- United States

- /

- Real Estate

- /

- NYSE:CBRE

Will Dovish Fed Outlook and Leadership Change Shift CBRE Group's (CBRE) Growth Trajectory?

Reviewed by Simply Wall St

- Following dovish Fed commentary, CBRE Group experienced renewed investor confidence as analysts raised earnings estimates and reaffirmed positive momentum for the commercial real estate services firm.

- A key leadership transition also took place, with Andrew Horn assuming the role of principal accounting officer following the departure announcement of Chief Accounting Officer Lindsey Caplan.

- We'll explore how analyst optimism and the leadership change may influence CBRE's investment narrative and growth expectations.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CBRE Group Investment Narrative Recap

To believe in CBRE Group as a shareholder, you need confidence in the company’s ability to leverage its scale and operational expertise to benefit from structural shifts in commercial real estate and resilient service-driven revenues. The recent leadership transition, with Andrew Horn succeeding Lindsey Caplan as principal accounting officer, appears unlikely to materially impact CBRE’s short-term catalyst: ongoing momentum from higher analyst earnings estimates and increased investor confidence following dovish Fed commentary. The primary risk remains market exposure to interest rate swings, which can impact deal activity and earnings.

Of the latest announcements, CBRE’s raised 2025 earnings guidance stands out, emphasizing the management’s confidence in financial performance despite executive changes. This commitment to transparency supports the investment narrative that improved operational focus and realignment can help mitigate some of the key risks associated with macroeconomic volatility.

However, investors should also be aware that in contrast to recent analyst optimism, there remains the possibility that rapid changes in rates or economic sentiment could...

Read the full narrative on CBRE Group (it's free!)

CBRE Group's outlook anticipates $50.1 billion in revenue and $2.3 billion in earnings by 2028. This scenario assumes annual revenue growth of 9.5% and a $1.2 billion increase in earnings from the current $1.1 billion level.

Uncover how CBRE Group's forecasts yield a $162.64 fair value, in line with its current price.

Exploring Other Perspectives

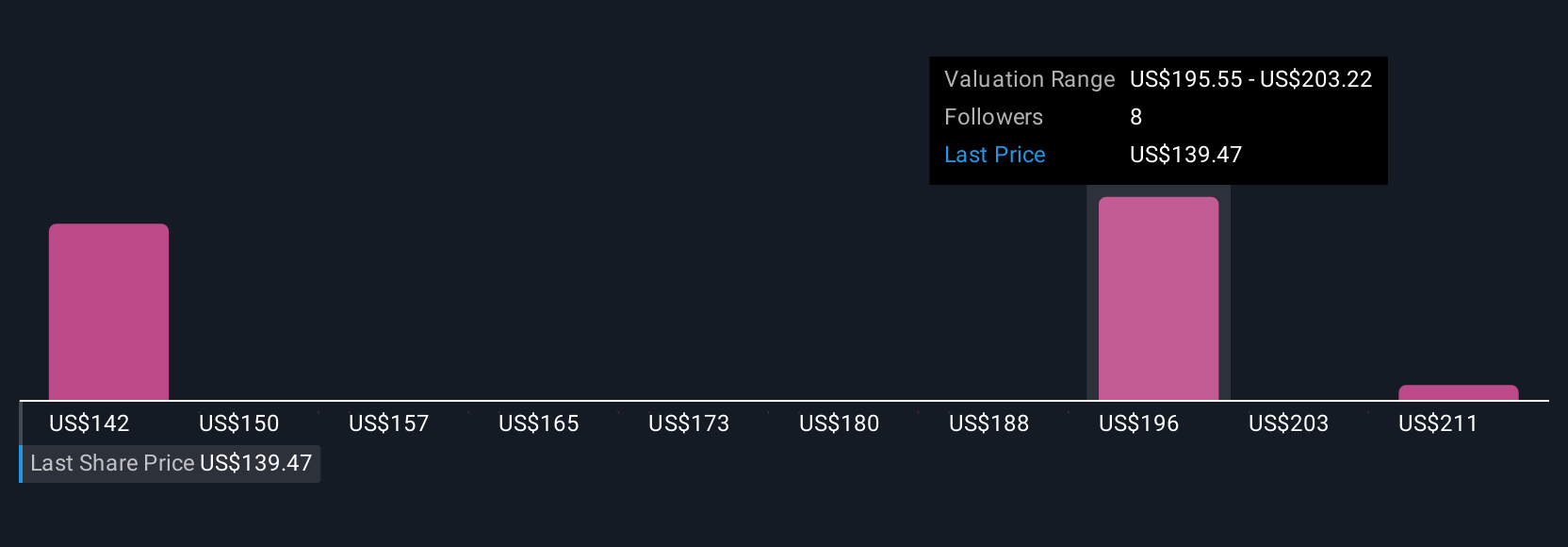

Simply Wall St Community members estimated CBRE’s fair value between US$159.42 and US$218.54 across three analyses. While many analysts highlight rising earnings expectations as a key catalyst, your outlook could differ, consider reviewing a variety of perspectives before making any decisions.

Explore 3 other fair value estimates on CBRE Group - why the stock might be worth just $159.42!

Build Your Own CBRE Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CBRE Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBRE Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives