- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

Zillow Group (ZG): Assessing Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Zillow Group.

Momentum for Zillow Group appears to be cooling after an impressive run, with the stock giving back some gains recently. Even so, the 1-year total shareholder return of 21% puts its performance well ahead of many peers, which suggests that long-term optimism and growth potential are still part of the story.

If you’re interested in uncovering other compelling opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the recent pullback and shares still trading below analyst targets, is Zillow Group set for further gains and offering a bargain for investors, or has the market already accounted for the company’s future growth potential?

Most Popular Narrative: 19.1% Undervalued

Zillow Group's most closely watched valuation narrative now points to a fair value of $88.46 per share, well above the last close of $71.53. This sets up a story of optimism driven by fundamental shifts in the real estate marketplace and digital innovation.

The shift toward integrated, end-to-end digital transaction ecosystems (such as Zillow 360 and Enhanced Markets) is enabling Zillow to capture more ancillary services revenue (mortgages, rentals, software). This reduces dependence on advertising and expands top-line growth, while also supporting EBITDA margin expansion through operational efficiencies.

What is fueling this surge in confidence? The narrative relies on breakthrough financial projections and a bold margin turnaround. Curious which future growth drivers and strategic bets are built into the valuation? Dive in to see the disputed assumptions that could unlock Zillow's next leg higher.

Result: Fair Value of $88.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability challenges and the threat of further regulatory changes could quickly undermine Zillow’s path to sustained growth and higher margins.

Find out about the key risks to this Zillow Group narrative.

Another View: Is the Price Justified?

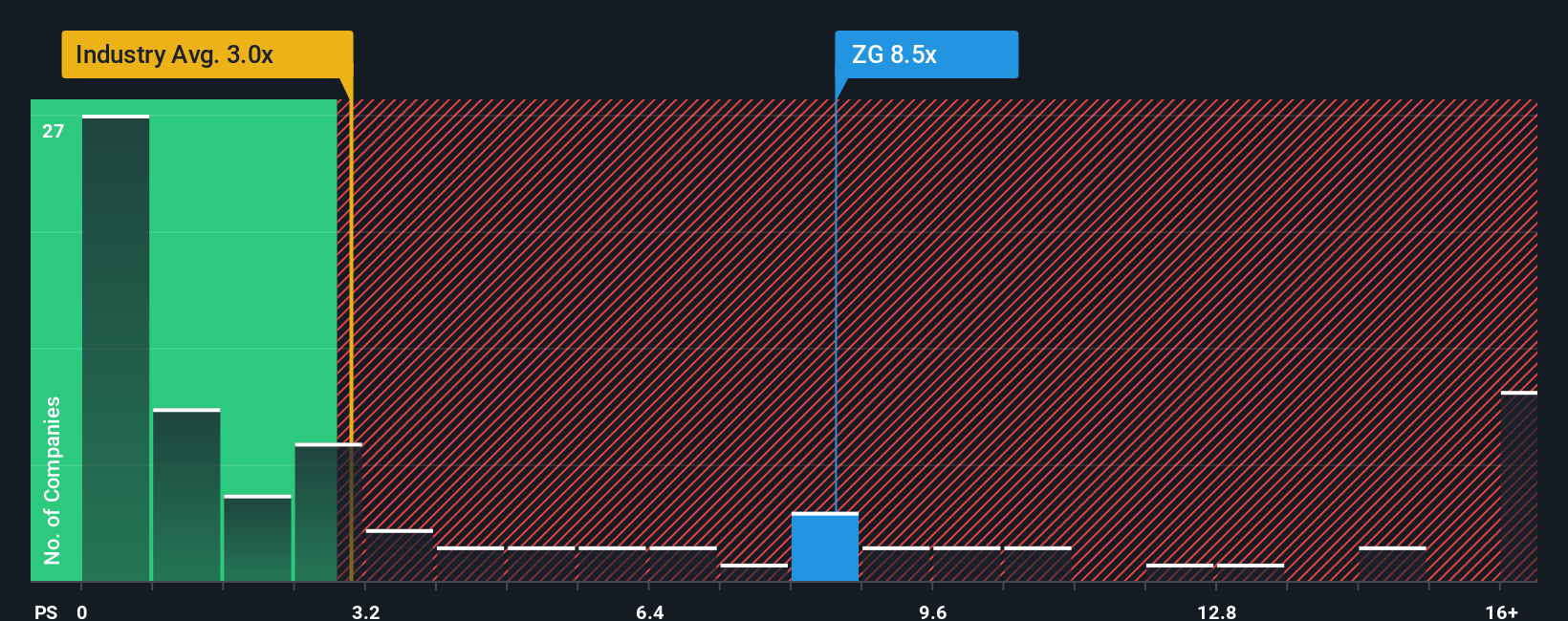

Looking at Zillow Group’s valuation through the lens of its price-to-sales ratio reveals a less optimistic picture. The shares trade at 7.3 times sales, far higher than the US real estate industry average of 2.9 and the peer average of 3.8. Even compared to its fair ratio of 4.2, Zillow’s valuation looks stretched. This gap could signal potential risk if the business does not deliver the strong growth investors expect. Could the market be getting ahead of itself, or is something bigger at play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zillow Group Narrative

If you think there is more to the story or want to test your own conclusions, you can dive into the numbers and build your narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zillow Group.

Looking for more investment ideas?

Stay ahead of the crowd by searching beyond the obvious. Simply Wall Street’s powerful Screener lets you gain an edge and never miss tomorrow’s top performers.

- Tap into rising market trends by examining these 25 AI penny stocks, which are positioned to benefit from the AI boom and disruptive innovation.

- Grow your passive income with these 19 dividend stocks with yields > 3%, highlighting reliable yields above 3% from companies committed to rewarding their shareholders.

- Find undervalued gems before they make headlines by screening these 894 undervalued stocks based on cash flows, which are currently priced below their fair value estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives