- United States

- /

- Real Estate

- /

- NYSE:CBRE

Upgraded Analyst Ratings and Earnings Revisions Might Change The Case For Investing In CBRE Group (CBRE)

Reviewed by Sasha Jovanovic

- In the past week, CBRE Group received a Zacks Rank upgrade to #2 (Buy) following a series of recent analyst reports, which highlighted improving earnings estimates and upward forecast revisions for the company.

- This momentum reflects heightened optimism among financial analysts regarding CBRE's near-term growth prospects and underlying business improvement.

- We will now consider how these analyst upgrades and positive earnings revisions could influence CBRE Group’s investment narrative moving forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 31 companies in the world exploring or producing it. Find the list for free.

CBRE Group Investment Narrative Recap

To be a shareholder in CBRE Group, you generally need to believe in the company’s ability to deliver steady earnings growth and operational resilience despite industry cyclicality. The recent Zacks Rank upgrade and positive earnings revisions reinforce confidence in near-term performance, but inflated valuation metrics and macroeconomic uncertainties remain significant, with interest rate volatility standing out as the largest short-term risk. The improved outlook is encouraging; however, the main catalyst, continued success in core business transformation, remains broadly intact, while overvaluation risk warrants careful attention.

Of the recent developments, the raised 2025 earnings guidance appears most relevant, as it aligns directly with the analyst upgrades and supports the current optimism around improved financial performance. The company’s increased full-year EPS forecast highlights management’s confidence in sustaining profit growth and leveraging business realignment, two critical elements underlying the positive revisions from the analyst community.

But with much of this good news likely priced in, investors should be aware of the risk that, if interest rates remain elevated, CBRE’s deal activity and margin outlook could face unexpected …

Read the full narrative on CBRE Group (it's free!)

CBRE Group is projected to reach $50.0 billion in revenue and $2.3 billion in earnings by 2028. This implies a 9.5% annual revenue growth rate and a $1.2 billion increase in earnings from the current level of $1.1 billion.

Uncover how CBRE Group's forecasts yield a $169.73 fair value, a 7% upside to its current price.

Exploring Other Perspectives

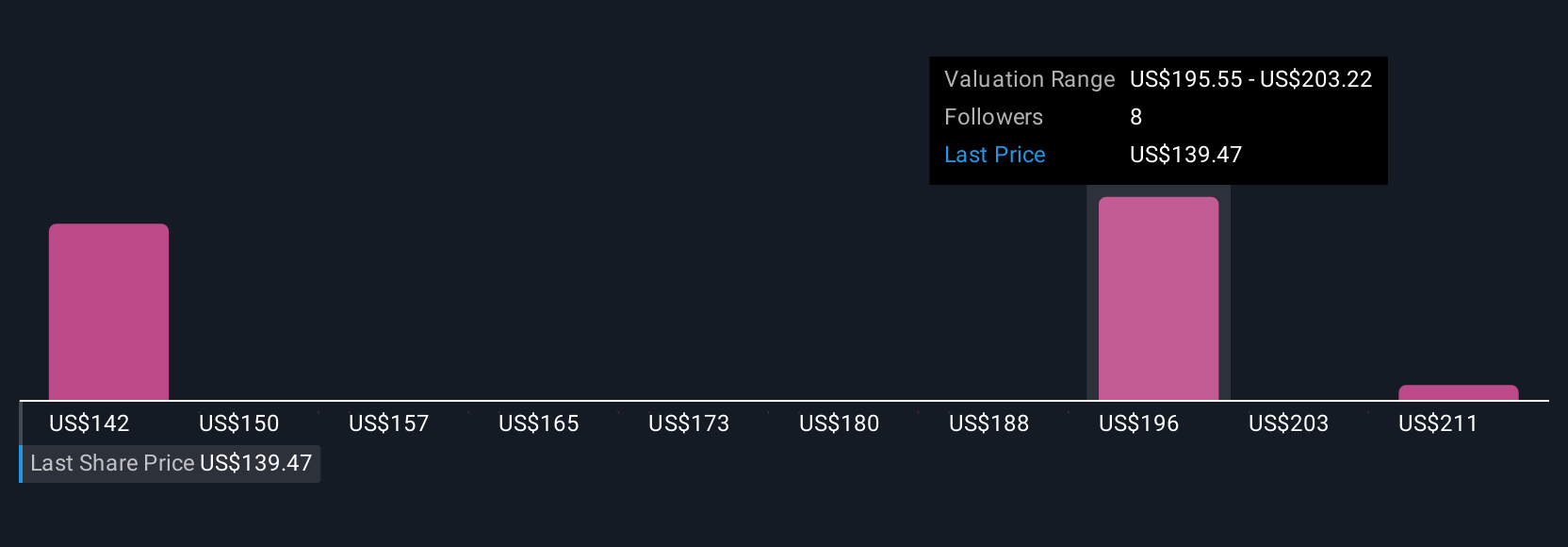

Three individual valuations from the Simply Wall St Community put CBRE’s fair value between US$156 and US$218. While the company’s raised earnings guidance has ignited optimism, interest rate risk may remain top of mind for many shareholders seeking long-term stability.

Explore 3 other fair value estimates on CBRE Group - why the stock might be worth just $156.35!

Build Your Own CBRE Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CBRE Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBRE Group's overall financial health at a glance.

No Opportunity In CBRE Group?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.