- United States

- /

- Real Estate

- /

- NYSE:BEKE

KE Holdings (NYSE:BEKE) Completes US$139 Million Share Buyback

Reviewed by Simply Wall St

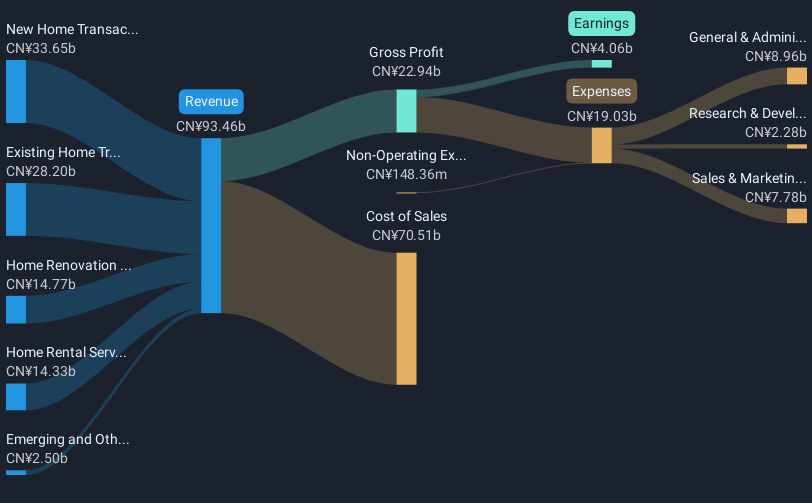

KE Holdings (NYSE:BEKE) recently executed a share buyback, acquiring 7.5 million shares for $139 million by March 31, totaling 10.98% of shares repurchased since their plan's initiation in August 2022. This robust buyback activity highlights their dedication to enhancing shareholder value amidst mixed quarterly earnings, where a revenue increase contrasted with a drop in net income. Concurrently, market conditions showed significant fluctuations with a 4.1% market climb this past week. KE Holdings' 29% price rise over the last quarter aligns closely with broader market gains, suggesting buybacks and dividends bolstered investor sentiment without deviating from general trends.

We've spotted 1 warning sign for KE Holdings you should be aware of.

The recent share buyback by KE Holdings, acquiring 7.5 million shares for US$139 million, underscores the company's commitment to maximizing shareholder value despite fluctuating earnings. This effort could bolster investor confidence and support KE Holdings' narrative focused on AI integration and market expansion. The company's initiatives, aimed at enhancing operational efficiency and customer experience, align with its strategy to improve both revenue and earnings. Over the past three years, KE Holdings has delivered a formidable total shareholder return of 74.23%, which emphasizes its growth trajectory amid sector uncertainties.

Comparatively, over the past year, the company's share performance has surpassed the US Real Estate industry average of 16.1%. This outperformance suggests a resilience in its business model and execution capabilities. However, KE Holdings faces challenges such as increased competition and execution risks associated with AI and digital innovations. Analysts project a 12.5% annual revenue growth over the next three years, which, along with profitability improvements, supports a consensus price target of US$25.74. With the current share price at US$20.24, this represents a potential price movement of about 21.4% upward, indicating market optimism relative to the price target. Whether these targets will be achieved depends on the effective implementation of their AI initiatives and navigating the volatile real estate market.

Explore historical data to track KE Holdings' performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEKE

KE Holdings

Through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives