- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

Zillow (ZG): Evaluating Valuation After Launching AI-Powered Virtual Staging for Home Listings

Reviewed by Simply Wall St

For anyone watching Zillow Group (ZG), the launch of Virtual Staging on its Showcase premium listing platform is more than just another feature release. This new AI-powered tool lets prospective home buyers instantly visualize properties in a variety of curated, stylish designs, right on the listing page. As the first major consumer-facing integration of technology from the firm's recent Virtual Staging AI acquisition, Virtual Staging sets the stage for a new era in home shopping, one that puts flexibility and personalization at the forefront.

These tech-forward additions come as Zillow continues to expand on its broader AI and digital vision, following earlier launches such as SkyTour and improvements to Aryeo's media offering. At the same time, the market has taken notice. Over the past year, Zillow shares have climbed 40%, with gains accelerating in the past three months, suggesting that investors are increasingly optimistic about the company’s direction. Momentum appears to be building as Zillow’s product suite adapts to changing consumer demands and helps agents gain an edge.

Following this sustained run, the big question is whether the stock’s valuation still offers upside or if Wall Street is already factoring in all of this AI-powered growth.

Most Popular Narrative: 2.1% Undervalued

The dominant narrative sees Zillow Group as slightly undervalued at current levels, with a fair value that is just above the latest share price. This outlook is grounded in future growth and margin expansion.

The shift toward integrated, end-to-end digital transaction ecosystems (like Zillow 360 and Enhanced Markets) is enabling Zillow to capture more ancillary services revenue (mortgages, rentals, software), reducing dependence on advertising and expanding top-line growth. It also supports EBITDA margin expansion through operational efficiencies.

Zillow’s valuation is not just about flashy AI tools or consumer growth. There is something happening deeper in the company’s financial engine. Find out how analysts turn a few bold assumptions into a striking fair value that challenges conventional thinking about real estate tech stocks. Curious what numbers support the narrative and how they compare to industry norms? Discover what drives this calculated optimism and consider whether you share the same positive outlook.

Result: Fair Value of $86.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistently low home affordability and increased regulatory scrutiny could quickly dampen Zillow’s growth story and challenge these optimistic assumptions.

Find out about the key risks to this Zillow Group narrative.Another View: A Closer Look at Market Comparisons

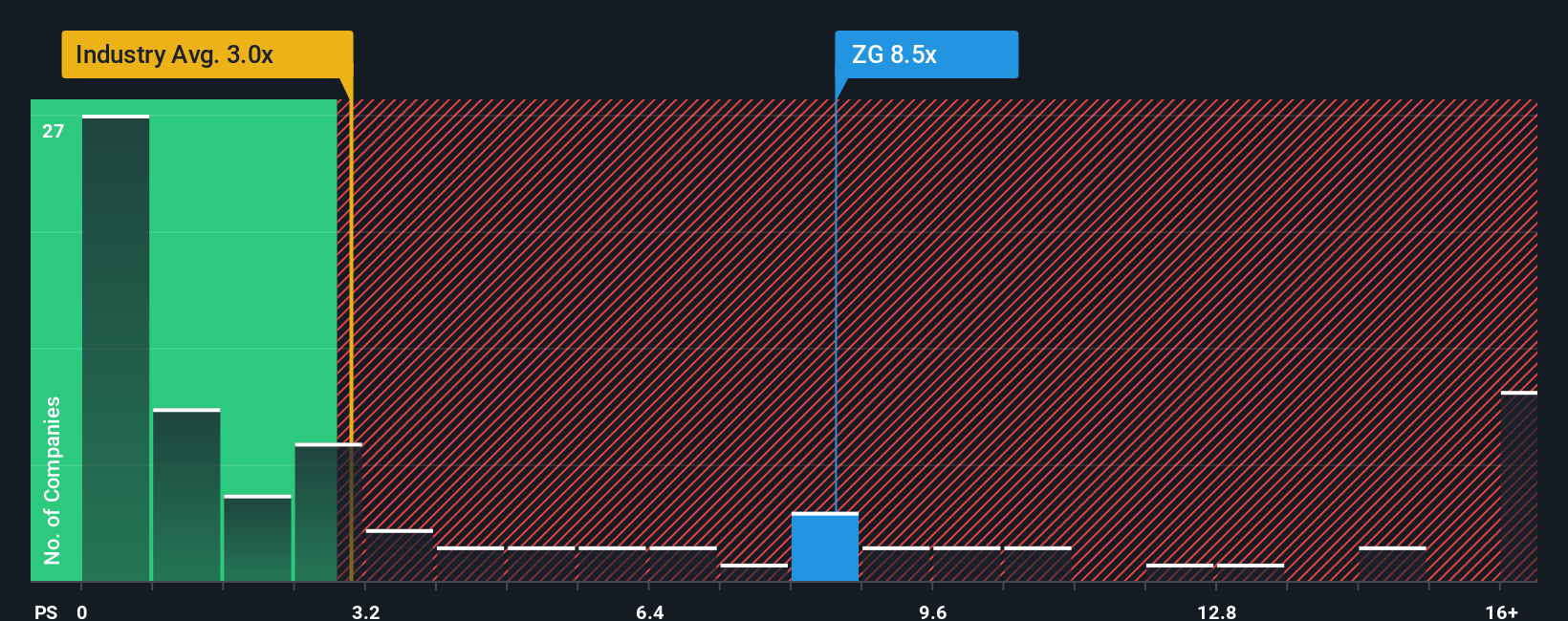

While the analyst consensus points to Zillow Group being fairly valued, comparing its valuation to the broader US real estate sector tells a different story. In this comparison, the stock actually looks expensive. So which perspective holds more weight?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Zillow Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Zillow Group Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can easily build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Zillow Group.

Looking for more investment ideas?

Don’t stop here. Your next winner could be one smart move away. Give yourself an edge with tools designed to help you find standout opportunities with confidence.

- Spot undervalued opportunities that may have been overlooked in the market by using our undervalued stocks based on cash flows. Reveal hidden gems based on cash flows.

- Seize the potential of tomorrow’s tech by scanning quantum computing stocks for companies pioneering advances in quantum computing and shaping the next frontier.

- Unlock a stream of reliable income and financial strength with dividend stocks with yields > 3%, featuring stocks offering dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives