- United States

- /

- Real Estate

- /

- NYSE:BEKE

KE Holdings’ (BEKE) Share Buybacks Could Be a Game Changer for Its Investment Narrative

Reviewed by Sasha Jovanovic

- KE Holdings Inc. disclosed in October 2025 that it had been actively repurchasing its shares throughout September and early October as part of efforts to optimize its capital structure.

- This ongoing share buyback activity not only signals management’s confidence in the business but may also influence shareholder perceptions and future capital allocation decisions.

- We'll explore how KE Holdings' recent buybacks and capital structure focus could reshape its long-term investment narrative and value proposition.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

KE Holdings Investment Narrative Recap

To invest in KE Holdings, you need conviction in China’s long-term urbanization trends, digital transformation in real estate, and the company’s ability to boost earnings through operational efficiency, even as China’s property market remains volatile. The recent share buybacks, while a strong show of management confidence, don’t fundamentally alter the company’s most critical near-term catalyst: the pace of recovery in housing transactions. The biggest risk continues to be persistent weakness in China’s real estate market, and these buybacks alone are not enough to offset market-wide headwinds.

Among recent announcements, KE Holdings’ August extension and increase of its equity buyback plan is most relevant. This move, expanding the program by US$2 billion up to US$5 billion and extending it through August 2028, reflects an intensified focus on capital management, closely tied to the ongoing buybacks disclosed in October. For investors, this supports the company’s effort to allocate capital efficiently in the face of challenging sector conditions and aligns tightly with catalysts framed by digital integration and operating leverage.

However, investors should be aware that even with expanding buybacks, ongoing downward pressure in China’s property sector may yet pose...

Read the full narrative on KE Holdings (it's free!)

KE Holdings' outlook anticipates CN¥136.4 billion in revenue and CN¥8.6 billion in earnings by 2028. This forecast is based on a 9.8% annual revenue growth rate and assumes a CN¥4.7 billion increase in earnings from the current CN¥3.9 billion.

Uncover how KE Holdings' forecasts yield a $22.83 fair value, a 24% upside to its current price.

Exploring Other Perspectives

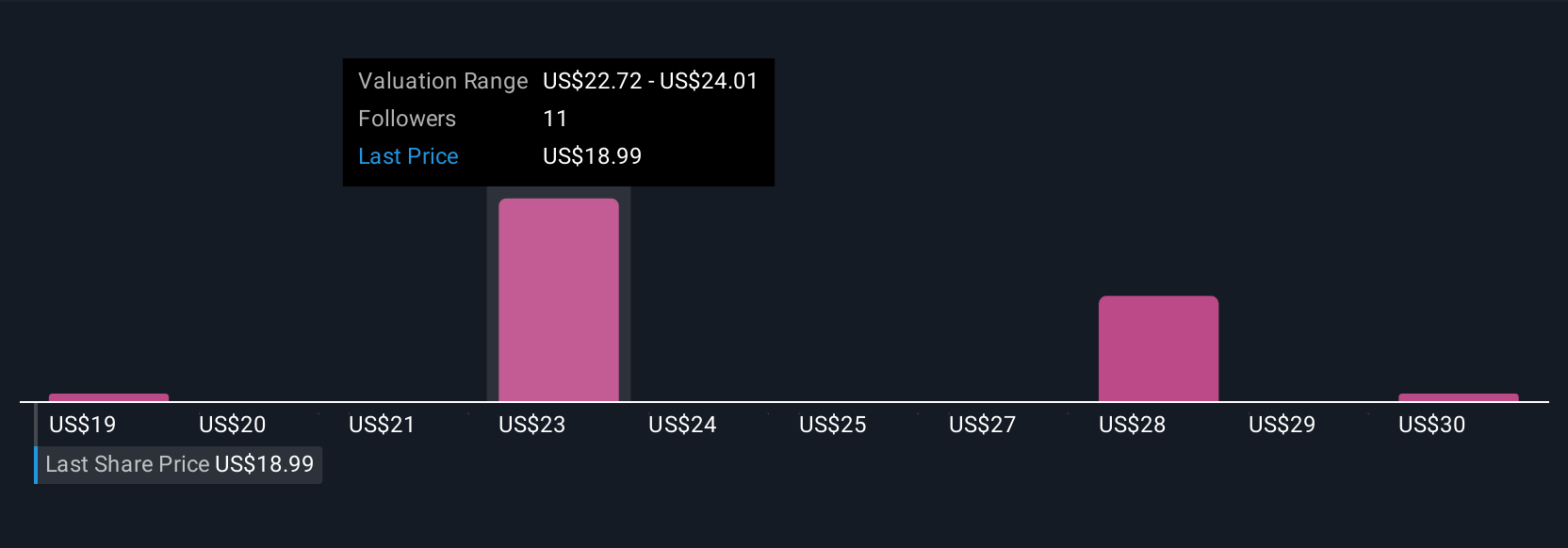

Four members of the Simply Wall St Community valued KE Holdings between US$18.86 and US$31.74 per share. While many point to structural urbanization and digital integration as reasons for optimism, the persistent risks in China’s real estate sector could affect the company’s ability to meet these expectations over time. Explore several alternative viewpoints to round out your perspective.

Explore 4 other fair value estimates on KE Holdings - why the stock might be worth just $18.86!

Build Your Own KE Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KE Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KE Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KE Holdings' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEKE

KE Holdings

Through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives