- United States

- /

- Real Estate

- /

- NYSE:CBRE

Taking Stock of CBRE (CBRE): Valuation After Barclays’ Overweight Call and Pearce Services Expansion Push

Reviewed by Simply Wall St

CBRE Group (CBRE) is back in the spotlight after Barclays initiated coverage with an Overweight rating, just as the company doubles down on strategic growth through its Pearce Services acquisition and fresh debt financing.

See our latest analysis for CBRE Group.

Despite a softer 1 day and recent 7 day share price return, CBRE’s roughly 24 percent year to date share price gain and triple digit multi year total shareholder returns suggest momentum is still very much intact as these strategic moves land.

If CBRE’s trajectory has you thinking about where else growth and ownership conviction might be lining up, now is a good time to explore fast growing stocks with high insider ownership.

With CBRE trading just below analyst targets after a strong multi year run and double digit earnings growth, investors face a key question: is there still mispriced upside here, or is the market already baking in the next leg of growth?

Most Popular Narrative: 8% Undervalued

With CBRE’s last close at $161.47 versus a narrative fair value of about $175, the spread hints at embedded optimism about earnings and margin expansion.

The strong balance sheet and improved cash flow position allow CBRE to invest aggressively in M&A and principal investments, potentially driving higher future earnings and improved financial performance during economic downturns. Continued investments in high-demand sectors such as data centers and strategic geographic markets, alongside capital deployment in share repurchases and M&A, are expected to deliver long-term EPS growth and shareholder value, leveraging favorable market conditions and strategic positioning.

Want to see what powers that premium valuation path? The narrative leans on compound revenue growth, fatter margins, and a punchy future earnings multiple. Curious which levers matter most?

Result: Fair Value of $175.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the timing of rate cuts and slower large leasing deals could quickly cool transaction momentum, challenging both the optimistic margin story and current valuation expectations.

Find out about the key risks to this CBRE Group narrative.

Another View: Rich on Earnings

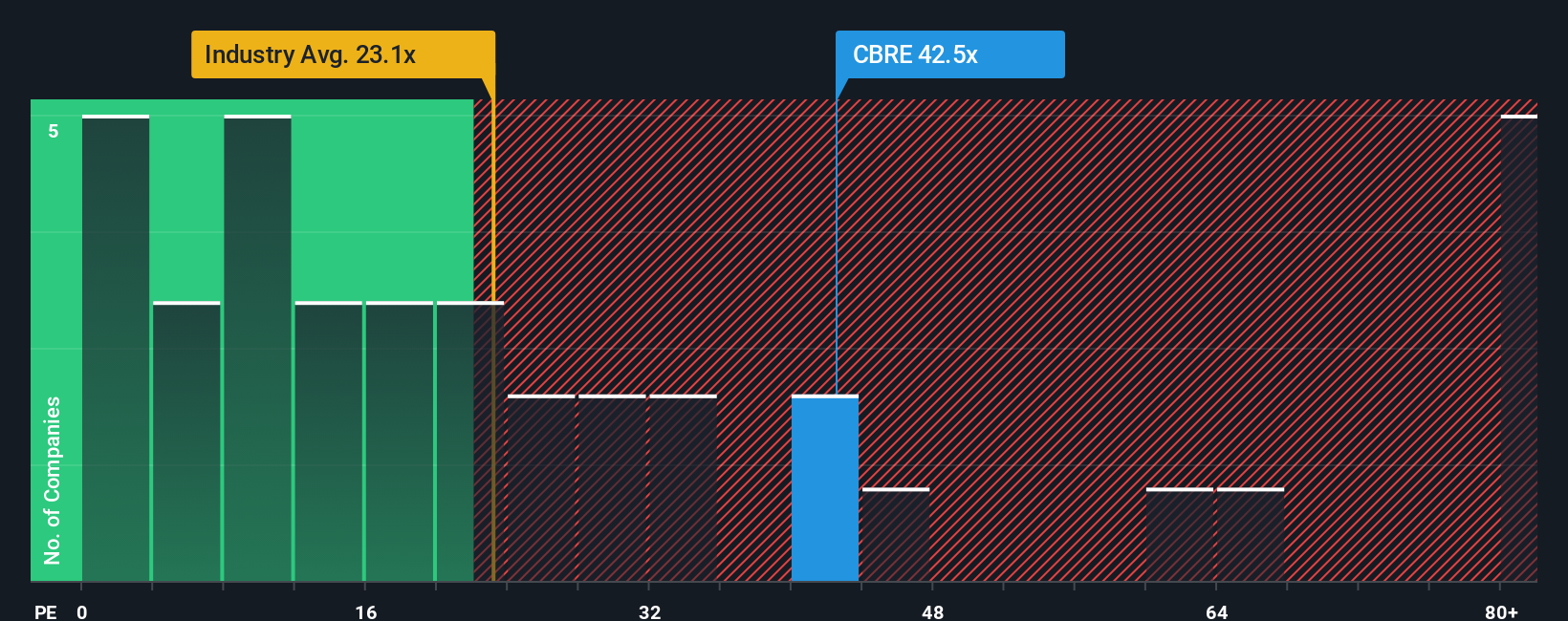

On an earnings multiple lens, CBRE looks far less forgiving. Its 38.5x price to earnings ratio towers over the US real estate sector at 30.2x, the peer average at 28x, and even a 28.3x fair ratio our work points to. Is the premium signaling durable growth or valuation risk building up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBRE Group Narrative

If this perspective does not fully align with your view, or you prefer to lean on your own research, you can build a custom take in just minutes, Do it your way.

A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity. Use the Simply Wall Street Screener to line up fresh, data backed stock ideas that others may be missing.

- Capture potential mispricings by targeting quality companies trading below intrinsic value with these 908 undervalued stocks based on cash flows to surface compelling candidates in seconds.

- Tap into innovation tailwinds by scanning for cutting edge names shaping the future of automation, machine learning, and data platforms through these 26 AI penny stocks.

- Boost your income strategy by focusing on resilient businesses offering attractive yields and payout histories using these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026