- United States

- /

- Real Estate

- /

- NYSE:CBRE

CBRE Group (CBRE): Revisiting Valuation After Analyst Upgrades, Strategic Expansion and Leadership Changes

Reviewed by Simply Wall St

CBRE Group (CBRE) is back in the spotlight after a string of upbeat analyst calls and fresh leadership moves, prompting investors to revisit how its evolving business mix might influence performance in 2026.

See our latest analysis for CBRE Group.

Those leadership promotions and the Pearce Services acquisition are landing against a solid backdrop, with a roughly 23 percent year to date share price return and a powerful five year total shareholder return of about 155 percent, suggesting positive momentum rather than a late cycle fade.

If CBRE’s run has you thinking about where else disciplined execution could pay off, this is a good moment to explore fast growing stocks with high insider ownership.

With CBRE trading about 14 percent below consensus targets but already boasting a five-year return of more than 150 percent, the real question is whether today’s price marks a fresh buying opportunity or a market that has fully priced in future growth.

Most Popular Narrative: 11.4% Undervalued

With CBRE Group’s fair value pegged near $180.50 against a last close of $160.01, the most followed narrative frames upside as a function of disciplined growth and capital deployment rather than a simple multiple re rating story.

Continued investments in high demand sectors such as data centers and strategic geographic markets, alongside capital deployment in share repurchases and M&A, are expected to deliver long term EPS growth and shareholder value, leveraging favorable market conditions and strategic positioning.

Want to see the math behind that upside claim? This narrative quietly leans on faster earnings growth, rising margins, and a richer future profit multiple than the sector. Curious how those moving parts combine into that fair value call?

Result: Fair Value of $180.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if higher-for-longer interest rates prolong sluggish brokerage volumes and delay the rebound in large leasing deals.

Find out about the key risks to this CBRE Group narrative.

Another Angle On Value

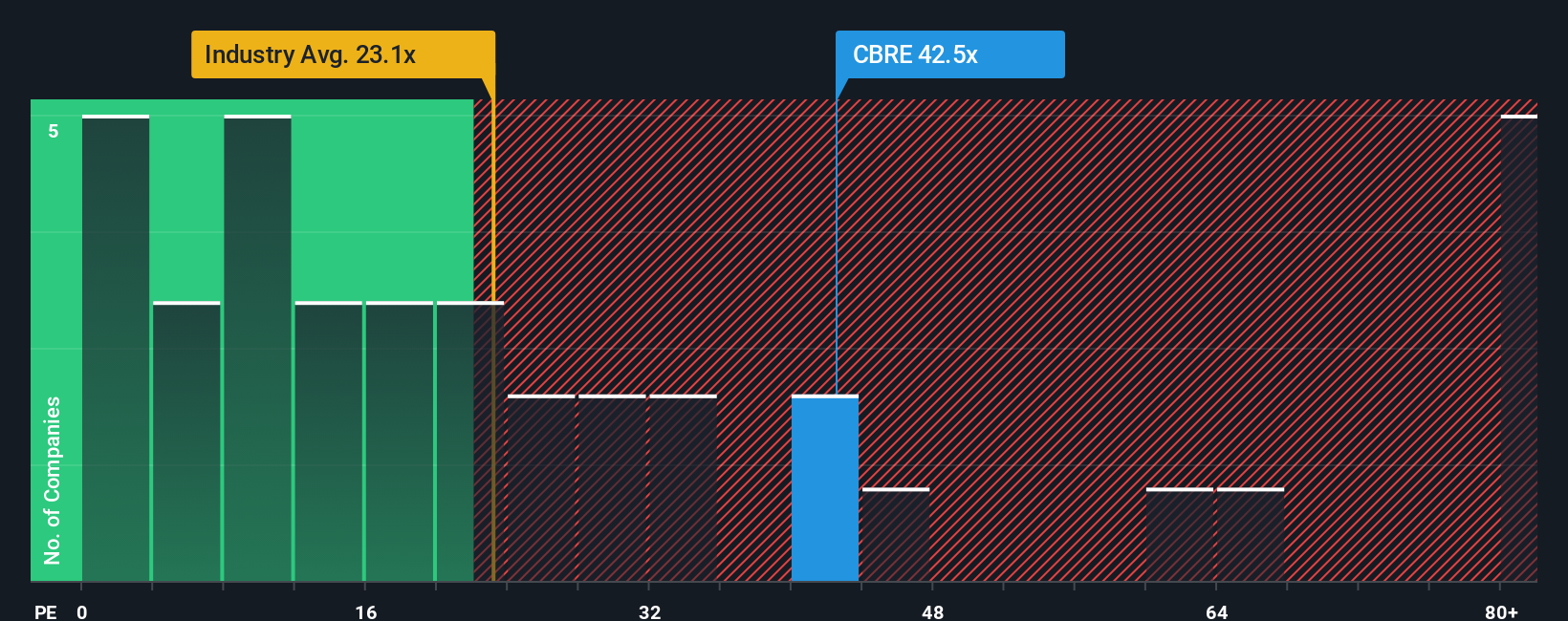

On earnings, the picture looks less forgiving. CBRE trades at about 38.2 times earnings, well above the 29.9 times industry average and a fair ratio of 28.2 times. If the market drifts back toward that fair ratio, is today’s upside really as comfortable as it looks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBRE Group Narrative

If this perspective does not quite match your own or you prefer to dive into the numbers yourself, you can craft a personal view in minutes, Do it your way.

A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investment moves?

Do not stop with one great idea. Use the Simply Wall St Screener to uncover more targeted opportunities that fit your strategy before the market wakes up.

- Capture potential long term compounders by scanning these 911 undervalued stocks based on cash flows that still trade below what their cash flows suggest they are worth.

- Capitalize on the AI revolution by zeroing in on these 26 AI penny stocks positioned to benefit from rapid adoption across industries.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that can help support reliable, recurring portfolio cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion