- United States

- /

- Real Estate

- /

- NYSE:COMP

It's Down 27% But Compass, Inc. (NYSE:COMP) Could Be Riskier Than It Looks

The Compass, Inc. (NYSE:COMP) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 107% in the last twelve months.

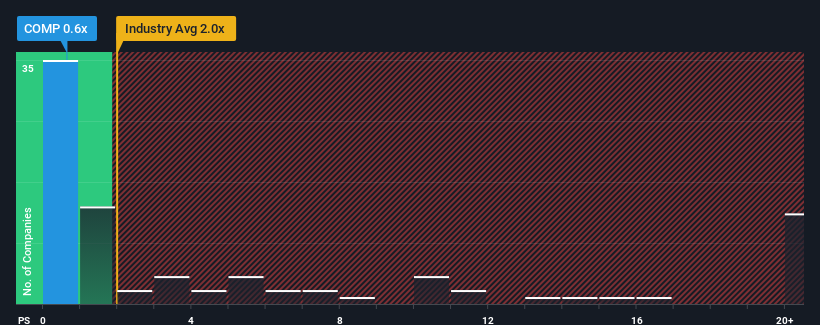

Following the heavy fall in price, Compass may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Real Estate industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 11x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

We check all companies for important risks. See what we found for Compass in our free report.See our latest analysis for Compass

What Does Compass' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Compass has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Compass.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Compass would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. Still, revenue has fallen 12% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 12% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Compass' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Compass' P/S?

Compass' P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Compass' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Compass with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Compass, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:COMP

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026