- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Will New Leadership and Activist Support Shift Opendoor Technologies' (OPEN) Strategic Direction?

Reviewed by Simply Wall St

- In recent weeks, Opendoor Technologies appointed Shrisha Radhakrishna as interim CEO and entered securities purchase agreements with Khosla Ventures and Wu for a US$40 million investment, issuing new common shares.

- This period also saw increased support from activist investor Eric Jackson, who is campaigning for co-founder Keith Rabois' return to the board as investors seek renewed leadership and vision for the company.

- We'll examine how the leadership transition and activist investor momentum reshape Opendoor Technologies' investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Opendoor Technologies Investment Narrative Recap

To be a shareholder in Opendoor Technologies, you have to believe in the company’s ability to revolutionize real estate with technology, withstand macroeconomic headwinds, and eventually achieve profitable growth. The recent executive shakeup and US$40,000,000 investment may not materially offset the key short-term catalyst, improved unit economics through margin optimization, nor allay the biggest risk of weak demand in a slower housing market, but they do give the company additional resources and renewed attention.

Among the latest developments, the US$40,000,000 private placement with Khosla Ventures and Wu stands out, as it directly bolsters Opendoor’s liquidity while the company seeks stability in a competitive and capital-intensive sector. This increased financial flexibility could support operations amid volatile demand and ongoing efforts to refine pricing, but does little to directly resolve vulnerability to persistent market softness, which remains front of mind for shareholders.

Yet, despite growing optimism, investors should be aware that high inventory exposure still looms as a pressing issue for Opendoor’s earnings and...

Read the full narrative on Opendoor Technologies (it's free!)

Opendoor Technologies' outlook forecasts $4.7 billion in revenue and $239.7 million in earnings by 2028. This assumes a 2.9% annual revenue decline and a $544.7 million increase in earnings from the current level of -$305.0 million.

Uncover how Opendoor Technologies' forecasts yield a $1.14 fair value, a 80% downside to its current price.

Exploring Other Perspectives

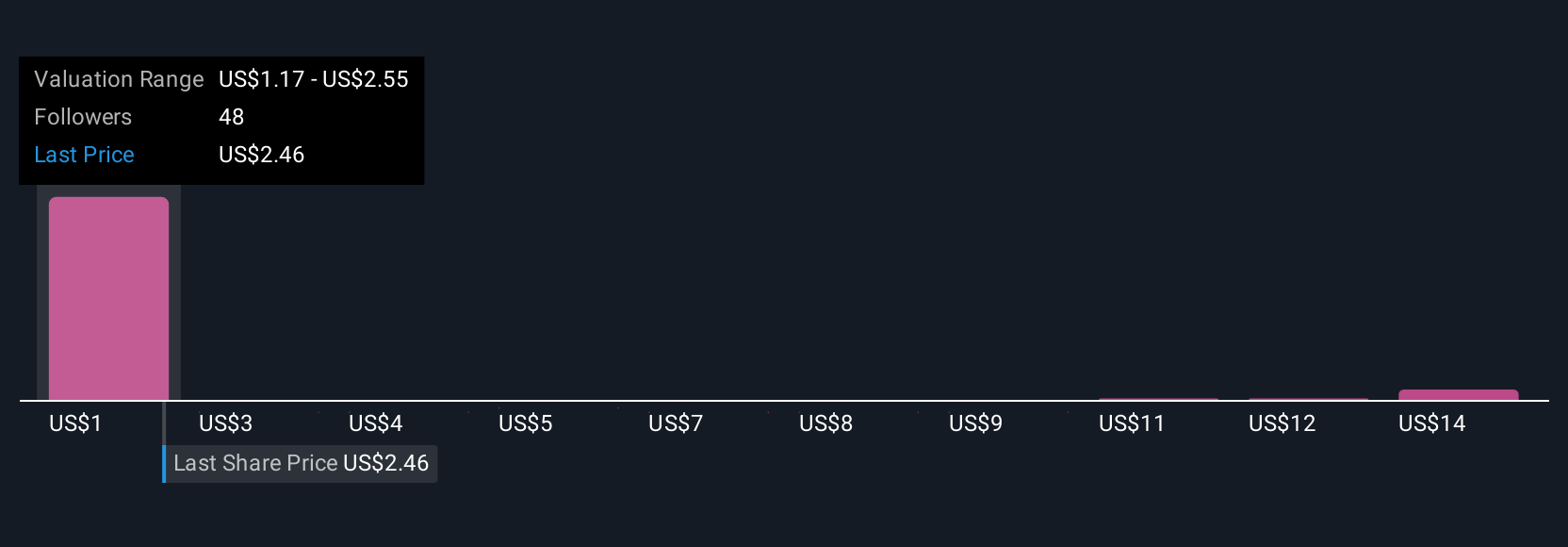

Fair value estimates from 18 members of the Simply Wall St Community range widely from US$0.70 to US$14.96 per share. With weak housing demand still the foremost risk, you are presented with sharply differing perspectives worth exploring further.

Explore 18 other fair value estimates on Opendoor Technologies - why the stock might be worth less than half the current price!

Build Your Own Opendoor Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opendoor Technologies research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Opendoor Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opendoor Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives