- United States

- /

- Real Estate

- /

- NYSE:BEKE

Did KE Holdings’ Ongoing Buybacks and Asset-Light Margin Gains Just Recast BEKE’s Investment Narrative?

Reviewed by Sasha Jovanovic

- In November 2025, KE Holdings Inc. carried out several share repurchases, including a buyback of 516,576 shares on November 21, as it continued to refine its capital structure during a weak Chinese property market.

- These buybacks coincided with improving profitability in BEKE’s home rental and renovation businesses, where asset-light models and supply chain efficiencies have lifted margins despite tough sector conditions.

- Next, we’ll examine how KE Holdings’ continued share repurchases amid profitable rental and renovation growth may reshape its longer-term investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

KE Holdings Investment Narrative Recap

To own KE Holdings, you need to believe its hybrid online and offline platform can keep benefiting from urbanization, digital adoption and growing service revenues, even as China’s property downturn drags on. The latest November 2025 buybacks, including 516,576 shares on November 21, do not materially change the near term picture, where the key catalyst is profitable growth in rentals and renovation, and the biggest risk remains prolonged weakness in housing transactions and prices.

The Q3 2025 update that KE Holdings repurchased 279,316,543 shares between July and September, taking total buybacks to 435,400,000 shares since 2022, is particularly relevant here. It underlines how aggressively management has been reducing the share count while rental and renovation businesses are contributing profitably, which may amplify the impact of any improvement in platform volumes if China’s property market stabilizes.

Yet investors should also be aware that prolonged real estate softness could still...

Read the full narrative on KE Holdings (it's free!)

KE Holdings' narrative projects CN¥136.4 billion revenue and CN¥8.6 billion earnings by 2028. This requires 9.8% yearly revenue growth and a CN¥4.7 billion earnings increase from CN¥3.9 billion today.

Uncover how KE Holdings' forecasts yield a $20.37 fair value, a 19% upside to its current price.

Exploring Other Perspectives

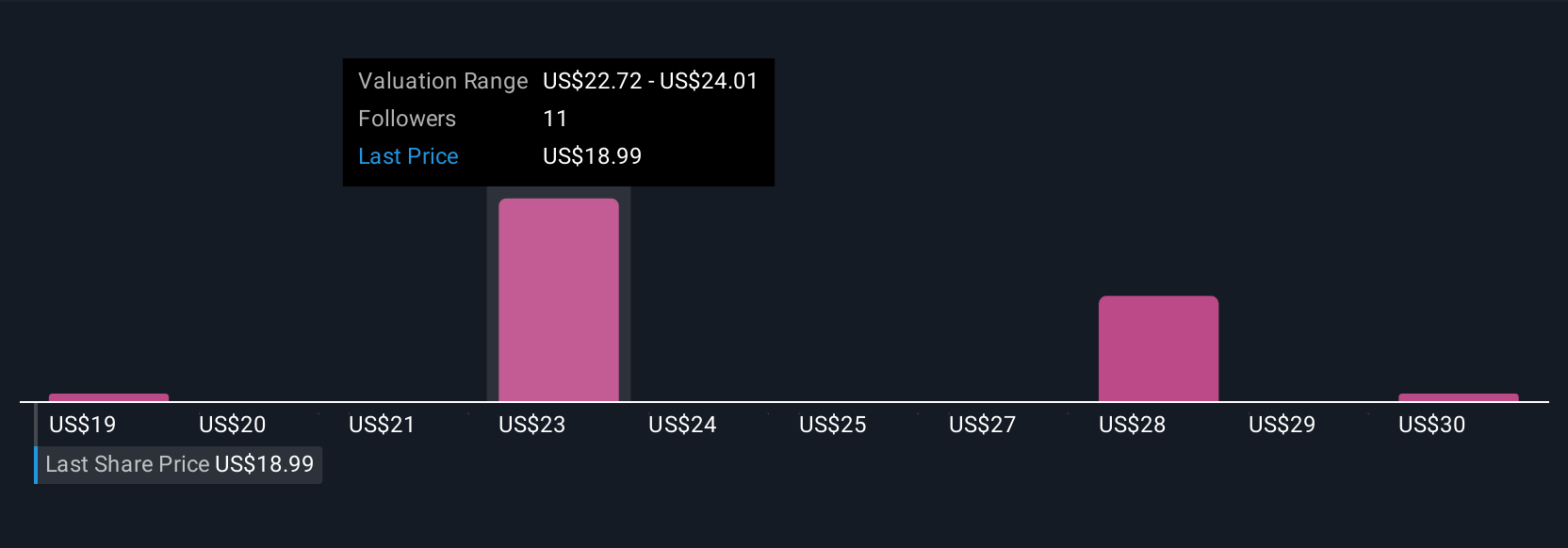

Four members of the Simply Wall St Community value KE Holdings between US$18.86 and US$31.74, highlighting wide differences in expectations. You can weigh these views against the risk that China’s weak property market keeps pressuring transaction volumes and sentiment for longer than many anticipate.

Explore 4 other fair value estimates on KE Holdings - why the stock might be worth as much as 85% more than the current price!

Build Your Own KE Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KE Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KE Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KE Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEKE

KE Holdings

Through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026