- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Opendoor Technologies (OPEN) Announces Leadership Transition As CEO Carrie Wheeler Steps Down

Reviewed by Simply Wall St

Opendoor Technologies (OPEN) has experienced pivotal executive changes with the departure of CEO Carrie Wheeler, succeeded temporarily by technology leader Shrisha Radhakrishna, amidst a robust share price surge of 304% this past quarter. Contributing to this momentum are the company's efforts in launching new products like Cash Plus and the Key Agent App during a period when the broader market showed mixed performance with record highs in major indices like the Dow. Opendoor’s strategic product advancements and investor enthusiasm appear to complement the overall market trends, despite not aligning with the slight declines in the S&P 500 and Nasdaq.

Be aware that Opendoor Technologies is showing 2 risks in our investment analysis.

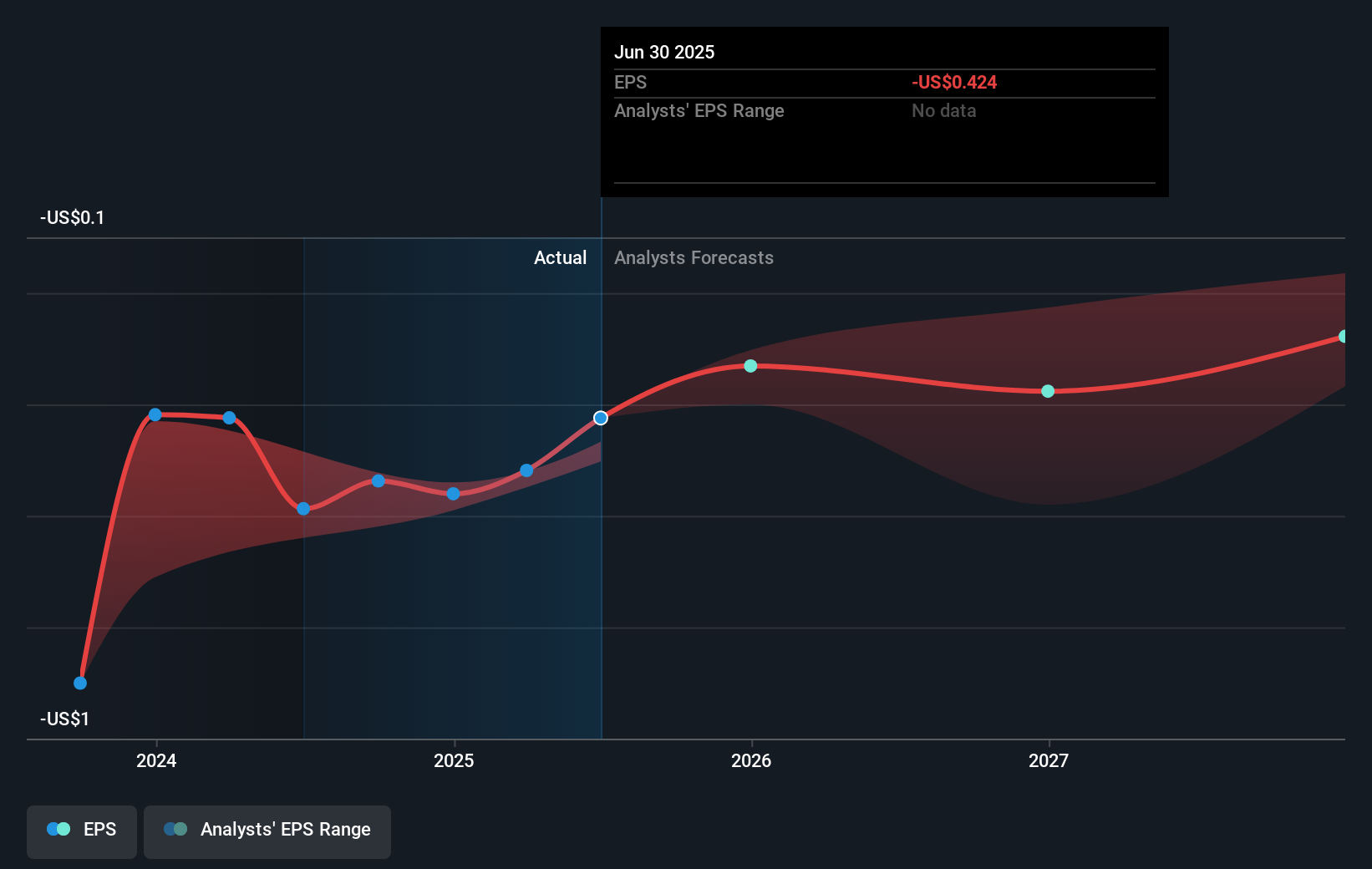

The recent executive changes at Opendoor Technologies, coupled with the significant share price surge this past quarter, could influence the company's strategic direction and execution. While the introduction of products like Cash Plus and the Key Agent App add potential for innovation-led growth, the revenue and earnings outlook remain cautious. The company's reliance on technological advancements may offer resilience amid high mortgage rates and affordability challenges, though analysts are bracing for persistent revenue pressures and ongoing unprofitability over the next three years. The interim leadership may navigate these waters with fresh insights, impacting future forecasts.

Over the past year, Opendoor's total shareholder return, including dividends, was 77.09%, indicating solid performance despite broader market volatility. This also stands out when compared to the US Real Estate industry's 26.9% return over the same period, suggesting Opendoor outperformed in a challenging market environment. However, given the longer-term context, the share price is currently US$3.17, offering a stark contrast to the analyst consensus price target of US$1.14. This highlights a significant discount that could reflect differing expectations of future performance and market conditions.

The recent price movement, powered by investor enthusiasm and product launches, suggests optimism. However, given the current share price exceeds the price target by a very large margin, investors might be pricing in greater optimism than analysts currently project. As the company focuses on revenue streams from innovative solutions, these efforts must translate into substantial profitability improvements to meet or exceed market expectations in the long run.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives