- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Opendoor Technologies (OPEN) Appoints Shrisha Radhakrishna As Interim CEO

Reviewed by Simply Wall St

Opendoor Technologies (OPEN) recently experienced the departure of CEO Carrie Wheeler and the appointment of Shrisha Radhakrishna as interim leader, which could have influenced the stock's dramatic rise of 1003% over the last quarter. This leadership shift, alongside product innovations such as the launch of Cash Plus and the Opendoor Key Agent App, coincided with broader market trends. However, the market remained relatively flat this past week but up significantly over the year due to expectations of interest rate cuts. These factors likely provided context to the company's remarkable share price performance during the same period.

Opendoor Technologies has 2 warning signs we think you should know about.

The leadership change at Opendoor Technologies, with Shrisha Radhakrishna stepping in as the interim CEO, may influence ongoing strategic initiatives and financial outlooks. This includes current efforts to optimize pricing and cost controls aimed at improving net margins despite exposure to macroeconomic factors and operational risks. Past innovative launches like Cash Plus and the Opendoor Key Agent App illustrate the company's adaptability, though it's crucial these developments translate into tangible improvements in financial performance.

Over the last year, Opendoor Technologies experienced a substantial total return of 237.56%. This remarkable gain outpaced the broader US market's annual return of 20.8% and the US Real Estate industry return of 29%, showcasing the company's robust market exposure during this period. However, these gains should be scrutinized against stock movements, as prices remain volatile.

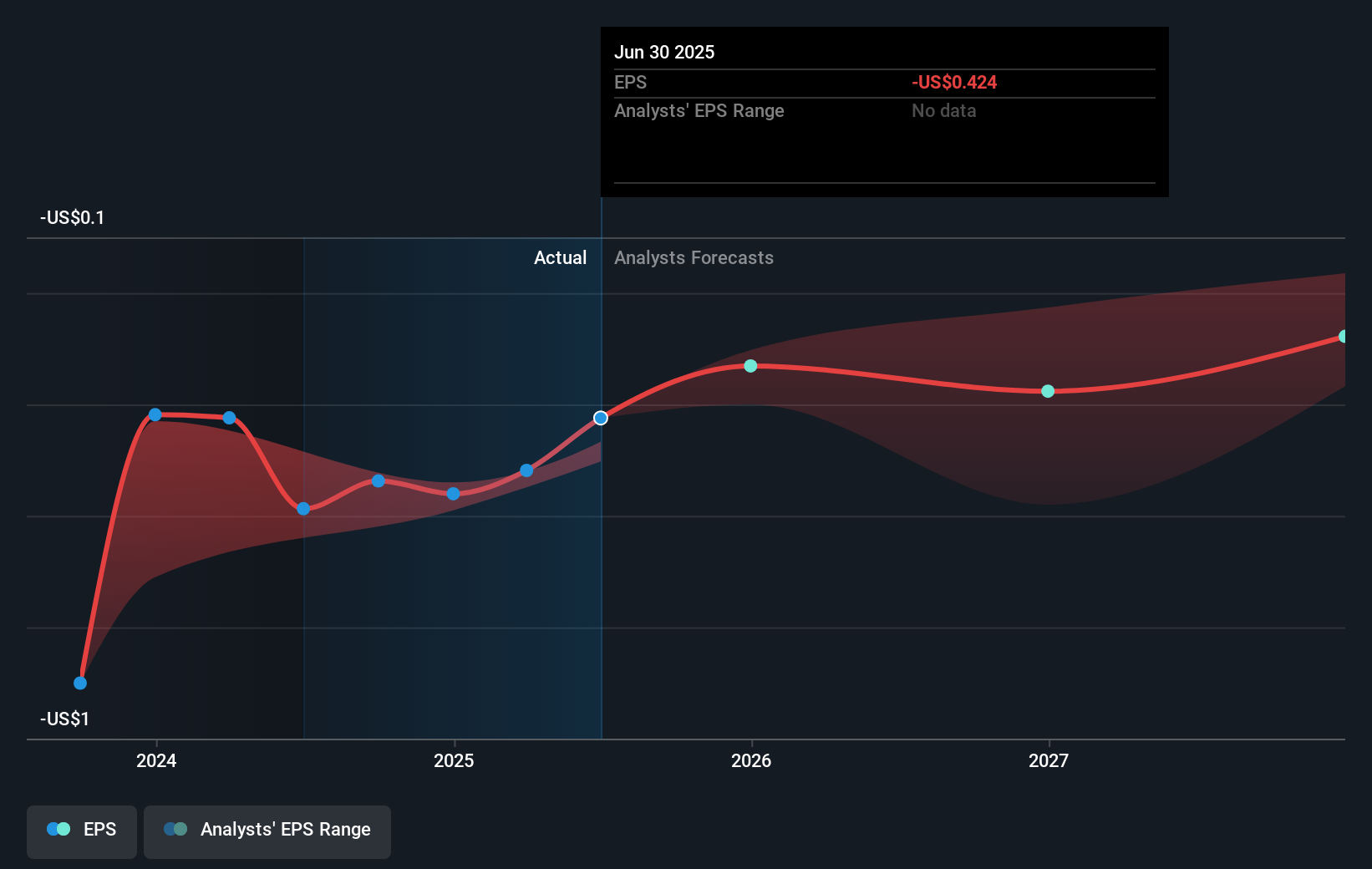

Amid these developments, Opendoor's revenue and earnings forecasts face potential adjustments. The company recorded a revenue of US$5.18 billion and earnings of US$305 million, with challenges anticipated in maintaining an increasing growth trajectory in the face of macro pressures. Analysts forecast a decrease in revenue over the next few years, which might necessitate a reevaluation of future strategies.

The company's share price movement to US$6.65 sits in stark contrast to the consensus analyst price target of US$1.14. This suggests market expectations may exceed analysts' projected valuations. Investors should carefully assess this discrepancy by considering both the potential and limitations of Opendoor's strategic innovations and macro exposures. As the market digests these elements, future share price alignment with analyst targets will persist as a point of interest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026