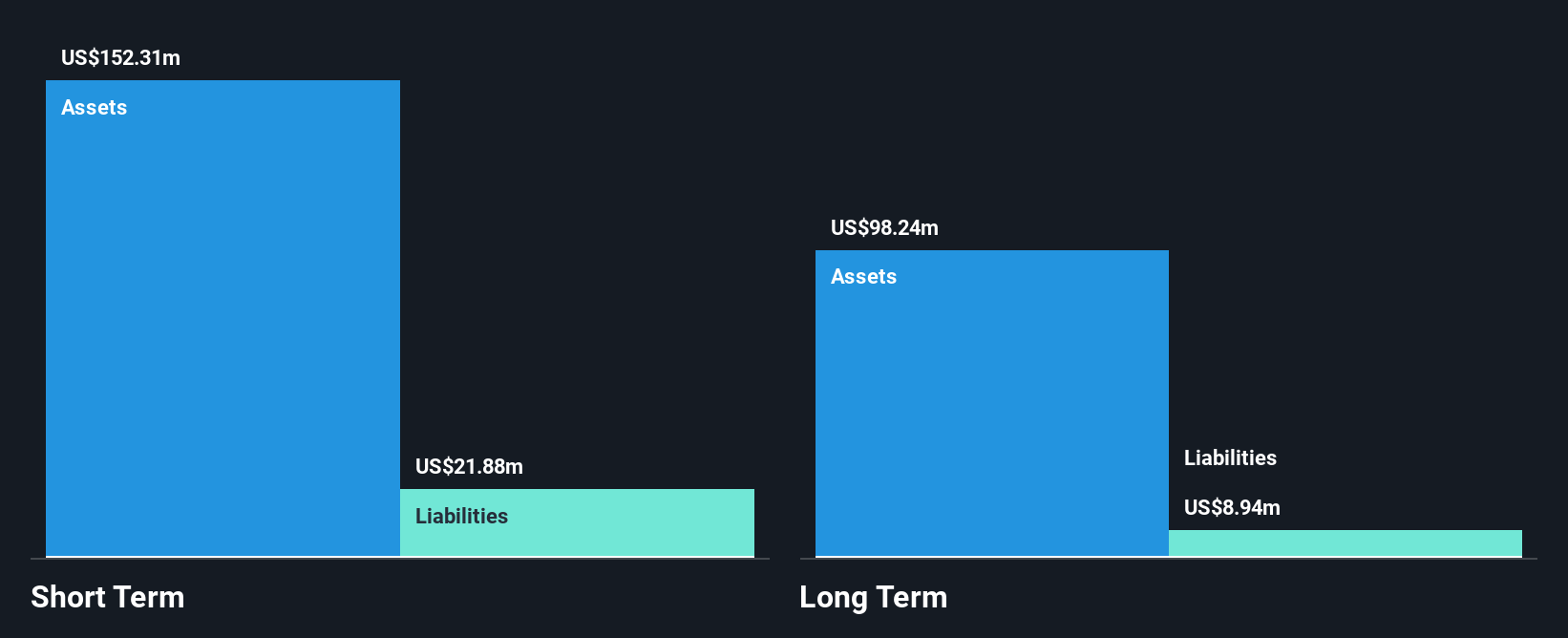

Cardlytics, Inc. faces challenges as it remains unprofitable with a net loss of US$189.3 million for 2024, widening from the prior year's loss. Despite trading at good relative value and having short-term assets of US$178 million covering both short- and long-term liabilities, its high net debt to equity ratio of 211.4% raises concerns about financial leverage. The company recently amended its loan facility extending maturity to 2028 without borrowing additional funds, maintaining US$60 million in available credit. Revenue guidance for Q1 2025 is set between US$57-60 million, indicating continued revenue pressures amidst operational volatility.

- Unlock comprehensive insights into our analysis of Cardlytics stock in this financial health report.

- Understand Cardlytics' earnings outlook by examining our growth report.

Douglas Elliman (NYSE:DOUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Douglas Elliman Inc. operates in the real estate services and property technology investment sectors in the United States, with a market cap of approximately $162.22 million.

Operations: The company generates its revenue primarily from real estate services and property technology investments in the United States, amounting to $1.05 billion.

Market Cap: $162.22M

Douglas Elliman Inc. operates with a market cap of US$162.22 million and reported revenues of US$1.05 billion, yet remains unprofitable with a negative return on equity (-25.61%). Despite an increase in revenue to US$253.4 million for Q1 2025 from the previous year, the company recorded a net loss of US$5.99 million, an improvement from prior losses but still concerning for investors focused on profitability. The company's short-term assets exceed its short-term liabilities, providing some financial stability; however, long-term liabilities remain uncovered by these assets, highlighting potential risks amidst its ongoing efforts to stabilize operations through recent shelf registration filings and earnings calls.

- Jump into the full analysis health report here for a deeper understanding of Douglas Elliman.

- Gain insights into Douglas Elliman's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Explore the 748 names from our US Penny Stocks screener here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CDLX

Cardlytics

Operates an advertising platform in the United States and the United Kingdom.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives