- United States

- /

- Real Estate

- /

- NYSE:CBRE

CBRE Group (CBRE): Evaluating Valuation as Shares Remain Steady in a Shifting Real Estate Sector

Reviewed by Kshitija Bhandaru

See our latest analysis for CBRE Group.

CBRE Group’s share price has drifted only slightly over the past year, but a 1-year total shareholder return of 0.3% highlights just how steady the stock has been despite changing sector dynamics and regular headline activity. While short-term price movements have been muted, the company’s solid history of generating returns continues to put it on the watchlist for those seeking consistent long-term performance.

If steady performance in this space has you thinking bigger, broaden your search and check out fast growing stocks with high insider ownership.

With CBRE shares staying resilient and only modestly below analyst price targets, investors now face a pivotal question: Is the current valuation offering room for upside, or is the market already accounting for the company’s growth potential?

Most Popular Narrative: 8% Undervalued

CBRE Group’s most followed narrative puts fair value at $169.73, about 8% higher than the last close of $156.14. Investors are watching to see if the company’s earnings path will meet the expectations that fuel this bullish target.

Strong cash flow supports aggressive investments, mergers and acquisitions, and share repurchases. This is seen as promising for EPS growth and increased shareholder value amid favorable market conditions.

Want to know which big financial bets analysts are banking on? This narrative hinges on rapidly rising earnings, ambitious profit margin expansion, and the expectation that CBRE’s future multiple will rival the industry’s best. Curious what bold forecasts drive that price target? Dive in to discover the powerful assumptions behind this fair value call.

Result: Fair Value of $169.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any prolonged slowdown in leasing activity or fresh interest rate volatility could quickly challenge the bullish assumptions that support current analyst targets.

Find out about the key risks to this CBRE Group narrative.

Another View: Price Multiples Tell a Cautionary Story

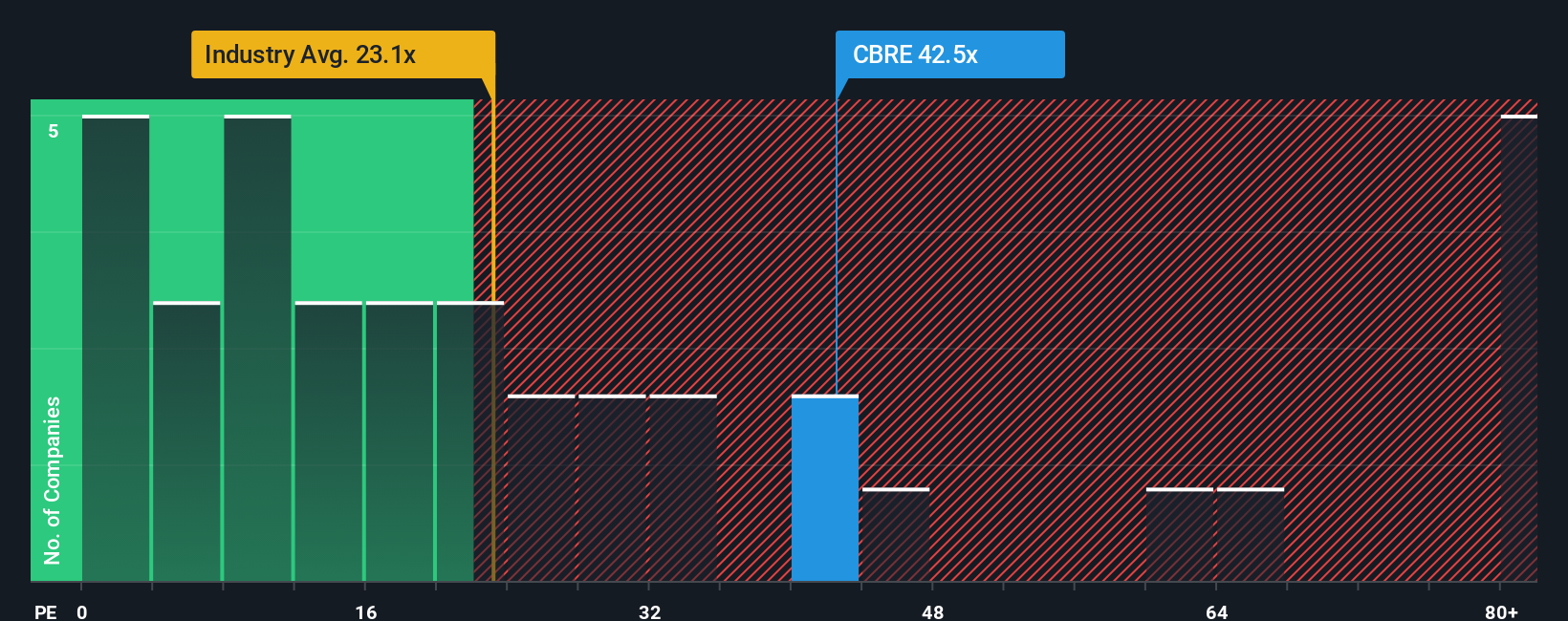

Looking at things through the lens of price-to-earnings, CBRE currently trades at 42 times earnings, well above the US Real Estate industry average of 24.3 times and above the peer average of 31.4 times. The fair ratio suggests a multiple closer to 27.1 times. This gap hints that investors are paying a premium, and premiums can sometimes turn into risk if lofty growth projections do not materialize. With valuations running hot by this measure, could the market be overlooking something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBRE Group Narrative

If you see the story differently or want your own take, it only takes a few minutes to craft your own CBRE Group narrative in your own way. Do it your way.

A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Maximize your investment potential by tapping into top trends and emerging opportunities with the Simply Wall Street Screener.

- Supercharge your return potential by evaluating these 24 AI penny stocks transforming industries with the latest breakthroughs in artificial intelligence.

- Power up your portfolio with strong, stable income by uncovering these 19 dividend stocks with yields > 3% consistently delivering attractive yields above 3%.

- Step ahead with cutting-edge digital innovation when you follow these 78 cryptocurrency and blockchain stocks at the forefront of blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives