- United States

- /

- Real Estate

- /

- NYSE:BEKE

KE Holdings (NYSE:BEKE) Share Buybacks: Taking a Fresh Look at the Valuation Story

Reviewed by Simply Wall St

KE Holdings (NYSE:BEKE) has been steadily buying back its own shares through November, which is a clear signal that management sees value at current levels and is comfortable committing meaningful capital to the stock.

See our latest analysis for KE Holdings.

The recent buybacks come after a choppy stretch for the stock, with a strong 1 month share price return of 9.49% helping to partially offset a weak 1 year total shareholder return of negative 17.28%. This suggests momentum may be stabilising as investors reassess the risk reward trade off.

If you are weighing KE Holdings against other ideas in today’s market, this could be a good moment to explore fast growing stocks with high insider ownership for more growth focused opportunities.

With buybacks accelerating, earnings recovering, and the share price still well below past highs, investors now face a key question: Is KE Holdings trading at a genuine discount, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 16.1% Undervalued

With KE Holdings last closing at $17.08 versus a narrative fair value near $20.37, the current price embeds a noticeable valuation gap worth examining.

The company's enhanced focus on operational efficiency, including centralized procurement, AI led process improvements, and business model innovation, has already yielded tangible improvements in segment margins (notably in home renovation and rental). This signals a path to sustainable margin expansion and stronger future earnings. Active government policy support aimed at improving real estate transparency, urban renewal, and housing quality is increasing demand for data driven, compliant platforms. KE Holdings' leadership in AI powered pricing, customer insights, and C2M solutions positions it as a preferred partner for developers and policymakers, supporting higher market share and topline growth going forward.

Curious how modest revenue assumptions, rising margins, and a richer future earnings multiple combine into that upside case? The narrative connects those moving parts in detail.

Result: Fair Value of $20.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained real estate weakness or tighter regulation could sap transaction volumes and margins, which would challenge the upbeat growth and valuation assumptions underpinning this narrative.

Find out about the key risks to this KE Holdings narrative.

Another Lens on Valuation

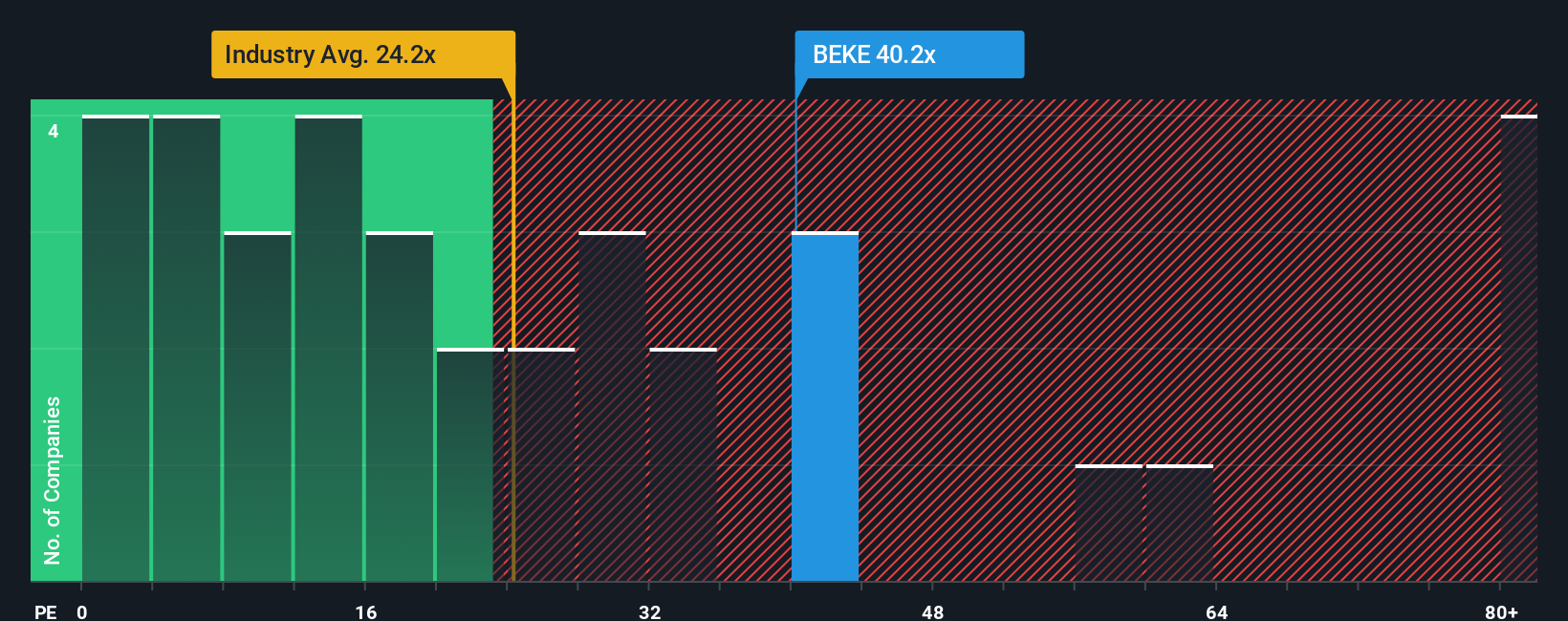

On earnings metrics, KE Holdings looks far less forgiving. The current P/E of 40.5x sits well above both peers at 26.6x and a fair ratio of 27.3x. This suggests the market already prices in a lot of good news and leaves less room for error if growth disappoints. Does that really align with your risk tolerance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KE Holdings Narrative

If this perspective does not fully resonate with you, or you would rather test your own assumptions using the data, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your KE Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in your next set of opportunities with targeted screeners that surface quality stocks you might regret overlooking later.

- Capture potential multi baggers early by scanning these 3595 penny stocks with strong financials for smaller companies already showing real financial strength.

- Ride structural growth in automation and machine intelligence by zeroing in on these 27 AI penny stocks shaping the future of tech.

- Strengthen your margin of safety by targeting these 904 undervalued stocks based on cash flows where cash flows suggest the market may be mispricing quality businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEKE

KE Holdings

Through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026