- United States

- /

- Real Estate

- /

- NYSE:CWK

Will Cushman & Wakefield's (CWK) Debt Repricing Meaningfully Boost Its Earnings Stability?

Reviewed by Sasha Jovanovic

- Cushman & Wakefield announced it has repriced approximately US$840 million of its Term Loan due 2030, reducing the interest rate by 25 basis points to Term SOFR plus 2.50%, with all other terms remaining substantially unchanged.

- This repricing follows significant debt repayments by Cushman & Wakefield since early 2024 and reflects proactive efforts to lower interest costs and strengthen financial flexibility.

- We’ll explore how this reduction in interest expense may support Cushman & Wakefield’s ongoing focus on operational efficiency and earnings stability.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cushman & Wakefield Investment Narrative Recap

At a high level, the Cushman & Wakefield investment case requires faith in the company’s ability to drive consistent earnings growth by enhancing operational efficiency, diversifying revenue streams, and managing debt prudently. The recent loan repricing reduces near-term interest costs and supports management’s drive for financial flexibility, but it does not materially address the largest short-term catalyst, improved transaction volumes, or the principal risk: vulnerability to a downturn in commercial real estate activity, which could weigh on revenues and margins despite efficiency gains.

Among recent announcements, Cushman & Wakefield’s August 2025 report of prepaying US$150 million of its Term Loan (totaling US$400 million in repayments since the start of 2024) is most relevant. This underscores the company’s deliberate deleveraging and aligns with the catalyst of increasing financial flexibility, but does not fully insulate the business from earnings volatility, especially if commercial property markets weaken.

By contrast, investors should be aware that even as debt service costs drop, Cushman & Wakefield’s significant reliance on cyclical leasing and capital markets revenues means ...

Read the full narrative on Cushman & Wakefield (it's free!)

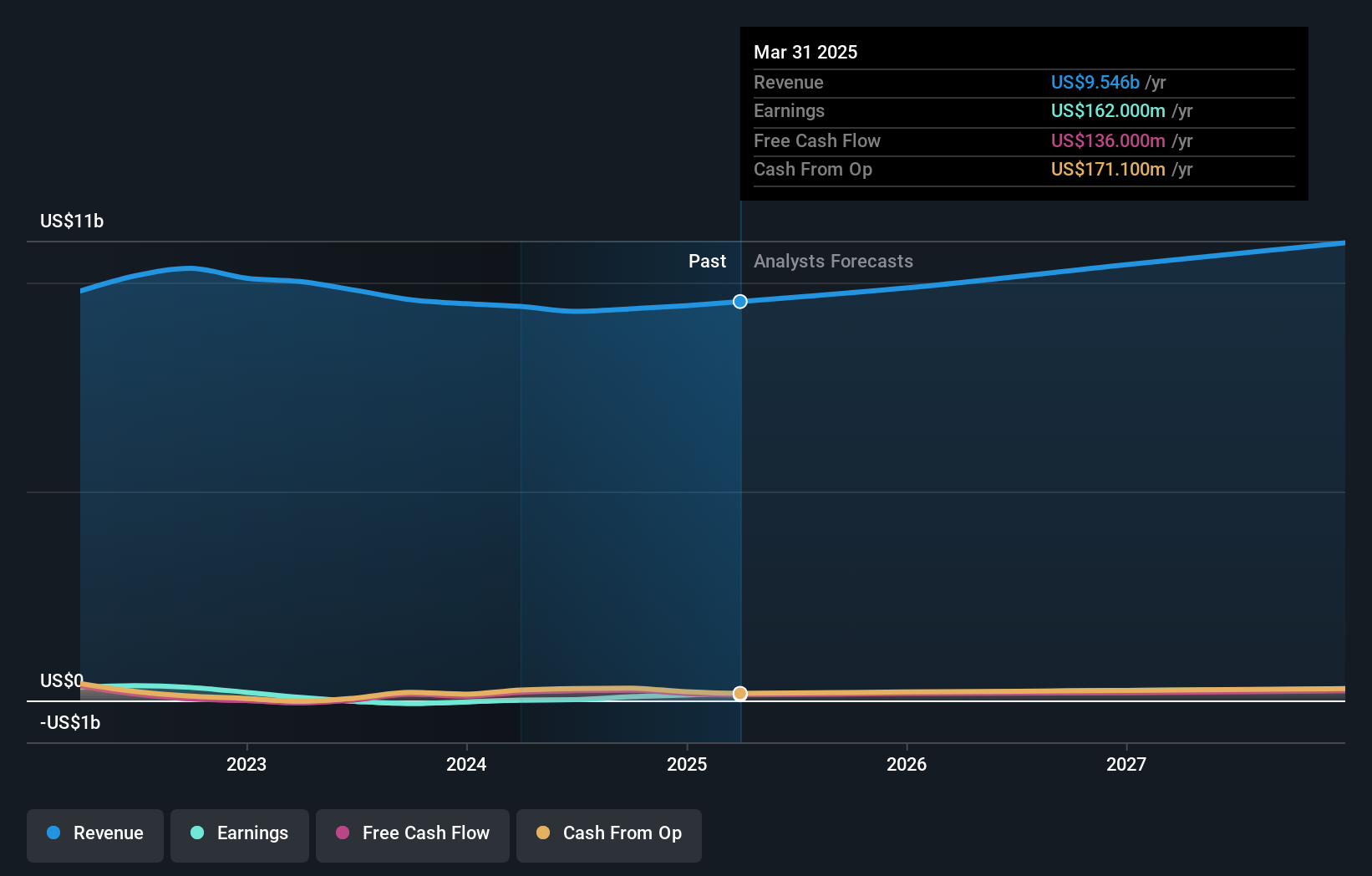

Cushman & Wakefield's narrative projects $11.4 billion revenue and $342.8 million earnings by 2028. This requires 5.4% annual revenue growth and a $137 million increase in earnings from $205.8 million currently.

Uncover how Cushman & Wakefield's forecasts yield a $16.06 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Cushman & Wakefield range from US$4.64 to US$18.01, based on three distinct forecasts. With ongoing debt reduction as a key catalyst, differing views signal broad debate about future earnings potential and resilience in changing market cycles.

Explore 3 other fair value estimates on Cushman & Wakefield - why the stock might be worth as much as 14% more than the current price!

Build Your Own Cushman & Wakefield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cushman & Wakefield research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cushman & Wakefield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cushman & Wakefield's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWK

Cushman & Wakefield

Provides commercial real estate services under the Cushman & Wakefield brand in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives